The Bitcoin Difficulty Ribbon Compression Goes Up

As pointed out by a BTC analyst on , the difficulty ribbon compression seems to be going up for the first time since the bull run started. The indicator is a measure of the moving averages of bitcoin mining difficulty. The mining difficulty metric can be calculated by estimating the number of hashes for mining a block.Related Reading | Bitcoin Fundamental Expert Claims Adoption Metrics “Look Awful”

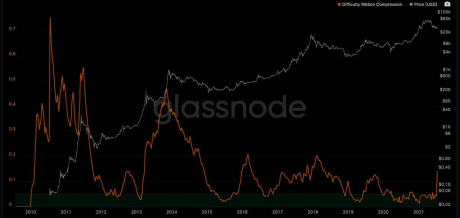

Now, here is how the chart looks like for the BTC difficulty ribbon compression in the past decade:

BTC difficulty ribbon compression seems to be sharply rising | Source:The above graph reveals some interesting features about the indicator. It does seem like that the difficulty ribbon compression has a historic relationship with the price.

Related Reading | Bitcoin Daily Close Pivotal To Save Dangerous RSI Breakdown

However, there is something to consider here. The indicator is a measure of the mining difficulty, and right now the world hash rate is facing some special circumstances due to the China crackdowns.

After massively dropping for a while, the global Bitcoin hash rate has started to go up again as miners migrate from China to other countries like the US. This should mean the difficult would go up quickly as the usual mining farms start their operations again. Such a ramp up in difficulty might look like what the chart is showing right now.BTC Price

Bitcoin price is around $32k at the time of writing, down 4% in the last 7 days. Over the last month, the coin has dropped almost 17% in value.

Here is a chart showing the trend in the crypto’s value over the past 6 months:

Bitcoin seems to be on a downtrend | Source: BTCUSD onBTC’s price continues to be range bound as the crypto remains stuck in the $30k to $35k range. It’s unclear when the coin might escape these levels, and which direction it might go in next.

If the difficulty ribbon compression is anything to go by, Bitcoin’s price might be seeing an increase soon. On the other hand, due to the special mining conditions, this rise in the value of the indicator might not directly translate to the price this time.