As the crypto landscape evolves, the opportunity to turn Real-World Assets (RWA) into digital tokens presents a $16 trillion potential, marking a significant shift in both TradeFi and DeFi. At the heart of this transformation is MANTRA, a blockchain platform that stands out with its robust technical capabilities and strong foundational principles. Specifically focusing on RWA tokenization, MANTRA aims to bridge the gap between the conventional financial world and the innovative realm of DeFi. This analysis delves into the promising prospects for MANTRA, spotlighting its potential for a bullish breakout driven by recent technical and fundamental advancements.

Technical Analysis:

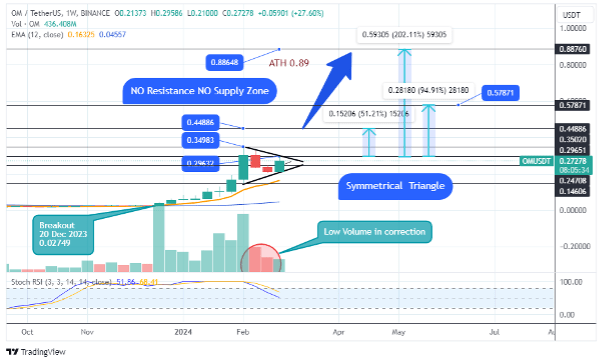

- Weekly Chart: The technical analysis reveals a pattern that typically indicates upcoming growth. The price has risen above $0.29600, which is a positive sign. It is expected to possibly reach $0.35000 and then $0.44900.

- Low volume during the correction Even during times when the price decreased slightly, the low number of sales suggested that many believe in its potential for price increase.

- Inside bar formation since February 5th: A breakout from this pattern could lead to significant upward movement towards $0.44900 and potentially reach new all-time highs (ATH).

- Daily Chart: After a brief correction, the price has shown positive movement in the past four sessions, further supporting the bullish outlook.

Price Levels to Watch:

- Support: $0.29600

- Targets: $0.35000, $0.44900, $0.58000, $0.88800

Fundamental Analysis:

- RWA adoption: The growing interest in Real-World Assets (RWA) within the DeFi space positions MANTRA as a potential frontrunner, aiming to facilitate secure and compliant RWA tokenization.

- Security-first RWA Layer 1 Blockchain: MANTRA emphasizes regulatory compliance and caters to institutional needs, potentially attracting broader participation.

- Permissionless Blockchain for Permissioned Applications: This unique approach allows developers to build permissioned applications (dApps) on a public blockchain, potentially enhancing security and trust for institutional users.

- In Top 4 projects in RWA Category as per Coingecko: MANTRA has been steadily climbing the ranks and now stands among the top 4 RWA projects on CoinGecko, showcasing its innovation and influence in the tokenization space.

- Listed on Top Exchanges: $OM is currently listed on the top crypto exchanges including Binance, OKX, KuCoin, Gate.io, and over 25 other exchanges.

- 100 Validators on Testnet: A strong network of active validators makes the infrastructure more decentralized. Validators include BwareLabs, SCVSecurity, 01node, Lavender.five Nodes, etc.

- 20+ Experience Leadership and Team: The MANTRA team has over 20 years of combined experience with backgrounds from leading organizations like HSBC, Deloitte, Bank of America, HP, DLA Piper, and Bitmex, ensuring expertise in the field.

Conclusion:

The technical analysis suggests a potential breakout on the MANTRA chart, with initial targets of $0.35000 and $0.44900. While not financial advice, this analysis, combined with MANTRA’s focus on real-world asset (RWA) tokenization, its security-first approach, and its feature set designed for both developers and institutions, paints a potentially promising picture for its long-term value proposition.