Tomb Forks And Rug Pulls

As per , in 2021 DeFi rug pulls took over $2.8 billion worth of crypto and accounted for 37% of all cryptocurrency scam revenue in the year, versus just 1% in 2020. A risky model called Tomb Fork, often FTM-based, has become perfect for rug pulls and many investors keep falling in.

A risky model called Tomb Fork, often FTM-based, has become perfect for rug pulls and many investors keep falling in.

was a project that allowed users to “create their own prediction markets about anything.” They launched a token model with the promise of rewarding “all participants fairly, while also making the network resilient.”

PulseDAO was a Tomb Fork. Based on Tomb Finance, Tomb forks are algorithmic stablecoin projects that peg their token to another coin, originally FTM.In the case of Tomb Finance, they to “create a mirrored, liquid asset that can be moved around and traded without restrictions.”

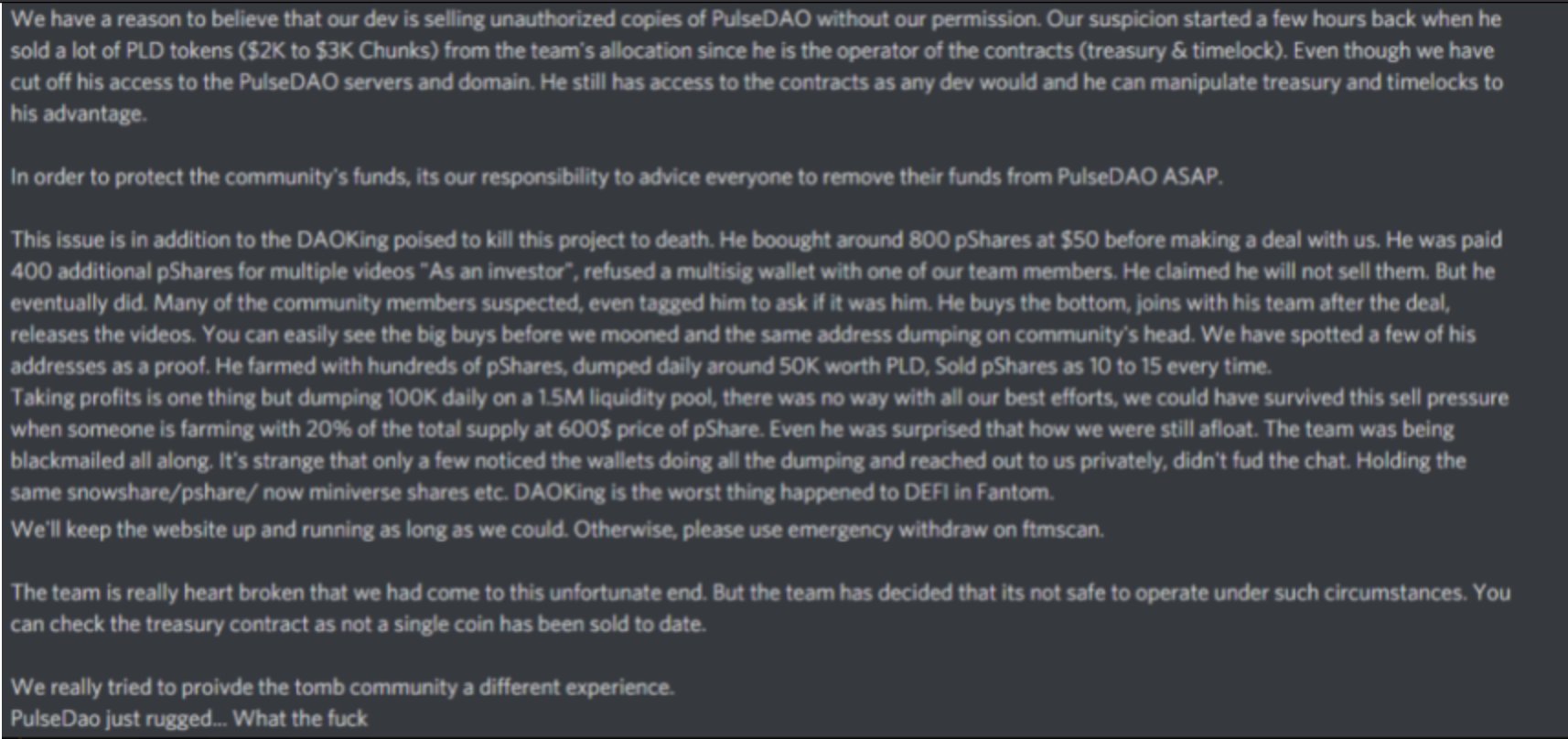

The PulseDAO Rug

The rug was by Rugdoc.io, who had previously warned that the project had a risk of governance mishandling and they needed their contracts to be subjected to a full audit with a reputable auditor. They highlighted the following risk vectors:-

Not KYC’d with RugDoc

-

No reputable audits as of date

-

Liquidity is not locked with RugDoc

-

Not in a multisig. We highly recommend the project to use one with community members or reliable 3rd parties as an approver due to the said governance risk.

Then, they spotted that 4243 FTM was removed from the project by the contract owner . It seems like they pulled out almost all of the project’s liquidity.

However, RugDoc missed that PulseDAO did KYC with ApeOClock, but it was not enough for safety, and this is a very important detail for investors to take into account. Is KYC enough? More on that below. About 5 days ago, PulseDAO said via Discord they were having issues with their cross-chain bridge, but nothing more. After March 13, all accounts and websites were down or deleted. There is not much information running around, but scraping screenshots of messages from the team, this is one of the excuses they gave:“It appears Tomb forks have inherent governance risks, which is why it is critical to have renounced contracts and KYC in place before entering.”

Related Reading | A Race For The Truth: Fantom Vs. Rekt, What Went Down

Why KYC Didn’t Matter

Many investors check a safety box when a project has KYC, but the PulseDAO example shows its weak face. Some of the reasons it might not do any difference are:- Recovering crypto thefts from some countries can be difficult or even impossible.

- Authorities might not look into smaller crypto projects.

- Scammers might not even be held accountable in several countries because the rug pull falls into grey areas.

FTM Price

Fantom (FTM) has been trading around $1.08 in the daily chart, down 5.50% in the last 24 hours. The coin has experienced fear from investors because of the departure of main developers. The foundation has claimed this will not affect their plans.Related Reading | Why Fantom Fell 22% Following Key Personnel Exit