Cardano & Litecoin Have Seen Most Growth In Long-Term Holders

In a new on X, the market intelligence platform IntoTheBlock has revealed data related to the long-term holders of the various assets in the sector. The “long-term holders” (LTHs) here refer to all those investors who bought their coins at least one year ago.

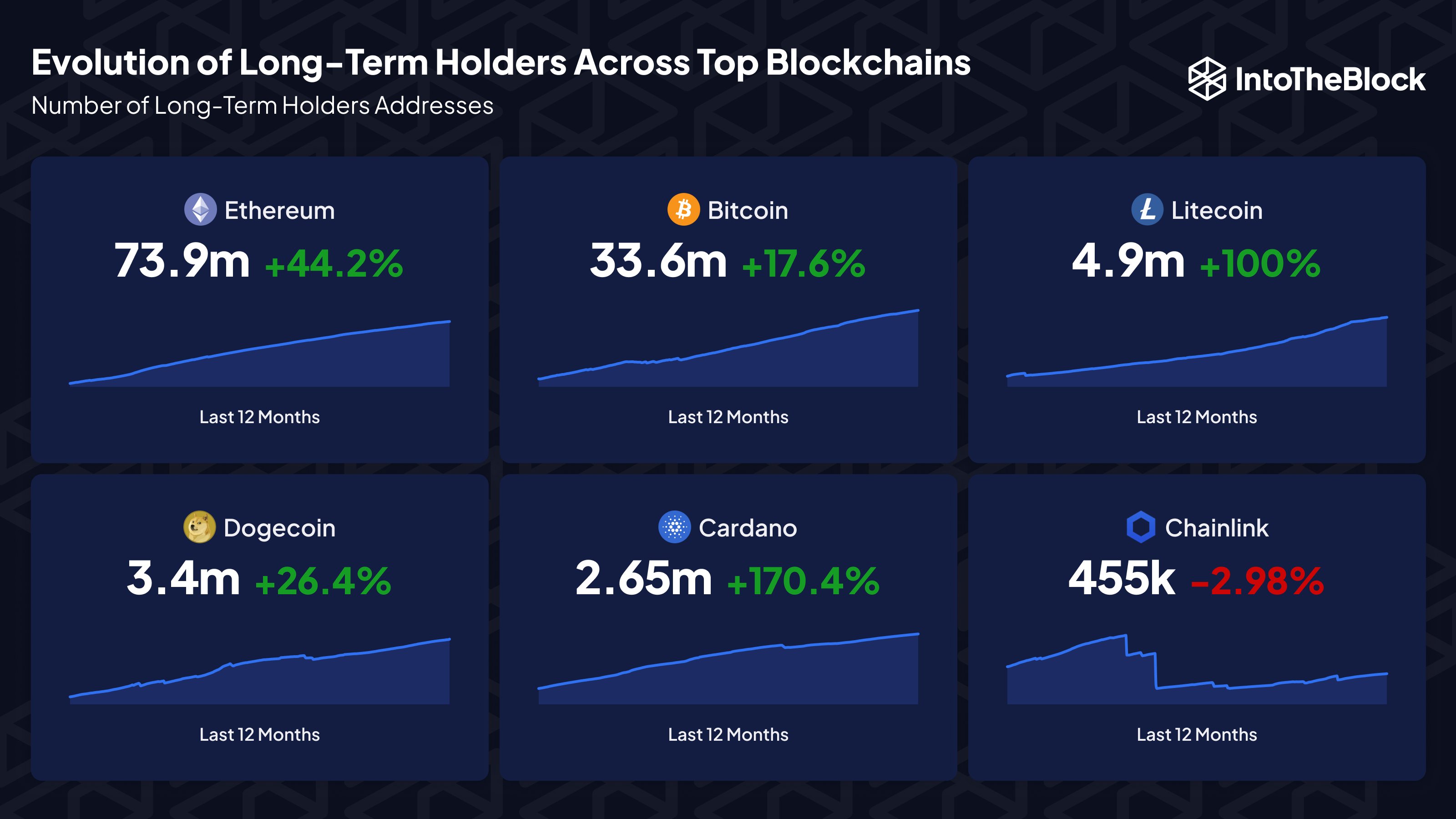

These HODLers are generally the most committed hands in the market, as they rarely participate in any selling. This cohort doesn’t usually budge even when FUD has taken over the market or an enticing profit-taking opportunity has appeared.Looks like Chainlink is the only one who has observed a decline in this metric | Source:As displayed above, the number one ranked cryptocurrency, Bitcoin (BTC), currently has 33.6 million LTH addresses, reflecting an increase of 17.6% during the past twelve months.

Despite its lower market cap, Ethereum (ETH) has BTC beat in this metric, as the number of LTHs on the chain is, interestingly, around 73.9 million, more than double what BTC has. The network has also observed a sharper growth in this indicator at about 44.2%.

This is also even though Bitcoin is also much older, meaning that it would have been able to accumulate more LTHs over the years in the form of lost coins, as such addresses would also fall under this category (although they certainly don’t carry the same meaning as an investor willingly choosing to HODL).While these largest coins have seen some decent increases in the number of LTHs, Litecoin (LTC) has them very easily beaten with its 100% growth, implying that HODLers on the blockchain have doubled during the past year. LTC is still far behind in terms of the pure number of LTHs, as the network hosts just 4.9 million.

Cardano, however, has complete victory over even LTC’s rapid growth, as the coin has seen LTHs go up by more than 170% in this period. This astonishing rise has taken ADA’s total HODLer count to 2.65 million. Chainlink (LINK) appears to be the only cryptocurrency in the table that has seen an adverse change in its number of LTHs, as the asset’s HODLers have decreased by about 3%. The strong increases in the indicator for Cardano and Litecoin can naturally be constructive signs for their prices, as it shows an increasing tendency among the investors to hold onto their tokens for extended periods.ADA Price

Cardano has failed to hold onto its gains from the latest rally, as the asset’s price has already fallen towards the $0.26 level.The value of the asset already seems to have retraced from the rally | Source: