Crypto Guide: When To Buy Altcoins

Van de Poppe opens his discussion by framing the issue as a “Million Dollar question,” emphasizing the difficulty many face when trying to navigate the highly volatile altcoin market. “How do you position yourself into an Altcoin running upwards? How do you avoid chasing FOMO and hype?” he queries, setting the stage for a deep dive into the complexities of market timing and investment strategies.

He starkly highlights a common misstep among investors, pointing out, “Between 80-90% of buyers who purchase an asset do that in the last 10% of the price movements.” This statistic underlines the herd mentality prevalent in the investment world, where many are drawn to an asset only after witnessing significant gains, often too late to realize similar returns.Van de Poppe argues for a contrarian approach to investing, suggesting that the greatest opportunities lie in moments of widespread doubt or negativity. He offers a compelling comparison, “After the collapse of FTX, Bitcoin’s price was swimming around a value of $15,500 per Bitcoin.

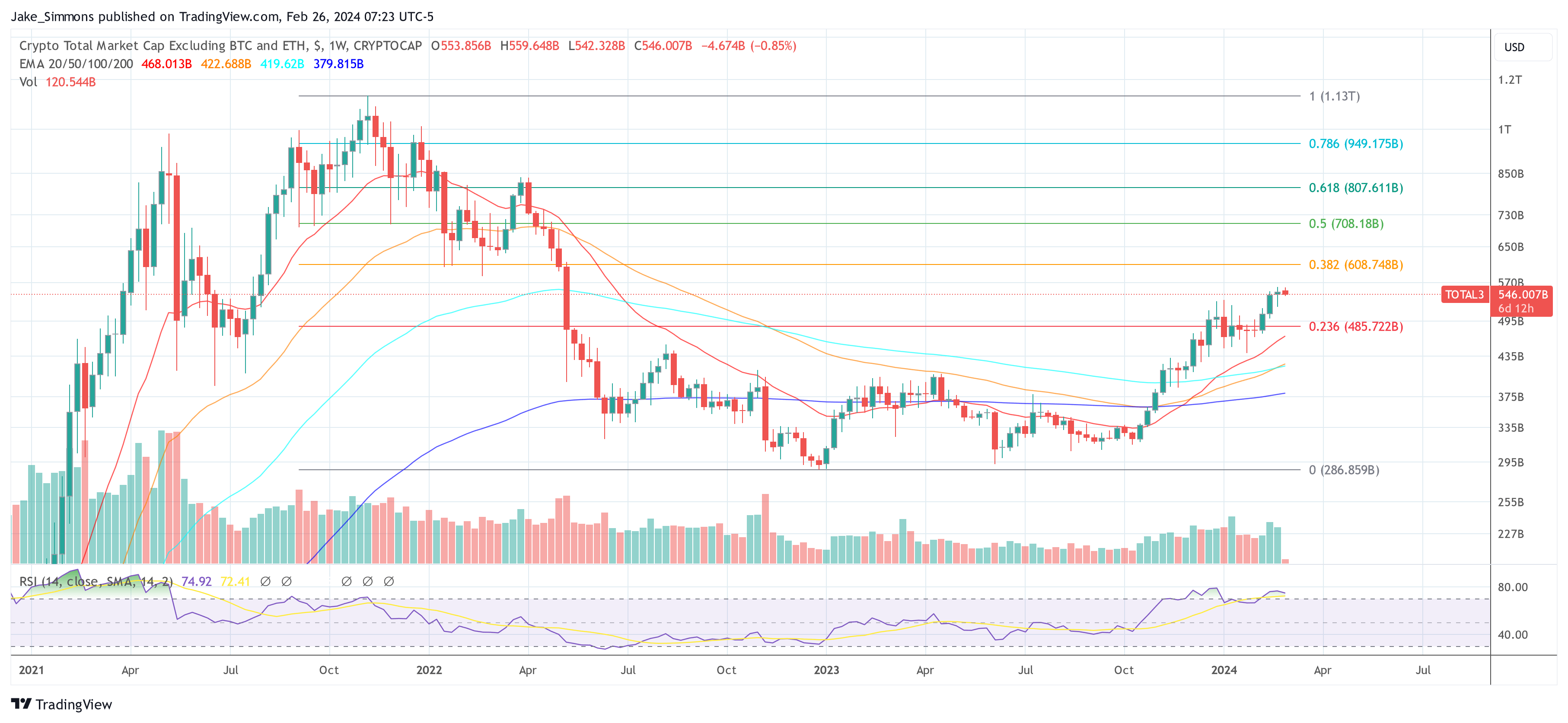

During this period, almost no one was interested in getting into a position.” He contrasts this with the period leading up to the ETF approval when Bitcoin was trading at significantly higher prices, to illustrate the heightened risks associated with entering the market during periods of optimism.Another option is to examine the total market capitalization of the altcoins, either with Ethereum (“TOTAL2”) or without ETH (“TOTAL3”) on TradingView.com. The two metrics can give an indication of what stage the market is currently in – a Bitcoin dominance phase or an emerging altcoin season. At press time, TOTAL3 stood at $546 billion after surpassing the crucial resistance at the 0.236 Fibonacci retracement level.