Recently, Cardano (ADA), the smart contracts platform famed for its energy-efficient Proof-of-Stake consensus process, has been creating attention. On-chain data shows a notable increase in big transactions, suggesting a possible comeback of the whales, powerful players with a big influence on the value of cryptocurrencies.

Whales Making Waves On The Cardano Sea

Blockchain analytics company IntoThe Block noted an increase in transactions topping $100,000. The average daily volume for these significant transactions during the past week came almost to $14 billion.

Cardano whales are busy, with an average large transaction volume of $13.84B a day in the last 7 days. For comparison, this is a third of Bitcoin’s current volume, 5x as much as Litecoin’s volume and over 16x that of Dogecoin! — IntoTheBlock (@intotheblock)

Within the same period, this accounts for a third of Bitcoin’s transaction volume and shows increasing Cardano network activity. Fascinatingly, the data highlights the growing interest in Cardano compared to the meme coin by dwarping Dogecoin’s huge transaction volume by a stunning sixteen times.

Unveiling The Mystery: Are Whales Buying Or Selling?

Unquestionably, there is a lot of transactions, but what this means for Cardano’s price is yet unknown. Large transactions might indicate both buying and selling activity, hence a clear price direction is not easy to forecast.

ADA market cap currently at $16 billion. Chart:

Still, the consistent volume above $10 billion over the week—even with a recent price decline—indicates ongoing network movement. This might mean major internal token transfers inside the ecosystem or imply institutional investors joining the Cardano market.

Data Hints At Bullish Undercurrents

Although the precise type of the significant transactions is yet unknown, another on-chain analytics tool called shows a perhaps positive indication. According to their data, big holdings show a developing accumulating tendency.

From the start of April, Addresses with between 100,000 and 100 million ADA have been progressively raising their holdings. Given their faith in the long-term viability of the project, this build-up by whales could be encouraging for Cardano’s future price.

Technical Analysis Paints A Target-Rich Environment

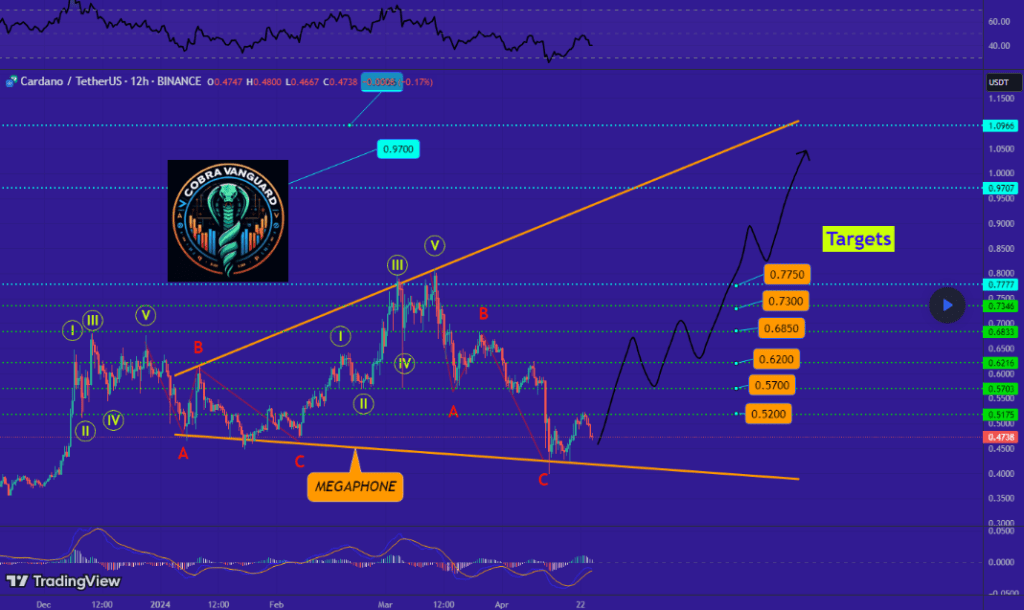

Using technical analysis to project Cardano’s price path, market analyst Cobra Vanguard has responded on the latest events. Starting with the beginning of the year, Vanguard notes Cardano has been trading within an upward price channel.

Should a breach be successful, the analyst projects more ascends towards $0.57, $0.61, and $0.67. With a positive $0.77 as the end aim, Cardano might see a substantial price rise.

Cardano: A Sea Of Opportunity Or A Whale’s Playground?

The recent explosion of significant Cardano network transactions has surely created buzz among the bitcoin community. Although the precise causes of the huge volume are yet unknown, the possible involvement of whales and the increase in accumulation by big holdings offer a cautiously positive picture.Featured image from Invyce, chart from TradingView