Related Reading | TA: Why Ethereum Could Rally Further Above $3K

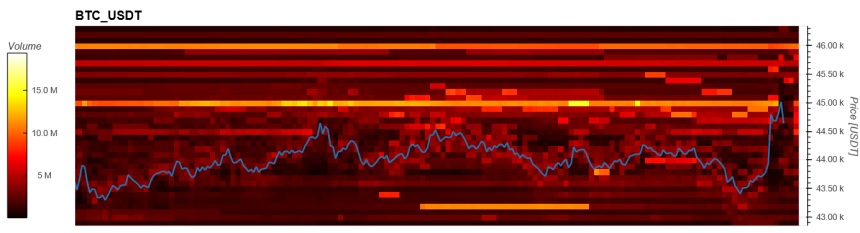

At the time of writing, Bitcoin trades at $43,748 with a 2.1% loss in the last 24-hours and a 14.1% profit in the past 7 days.

(the FED) remained on track to raise interest rates later this month as the economy remained firm despite ongoing political tensions.

The Market Speaks, How Bitcoin Could React

According to a pseudonym crypto analyst, expectations of a hike in interest rates have turned positive. Thus, why BTC’s price could be experiencing a relief bounce. Based on the target rate probabilities of an increase for rates, the market favors a 25-bps hike.

Mr. Market is saying no to a 50bps rate hike in March and yes to a 25bps hike – that means that the risks headed into this month’s Fed meeting are (imo): A) No hike = #BTC to $50k+, B) 50bps hike = Bitcoin to mid 30k, C) 25bps hike = Bitcoin continues to slowly trend higher.

As NewsBTC has been reporting, there are seemingly two scenarios for Bitcoin and the crypto market going into a possible interest rates hike. In the first scenario, the FED announces an aggressive change to its monetary policy. Director of Global Macro for Fidelity Justin Timmer said on this possibility:

The ongoing inflation news will force the Fed to tighten so many times that it eventually “breaks” something, which will in turn force it to pivot much like it did in 2018 after a 20% sell-off in equities.

Related Reading | TA: Bitcoin Consolidates Below $45K, What Could Trigger A Correction

The second scenario will be more bullish for Bitcoin, and it seems more likely according to the data presented above. In this scenario, the FED takes a more passive stance and allows the market to “tighten” on its own by raising rates with an initial 25 bps this month, topping at 2% in 2023.