In this episode of NewsBTC’s daily technical analysis videos, we are once again examining a possible expanded flat correction in Bitcoin. Once the correction has completed, the bull market could resume.

Take a look at the video below:VIDEO: Bitcoin Price Analysis (BTCUSD): October 18, 2022

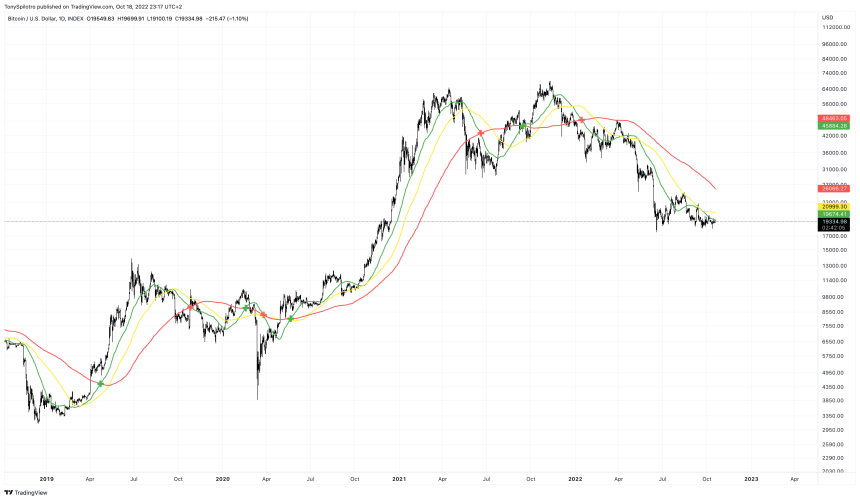

In addition to the video highlights listed below the video, we also analyze BTCUSD using the Ichimoku, Bollinger Bands, SuperTrend, TD Sequential, and other technical tools.Three Strikes: BTCUSD Rejected From 50-Day Moving Average

BTCUSD daily price action was once again rejected from the 50-day moving average. This is the third rejection since September, making the 50MA a critical line in the sand to pass before any chance of further upside.

Zooming out and comparing the 50MA and its behavior around the 2018 bear market bottom, we can see that breaking through it is the key to bulls regaining control on daily timeframes. Given the close proximity of the 100-day moving average in yellow, the next target would be the red, 200-day moving average located at around $26K.

If Bitcoin can break the 50-MA and 100-MA, $26K is next | Source:

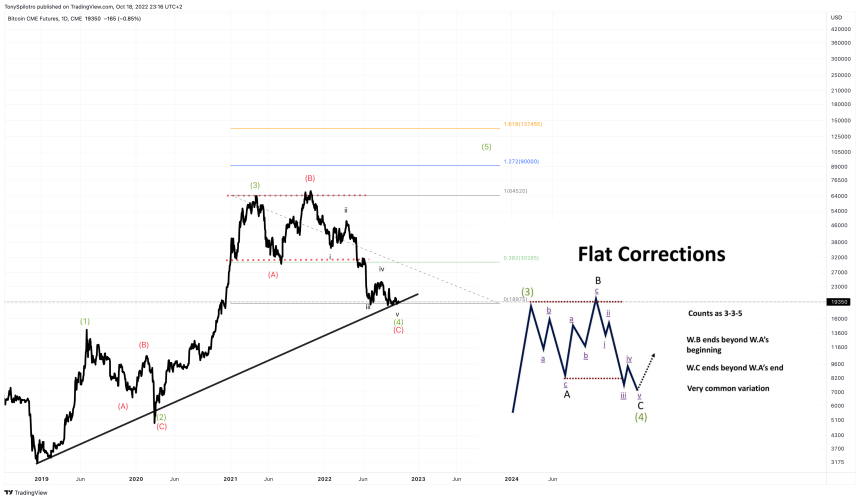

Bitcoin CME Futures Paints Near-Perfect Expanded Flat Pattern

The BTC CME Futures line chart causes the price action over the last 18 months to nearly perfectly fill out an expanded flat pattern. An expanded flat features a higher high at the top of the B wave, followed by a lower low as the C wave terminates. The C wave is an impulse wave down made up of 5 total sub-waves.

The BTC CME chart begins with a bear market. The primary count would suggest the expanded flat correction formed in wave 4 and there is still a wave 5 ahead. In , one way to possibly project the peak of where wave 5 will terminate, is to find the inverse Fibonacci extension of wave C.

At the 1.272 extension, Bitcoin would reach $90,000, while if the 1.618 golden ratio extension is tapped, the top would be over $137,000 per BTC.

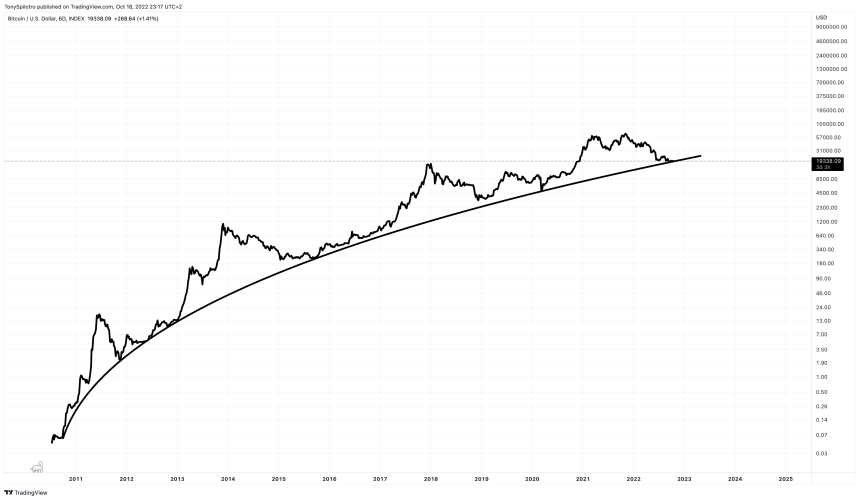

Will The Crypto Winter Conclude With A Touch Of The Log Growth Curve?

Although given the macro sentiment, the risk of recession, and the fact each floor in crypto has fallen out again and again, this is not an unusual place for Bitcoin to bottom out.

Bitcoin price continues to grind along the logarithmic growth curve. All price action throughout the entire history of cryptocurrencies has been contained within this narrowing curvature. Why would it suddenly stop now?