The cryptocurrency market is still navigating rough seas, with substantial price declines seen in some digital assets. But it appears that XRP is on a different path. Despite the general cautious tone in the market, big investors, sometimes known as “whales,” have been covertly building up their XRP holdings. Some analysts are projecting a possible spike for XRP in the upcoming months based on this bullish behaviour by whales and favourable technical indicators.

XRP Whales Dive Deep: A Sign Of Confidence Or Opportunism?

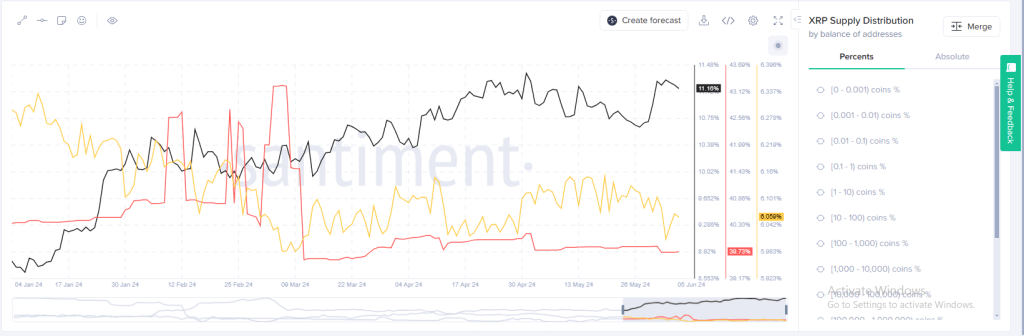

The holdings of XRP whales (addresses owning over 1 billion tokens) have increased from about 40% in mid-June to 42% at the time of writing, according to data from blockchain analytics company Santiment. Whale accumulation has increased significantly, which may indicate that investors are becoming more optimistic about XRP’s prospects.

There are two possible interpretations for the current whale buying spree: It may indicate that they think XRP is cheap and about to rise. On the other hand, they may see the present decline to be a compelling chance to purchase.

The impact is evident even if the motivations driving the whale behaviour are yet unknown. Large purchase orders are flooding the market, which may help keep the price stable or possibly spark a brief upswing. Analysts warn that whale activity by itself cannot ensure a steady price increase.

Long-Term Holders Stay Put

On-chain analysis provides additional information on the possible trajectory of XRP, in addition to whale movements. A statistic that monitors the flow of tokens kept in long-term storage, known as dormant circulation, shows promise.The low dormant circulation of XRP at the moment suggests that long-term investors aren’t selling their holdings. This may indicate a willingness to hold onto the Ripple ecosystem for the long run and a probable reluctance to sell at the current levels.

A good omen is the low dormant circulation. It suggests that XRP’s long-term investors are sticking onto their holdings, which may help stop the price from falling any lower. This can provide a strong basis for a price hike in the future.

What Do Technical Charts Say?

For supporters of XRP, technical analysis—which examines past price data and chart patterns—also provides a ray of optimism. As of right now, the momentum indicator Relative Strength Index (RSI) indicates that XRP is oversold. This can indicate that a price increase is about to occur.

According to statistics from Coingecko, the price of XRP was $0.41 at the time of writing. This is a decrease of 4.82% from the day before. The value may, however, level off at the suggested price or perhaps climb towards $0.45 given the recent whale action.

A Cautiously Optimistic Projection

The cryptocurrency market is still uncertain, despite the fact that XRP’s recent whale accumulation, low inactive circulation, and favourable technical indications present a cautiously hopeful picture. The outcome of XRP’s prospective rally will depend on a number of variables, such as the general mood of the market, the regulatory framework governing Ripple’s continuing legal dispute with the SEC, and any unanticipated developments that may affect the market.Featured image from Pexels, chart from TradingView