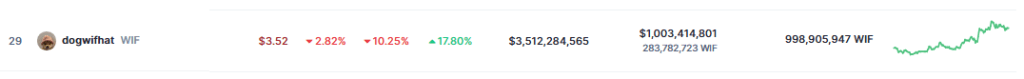

Dogwifhat: Recent Performance Ignites Bullish Momentum

WIF has left its rivals in the doghouse while defying the odds in recent weeks. The around 20% over the past seven days alone; the past month has seen even more amazing 30% increase.

With many investors waving their tails in expectation of more gains, this increasing trend has inspired hope throughout the crypto community.

Breaking Through Key Barriers

Not hesitant about his optimistic view on WIF, eminent crypto specialist Alex Clay Clay says the current explosion marks a possible turning point for the meme coin.Following a 43-day strategic accumulation period, WIF effectively broke a critical resistance level, labelled the “Key Zone” by Clay. According to Clay, this breakthrough points to changes in investor confidence and market mood.

broke above the Key Zone around $3.3 after 43 Days of Accumulation🧐 Looking for a retest of the $4.4 Major Supply Zone and more upside if we do break out🚀 🎯 Target: 6.7$ — Alex Clay (@cryptclay)

Clay sees WIF driven towards a “retest of the $4.4 Major Supply Zone” by this fresh optimism. Should WIF be able to overcome this resistance level, Clay confidently forecasts a further climb to a price objective of a shockingly $6.7.

Meme Coin Frenzy: A Word Of Caution

Though Clay’s projections present WIF in a positive light, it is important to consider the natural volatility of meme currencies. Unlike more well-known cryptocurrencies with substantial underlying value, meme coins largely rely on social media trends and buzz. Their irregular price swings create this reliance to make investments more dangerous than those of more grounded choices.

WIF Price Prediction

Based on the present study, Dogwifhat seems to be in a positive trend; its of 230% to $12.37 by June 29, 2024. Supported by a Fear & Greed Index value of 73, which shows market greed, the technical indications point to a good attitude among investors.

Featured image from Pexels, chart from TradingView