In light of Hong Kong’s recent opening to cryptocurrency trading by retail investors, a new bullish narrative is therefore emerging, as renowned expert Lex Moskovski explained via Twitter. According to him, the Chinese stimmies could go directly into “unregistered securities” (allusion to the classification of altcoins by SEC chairman Gary Gensler).

Chinese stimmies going into your unregistered securities. Here’s your bullish narrative. — Lex Moskovski (@mskvsk)

China Mulls Stimulus Package

According to the report, China is considering a comprehensive package of stimulus measures as pressure mounts on Xi Jinping’s government to revive the second-largest economy. Anonymous sources claim the proposals include at least a dozen measures to support areas such as real estate and domestic demand.What Impact Could The Package Have On Bitcoin And Crypto?

While investors in the broader financial market are likely to welcome the Chinese authorities’ plans, much will depend on the final scope and composition of the stimulus measures to assess the extent to which Bitcoin and crypto may also benefit from the stimulus package. Nevertheless, the package and Hong Kong’s recent opening on June 1st are an interesting development with regard to cryptocurrencies. The liberal Hong Kong is considered a gateway for wealthy Chinese to invest in foreign assets. Meanwhile, the hoped-for “China effect” on the Bitcoin and crypto market has not yet materialized, in part because the registration of exchanges is rather slow. For example, Coinbase only received an invitation from Hong Kong lawmakers to apply in the region yesterday, as Bitcoinist .In the US, the $1,200 stimulus checks had a measurable impact on Bitcoin. According to the Federal Reserve Bank of Cleveland, there a “significant increase” in Bitcoin purchases of $1,200 in April 2020. Furthermore, the central bank noted that overall Bitcoin trading volumes increased by about 3.8% in response to the distribution of the first stimulus checks.

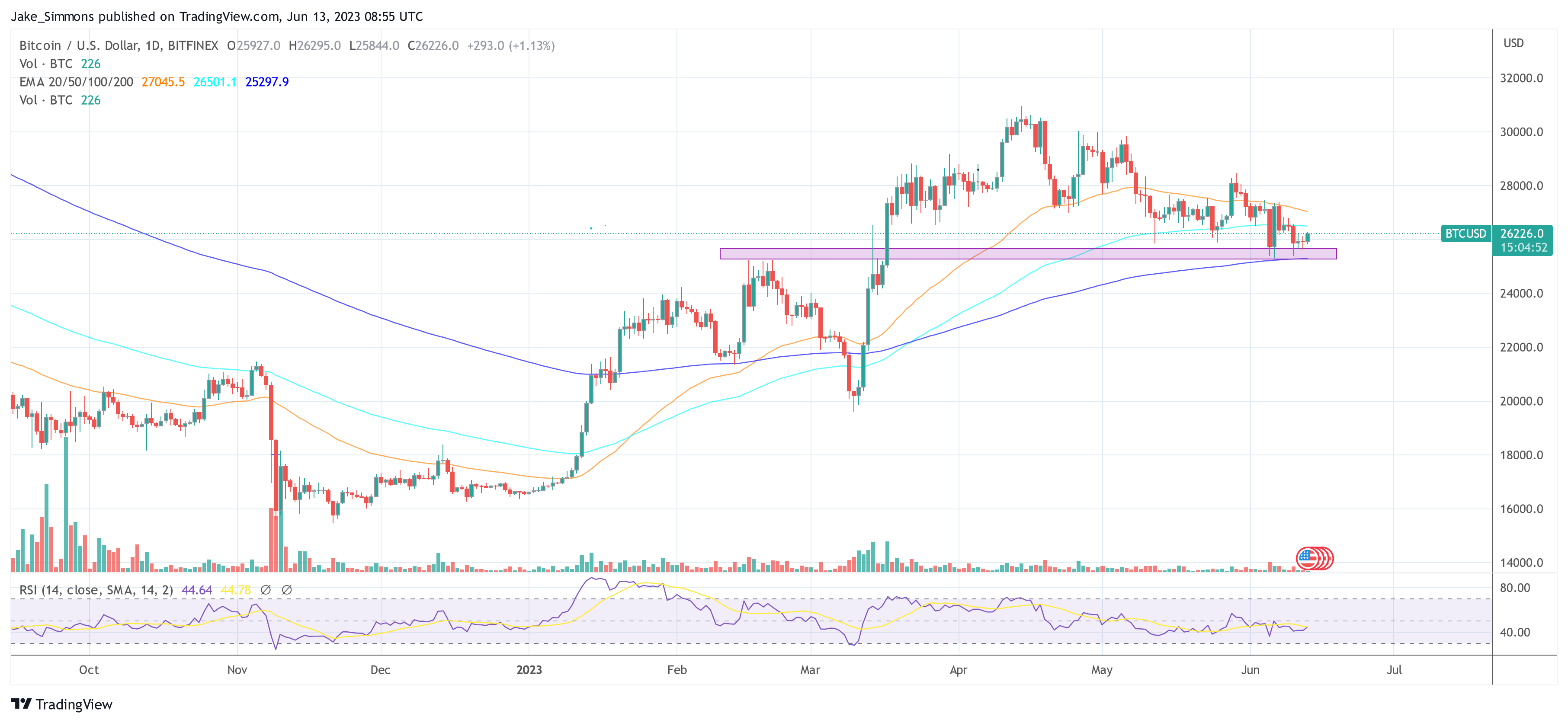

While the environment in China is not comparable to that in the US, a similar effect could still be possible. As NewsBTC Chief Analyst Tony “The Bull” recently discussed, Bitcoin’s best rises have always occurred before large monetary stimulus.All of Bitcoin’s best rallies were before major monetary stimulus Zoom out — Tony “The Bull” (@tonythebullBTC)This time, the stimulus may not come from the US, but from China. At press time, the Bitcoin price stood at $26.226 ahead of today’s crucial CPI release in the US.