For nearly as long as Bitcoin has been trading, its existence has been a thorn in the sides of crypto investors everywhere. And starting today, new investors in crypto may soon find out why veterans cringe when they hear the name: Mt. Gox.

Find out why the infamous, original crypto exchange could continue to be the bane of each Bitcoin bull run.What Is Mt. Gox And What Does It Mean To Bitcoin?

Mt. Gox is short for “Magic: The Gathering Online eXchange,” . But when its creator Jed McCaleb became interested in Bitcoin, he turned it into a cryptocurrency exchange.Related Reading | Analyst: Bitcoin Parabolic Trend Is “Close To A Breakdown”

Word is spreading, , that Coinlab has reached a deal with Mt. Gox creditors in which original investors can claim up to 90% of the original BTC lost. The deal is subject to creditor approval, but it could lead to a portion of the original 140,000 BTC making its way into the market.Much of what has been driving the recent Bitcoin rally has been a lack of coins on exchanges, but a sudden influx of sellers in tens of thousands of profit per coin could turn the tides on a the overall bull trend once again.

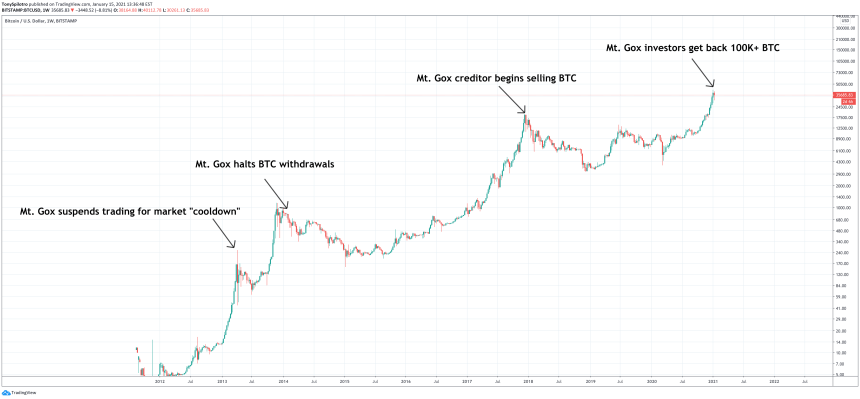

The effects of Mt. Gox over the years | Source:

How The Early Exchange Has Crushed Each Major Crypto Rally

While the existence of the early exchange was vital to Bitcoin’s initial growth, it has been nothing but a thorn in its paw since. Mt. Gox has been responsible for nearly every major peak in the cryptocurrency’s history, dating back to 2013.

Related Reading | The Striking Similarities Between The 2017 Bitcoin Peak And Now

The trustee began moving Bitcoin on December 18, the exact peak of the last bull market. The rest is history.

Bitcoin is back, and even doubled its 2017 peak. Will these early investors in crypto continue to hold for much higher prices? The highest price the cryptocurrency was trading at in 2013 and 2014 was under $1,200. That means even at today’s price of $35,000 and a 90% allocation, they’re still in over $30,000 profit per coin.

Even if every investor of some 100,000 BTC only sold half, that’s 50,000 BTC suddenly flooding the market. The trustee , and it took the cryptocurrency back down to $3,200 in the end. What sort of damage will this do to the market this time?Featured image from Pixabay, Charts from TradingView.com