Bitcoin has reclaimed the high area around the $50,000. In the meantime, indicators are turning bullish as the cryptocurrency could be preparing for another leg-up into uncharted territory.

At the time of writing, BTC trades at $57,654 with a 3.1% profit in the daily chart. In the weekly chart, BTC has a 7.5% profit with sideways movement in higher timeframes.

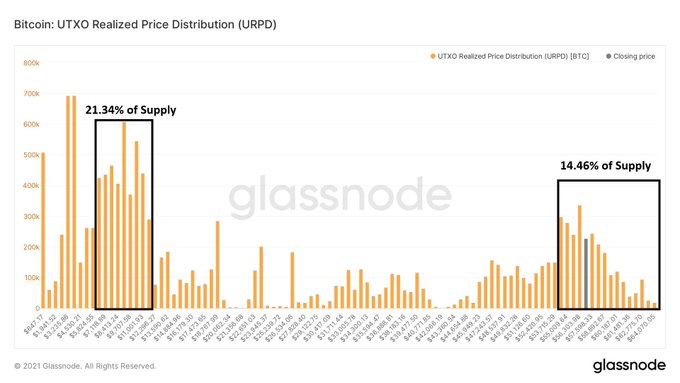

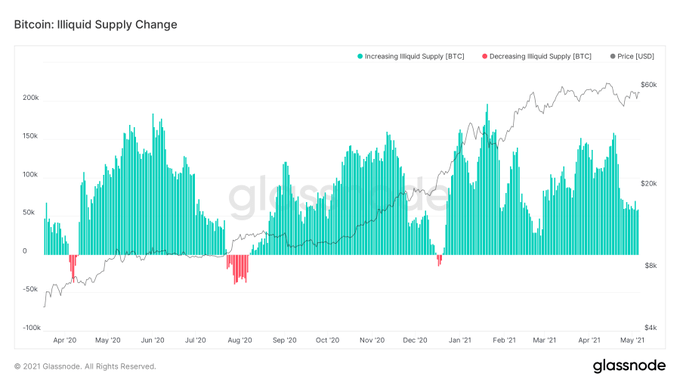

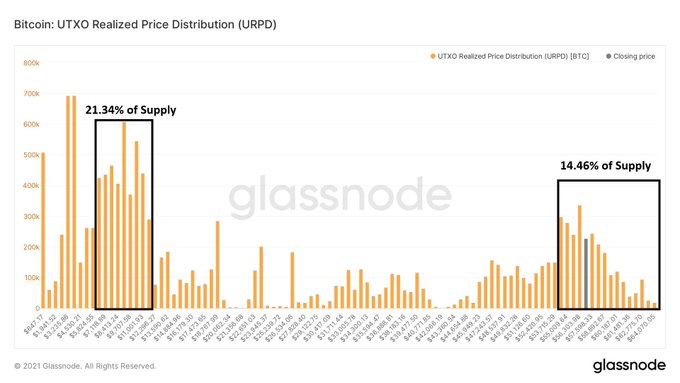

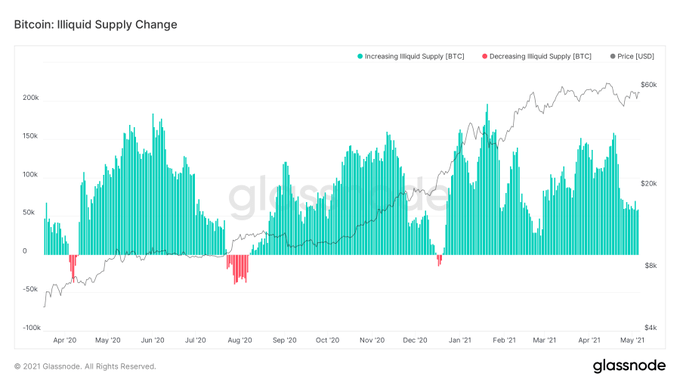

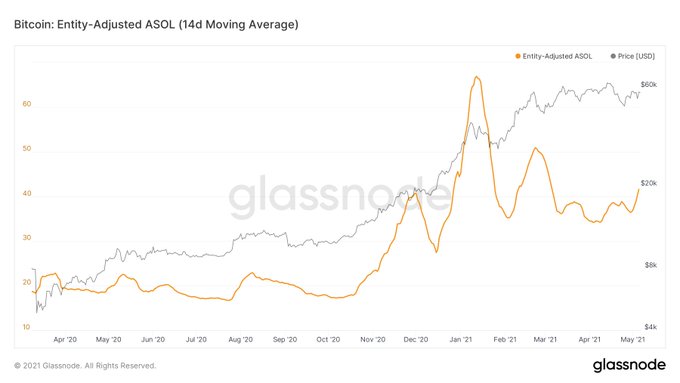

BTC’s supply has become a major factor in its price appreciation. As the chart and Clemente showed, BTC is “consistently moving” into cold storage or addresses with intention of holding it. The trend continues to accelerate with no signs of slowing down.

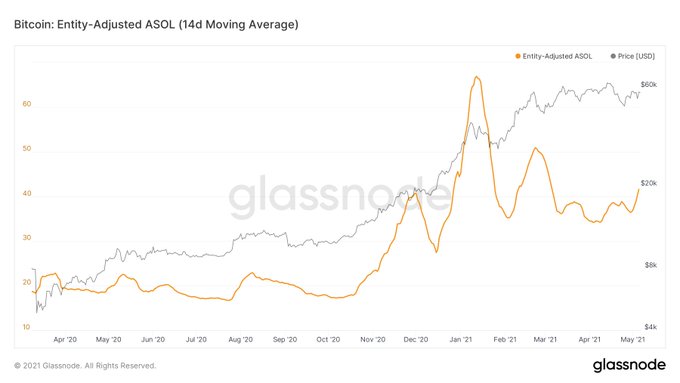

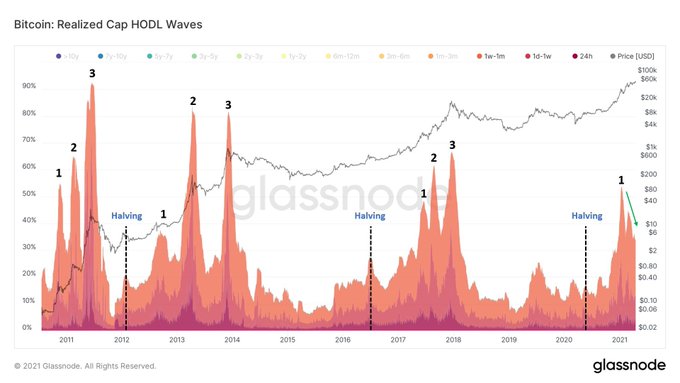

(Who is selling BTC) The answer is newer, inexperienced market participants. The average age of coins being sold has been steadily trending downward since February.

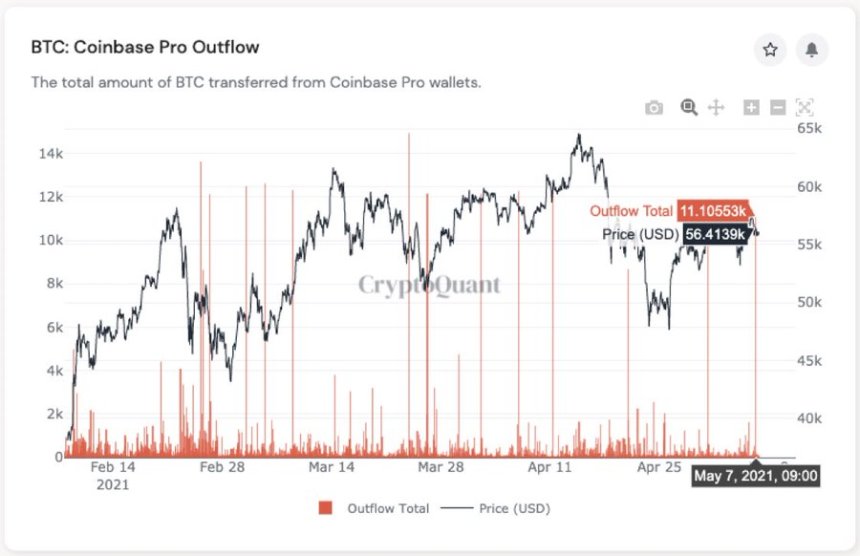

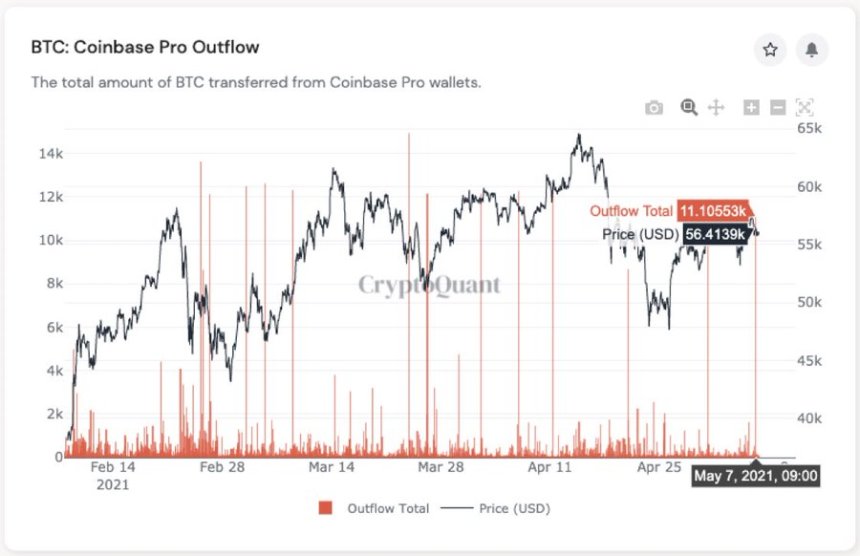

Increase In Bitcoin’s Exchange Outflows

Data from CryptoQuant supports the above, with 11,000 BTC being moved out of Coinbase Pro service and 7,200 across all exchanges, according to Glassnode. In less than 24 hours, over 12,000+ BTC seem to have left exchanges into cold storage. As the chart below shows, every time there is a large BTC outflow on this platform, the price goes higher.

Additional data from Santiment, registered an increase in BTC’s whale. Around 86 addresses hold 10,000 BTC with 120,000 BTC accumulated just in April. The firm claims this period saw the “most sustained accumulation since July 2019. Clemente concluded his bullish theory with the following statement:

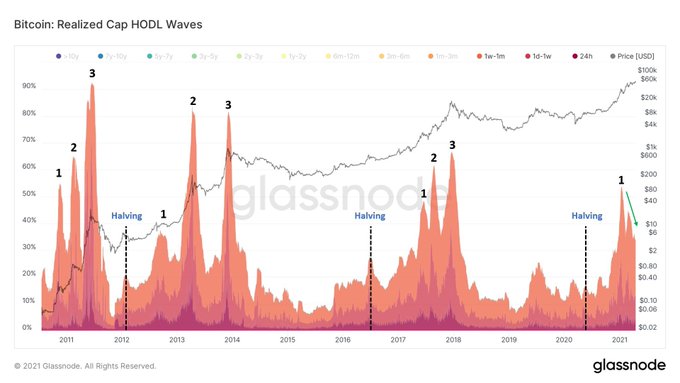

Coins are moving from weak hands to strong hands. We are in a massive mid-way consolidation of this cycle. Don’t let short-term price action freak you out, this bull run still has a long way to go before becoming overheated. HODL on.

Bitcoin has reclaimed the high area around the $50,000. In the meantime, indicators are turning bullish as the cryptocurrency could be preparing for another leg-up into uncharted territory.

At the time of writing, BTC trades at $57,654 with a 3.1% profit in the daily chart. In the weekly chart, BTC has a 7.5% profit with sideways movement in higher timeframes.

BTC’s supply has become a major factor in its price appreciation. As the chart and Clemente showed, BTC is “consistently moving” into cold storage or addresses with intention of holding it. The trend continues to accelerate with no signs of slowing down.

(Who is selling BTC) The answer is newer, inexperienced market participants. The average age of coins being sold has been steadily trending downward since February.

Increase In Bitcoin’s Exchange Outflows

Data from CryptoQuant supports the above, with 11,000 BTC being moved out of Coinbase Pro service and 7,200 across all exchanges, according to Glassnode. In less than 24 hours, over 12,000+ BTC seem to have left exchanges into cold storage. As the chart below shows, every time there is a large BTC outflow on this platform, the price goes higher.

Additional data from Santiment, registered an increase in BTC’s whale. Around 86 addresses hold 10,000 BTC with 120,000 BTC accumulated just in April. The firm claims this period saw the “most sustained accumulation since July 2019. Clemente concluded his bullish theory with the following statement:

Coins are moving from weak hands to strong hands. We are in a massive mid-way consolidation of this cycle. Don’t let short-term price action freak you out, this bull run still has a long way to go before becoming overheated. HODL on.