Bitcoin Puell Multiple 365-Day Rate Of Change Has Shot Up

As pointed out by an analyst in a CryptoQuant , this could be one of the first indications of the return of the bull market. The “Puell Multiple” is an indicator that measures the ratio between the daily Bitcoin mining revenue (in USD) and the 365-day moving average (MA) of the same.

When the value of this metric is greater than 1, miners are making more income than the yearly average right now. On the other hand, values below the threshold imply the revenues of these chain validators is less than usual.

Looks like the value of the metric has spiked in recent days | Source:In the above graph, the quant has marked the relevant zones for the Bitcoin Puell Multiple 365-day RoC. It seems like tops have taken place in the crypto price whenever the metric has touched the red line, while mid-cycle highs have been set around the orange line. And it would appear that bear markets have lasted while the indicator has been around the green line. It also looks like transitions to and from bear markets have generally followed the dotted line historically.

With this spike, the metric has finally crossed above the dotted line, which could mean, if the past pattern is anything to go by, that the bear market may be coming to an end, and the crypto might have started transitioning towards a bullish trend. The analyst notes, however, that it will still take some more price action before this breakout can be fully confirmed.

BTC Price

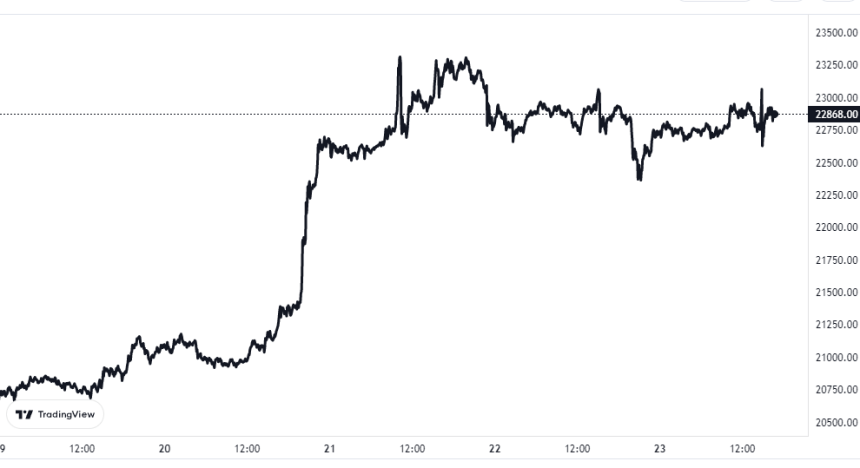

At the time of writing, Bitcoin is trading around $22,800, up 9% in the last week.

The value of the crypto seems to have been moving sideways in the last few days | Source: