Beanstalk Farms’ Hack: What Went Down

The shows that the hacker used what’s commonly known as a ‘flash loan attack,’ one that has been seen on DeFi protocols previously. A flash loan in crypto allows a user to borrow and repay a loan in a single transaction, which minimizes risk for lenders and can streamline processes for borrowers. In the Beanstalk Farms hack, the hacker borrowed nearly a third of the BEAN supply, roughly 32 million tokens and utilized Curve Finance’s $3Crv tokens to generate a unique tokens ‘BEAN3CRV-f’ and ‘BEAN3LUSD-f.’ The attacker utilized these two new tokens to deceive Beanstalk’s governance model and gave the hacker a massive majority holding of ‘seeds,’ the platform’s governance token. With such a larger holding of seeds, the hacker had the contractual capability to execute an ’emergency governance action,’ siphoning massive amounts of funds from the Beanstalk contract.

Lossless (LSS) has reached out to Beanstalk; the project is an increasingly-utilized tool to combat against potential hacks. | Source:

Related Reading | Bitcoin Clings To $40K On Easter Sunday As Crypto Seen To Head Lower In The Short Term

Can The Protocol Recover?

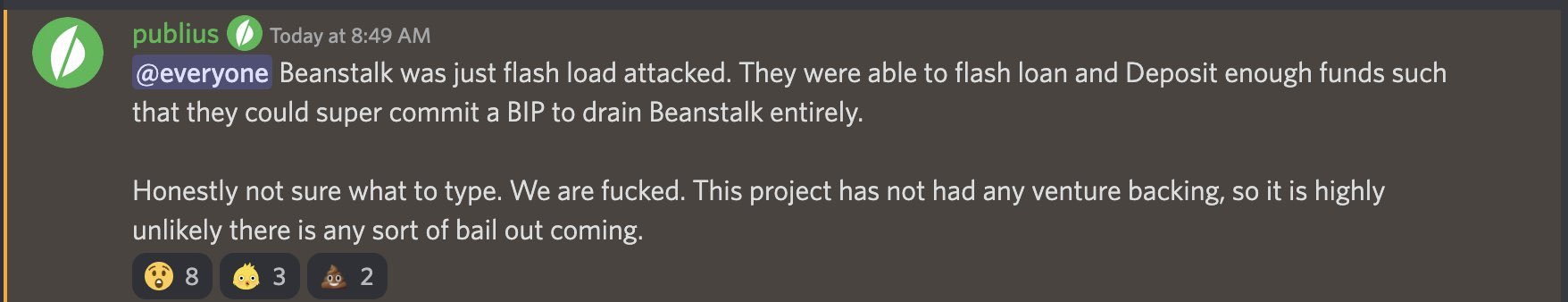

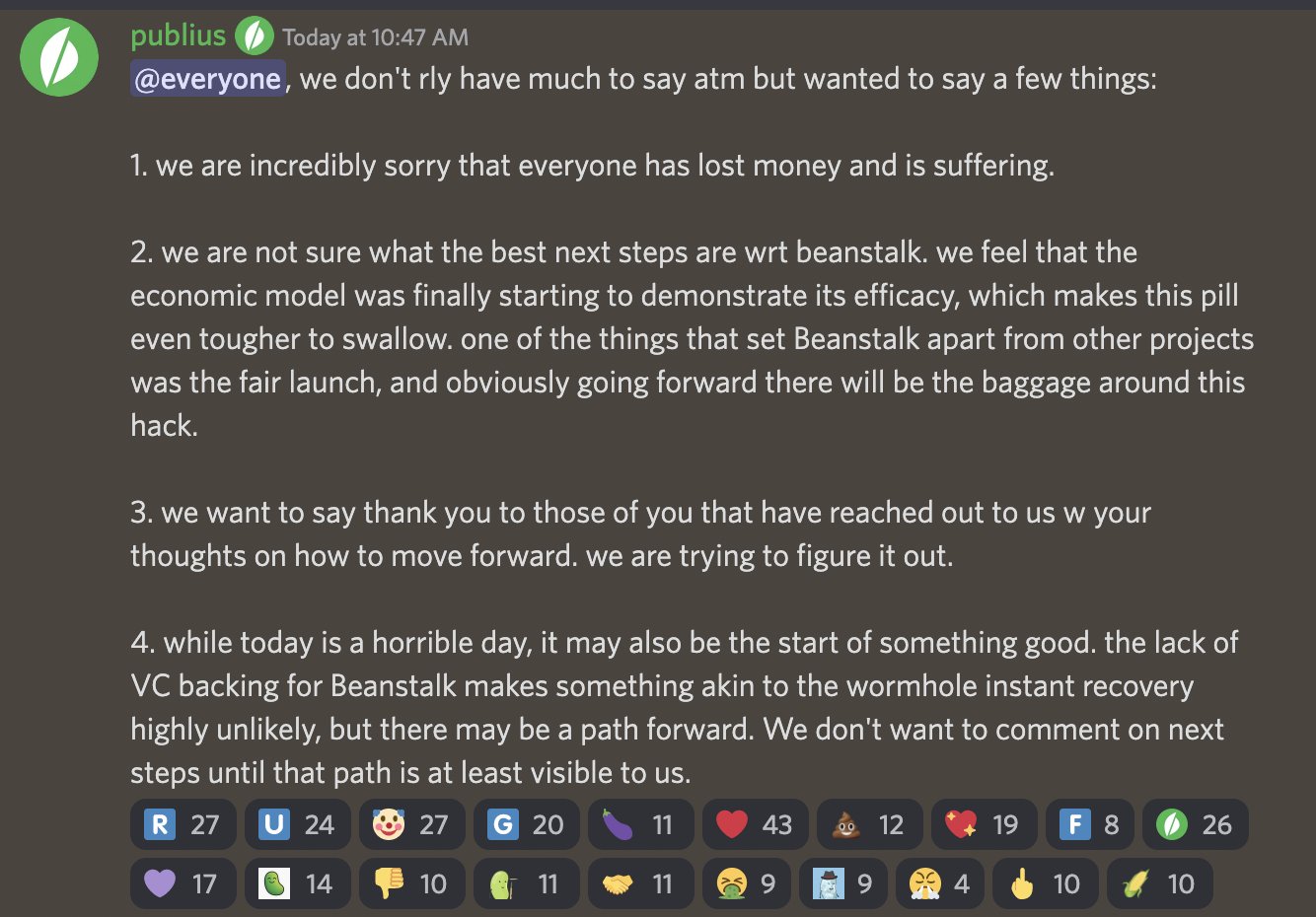

Just days ago, Beanstalk was celebrating over $150M in TVL, over $130M in liquidity, and a rapidly approaching market cap of $100M that was impending. The protocol has had to pump the brakes, and it’s future is now unclear – with a stark Discord screenshot from admins:We’re engaging all efforts to try to move forward. As a decentralized project, we are asking the DeFi community and experts in chain analytics to help us limit the exploiter's ability to withdraw funds via CEXes. If the exploiter is open to a discussion, we are as well. — Beanstalk Farms (@BeanstalkFarms)

Related Reading | ADA To Rebound With Integration Of USDT And USDC On Cardano

Featured image from Pixabay, Charts from TradingView.com The writer of this content is not associated or affiliated with any of the parties mentioned in this article. This is not financial advice.