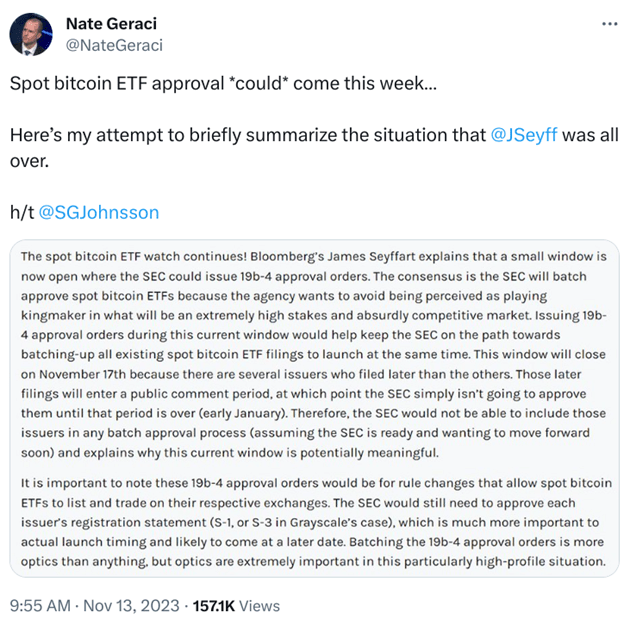

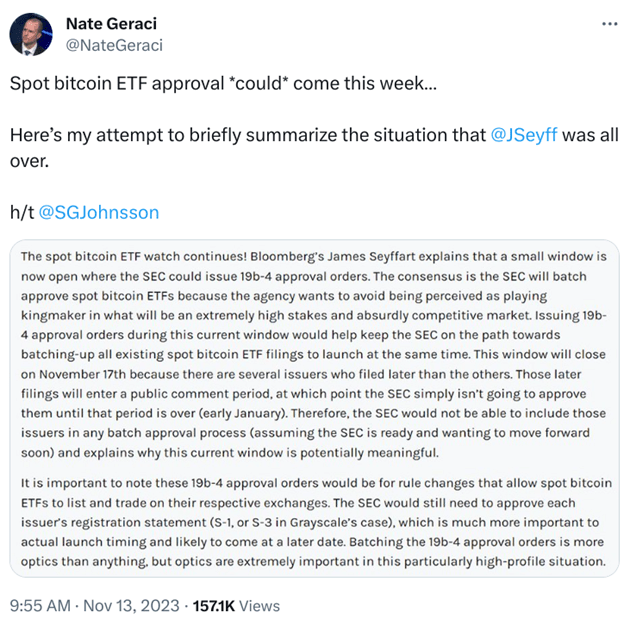

An analyst has just taken to X (formerly Twitter) to exclaim that this week could prove pivotal to the SEC’s decisions on Bitcoin ETF approvals.

Meanwhile, the trend-savvy presale project Bitcoin ETF Token ($BTCETF) has just hit $500K as anticipation around the approvals ramps up.

SEC May Decide Bitcoin ETF Approval Orders This Week to Maintain Parity

With countless global money managers, including Blackrock, Citadel, and Fidelity, all partaking in somewhat of a digital gold rush to get their Bitcoin ETFs approved, the SEC’s stance has been impartialness and equal treatment to all players.

As such, the market consensus is that the SEC will approve a batch of Bitcoin ETFs in one sweep to remove any first-mover advantage in such uber-competitive market conditions.

Well-respected market insider an upcoming event highlighted by Bloomberg Analyst James Seyffart.

The analysis points out a supposedly crucial deadline for 19b-4 approval orders ending on 17 November. According to Geraci, the window for these 19b-4 approval orders will close because some Bitcoin ETF issuers filed later than others.

Without passing said approval orders before the deadline, the SEC may not achieve its desired impartialness in the Bitcoin ETF approval process.

Geraci also notes that these approval orders are not necessarily all-out Bitcoin spot ETF approvals. More so, they are approvals for “rule changes that allow Bitcoin spot ETFs to list and trade on their respective exchanges.”

However, the analyst notes that while the importance of these approvals is mainly for “optics,” he states that “optics are extremely important in this particularly high-profile situation.”

He then published a highlighting a potential U.S. government shutdown that could occur later this week. This adds an air of uncertainty and urgency to the situation.

The approval of Bitcoin ETFs is anticipated to be pivotal for the crypto market, with some a $1 trillion liquidity inflow following their launches. The current global cryptocurrency market cap is $1.46 million, so the ETF approval combined with other upcoming events like the Bitcoin halving and mass adoption could see crypto enter a monumental bull rally.

One project capitalizing on the current frenzy is Bitcoin ETF Token, a new presale project that has raised over $500K in one week.

Stake-to-Mine Bitcoin ETF Token Will Burn 25% of Supply and Offers 504% Staking APY

is a new crypto captivating the crypto community through its position at the center of one of the industry’s most crucial-ever narratives.

The token will harness the hype and new liquidity entering the market through its combination of robust tokenomics and community-building efforts, all Bitcoin ETF-focused.

It features a staking mechanism that rewards users with a 504% annual percentage yield (APY). However, the rewards will decrease as the staking pool size grows, incentivizing early investors.

Meanwhile, it boasts a burn mechanism destroying 5% of $BTCETF tokens at five key Bitcoin ETF events. This will inject a sense of scarcity into the market while the hype is highest, creating massive price potential.

It will implement a 5% burn tax on each transaction to make the token deflationary and reduce the circulating supply over time. This will also encourage long-term holding and likely reduce sell pressure.

Lastly, the project will garner an active and engaged community through Bitcoin ETF education, aggregating the most impactful Bitcoin ETF news from around the internet to its website dashboard.

Investors can buy $BTCETF for $0.0052, but they must act fast as its price will rise in three days.