Past Bitcoin Volatility Index Pattern Suggests A Short Squeeze May Happen Here

As explained by an analyst in a CryptoQuant , the BTC volatility index has now reached values where a short squeeze has happened in the past.The “volatility index” is an indicator that shows how much the price of Bitcoin has fluctuated in a day compared to its historical average.

Related Reading | Bitcoin Bearish Signal: Binance Observes Massive Inflow Of 10k BTC

The price usually crashes during a long liquidation squeeze due to a cascading effect by these liquidations. On the contrary, the price may instead jump up during a short squeeze.

Now, here is a chart that shows the trend in the Bitcoin volatility over the past six months:

The index's value seems to have risen and subsequently fallen recently | Source:As you can see in the above graph, the indicator’s value shot up recently following a long squeeze, but has now come back down. At the moment, the Bitcoin liquidation index seems to have values of around 19.12. In the chart, the quant has highlighted past portions that are relevant to this current trend. It looks like shortly following such a formation, the price has made a strong move up with a short squeeze.

Related Reading | ‘Bitcoin Rush’: Small-Time Solo Miners Strike Gold With Full BTC Blocks

The analyst thus thinks that the coin may follow this pattern now as well, and its price may go back to $46k to $47k. However, the quant believes that such a move will only be short term relief, and Bitcoin will resume the downtrend soon after.BTC Price

At the time of writing, Bitcoin’s price floats around $36.2k, down 5% in the last seven days. Over the past month, the crypto has lost 28% in value.

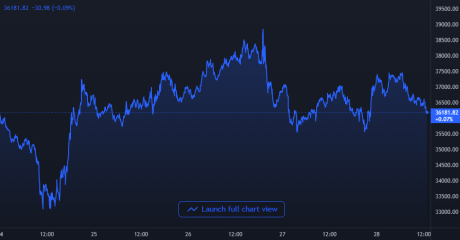

The below chart shows the trend in the price of BTC over the last five days.

BTC's price seems to have moved sideways in the last few days | Source:A few days back, the price of Bitcoin jumped back to $38k, but the recovery didn’t last long and the crypto fell down to $36k.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com