#1 SEC’s Non-appeal On Grayscale Spot Bitcoin ETF

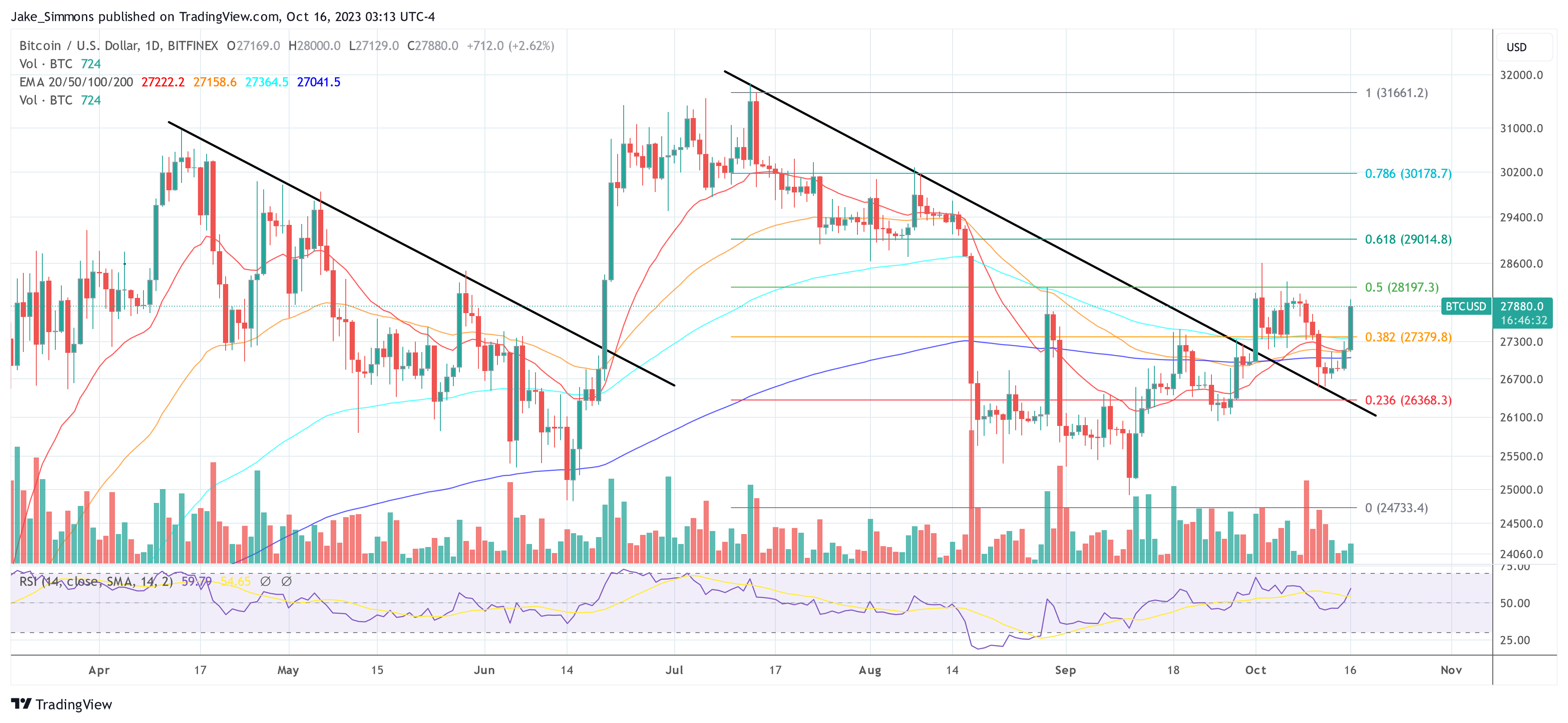

Late on Friday night, the market became aware of the US Securities and Exchange Commission’s decision not to appeal the verdict which favored Grayscale’s conversion of the Grayscale Bitcoin Trust (GBTC) into a spot ETF. This decision wasn’t perhaps fully priced in on Friday, as Bitcoin’s price rose by a mere 1.2% on Friday ((followed by a fast retracement), in stark contrast to the 8% spike on August 29 when the initial ruling was announced. The move signifies the SEC’s potential readiness to green-light a Bitcoin ETF in the imminent weeks. As one Grayscale spokesman out, “The Federal Rules of Appellate Procedure’s 45-day period to seek rehearing has now passed. The Grayscale team remains operationally ready to convert GBTC to an ETF upon the SEC’s approval.”As for when a Spot ETF is coming, Bloomberg Intelligence analysts predict a staggering 90% chance of the SEC’s approval by around January 10.

#2 BTC’s Correlation With Gold

Renowned analyst MacroScope recently in-depth insights into the complex relationship between gold and Bitcoin which may have contributed to today’s price move. Gold has soared by more than 6.5% from October 6 till Friday last week, driven by a combination of elements such as central bank policies, the US’s fiscal challenges, and unfolding geopolitical events like the Israel-Hamas war.Related Reading: Analyst Predicts Next Bitcoin Cycle Top – Is It $89,000 Or $135,000?

This evolving dynamic in the gold market bears significant implications for Bitcoin. Historically, gold often pioneers a trend, with Bitcoin tailing behind to emulate it. This lead-lag relationship, as highlighted by MacroScope, might have been pivotal in forecasting Bitcoin’s move today. As gold appears to be charting a bullish course, Bitcoin, while influenced by its distinct set of catalysts like the spot ETF approval, could be poised to mirror gold’s trajectory.#3 Short Squeeze

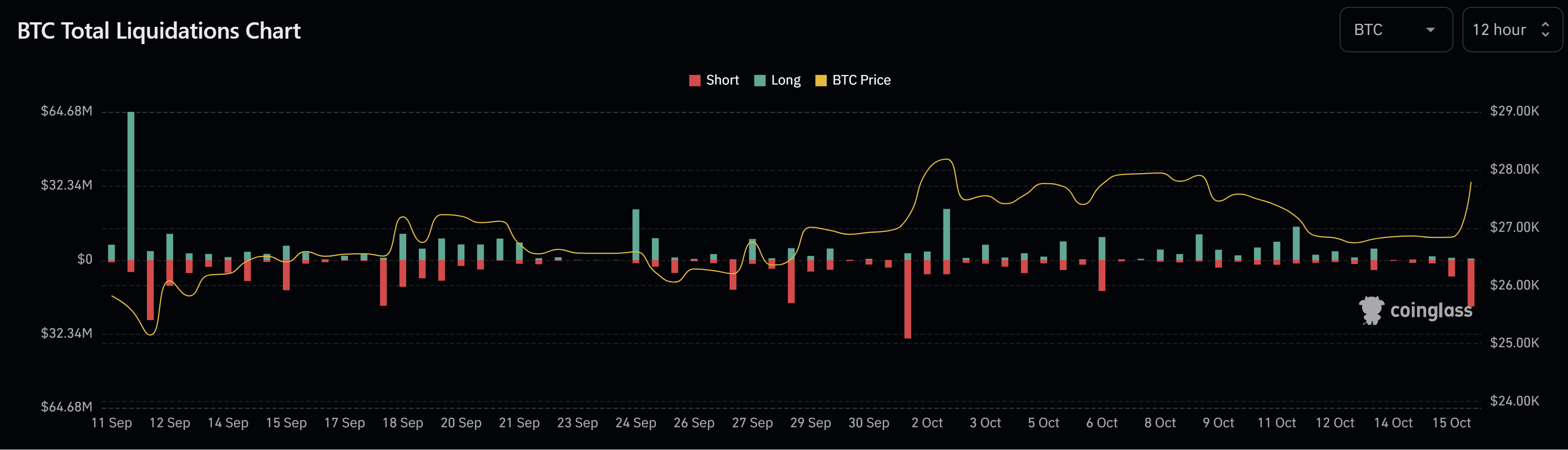

Finally, on a more technical note, there has been significant activity in the BTC futures market that played a part in the soaring price. Thus far today, about $20 million in short positions have been liquidated, the highest amount since October 1, when $37.5 million in shorts were liquidated and BTC rose 4% from $27,000 to nearly $28,100 in a very short period of time.