Elrond (EGLD) and Aptos (APT) are attractive in a sideways market as they record extreme price fluctuations. This price action is attracting market participants tired of Bitcoin and Ethereum trending sideways, chopping out long and short positions.

Launched a day ago in most crypto exchanges, Aptos experiences massive price fluctuations. At the time of writing, Elrond trades at $57 with a 4% profit in seven days and a 20% profit in thirty days. In the meantime, Aptos deals at $7 with a 47% loss in the last 24 hours.

Retail Traders Pile In, Betting On Elrond and Aptos

NewsBTC reported earlier that Bitcoin and larger cryptocurrencies would likely continue with their sideways movement over the coming weeks. This sideways price action might extend the spikes in volatility for EGLD, APT, and tokens going viral across social media.

In that sense, data from Santiment recorded an increase in the “Discussion Rate” across Twitter, Telegram, and other platforms. Retail traders have been posting about these cryptocurrencies causing more people to become interested, leading to further volatility.

The research firm said the following on Elrond and Aptos’s price action while the chart below:

Elrond and Aptos are both trending Wednesday for different reasons. The price of $APT tanked after launching its highly anticipated mainnet. Meanwhile, $EGLD has benefited from some shilling and giveaways making rounds on Telegram, in particular.

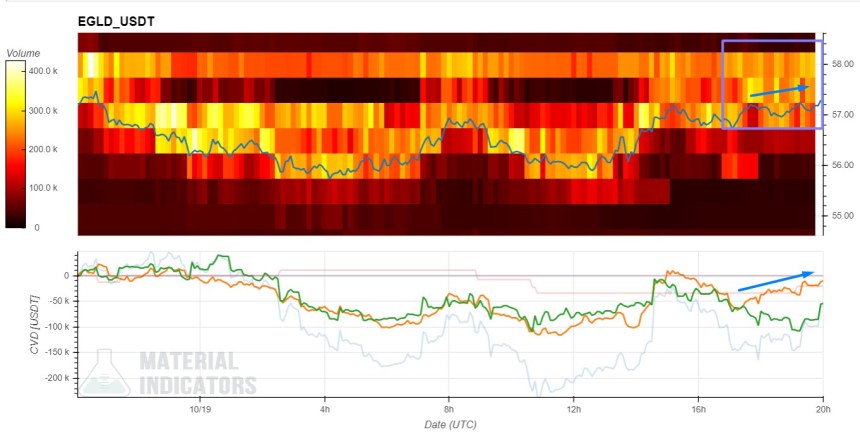

Additional data from Material Indicators support this thesis. Retail traders have been following as Elrond increases its social media posting volumes. Traders with buy orders from $100 to $1,000 are bidding into EGLD’s price action.

The cryptocurrency is losing momentum on lower timeframes. As seen in the chart below, EGLD’s price is coming into heavy resistance at its current levels. Selling orders are thickening and might prevent the price of this cryptocurrency from sustaining its price action.

While more significant cryptocurrencies trend sideways, any rally or volatility in the price of Elrond and Aptos might be short-lived. However, if too many traders jump into these tokens, Bitcoin and Ethereum might lose stability.

According to a pseudonym trader, APT’s volatility and participation might take out the liquidity from other trading pairs. This price action leads to a sudden shift in price direction for more prominent cryptocurrencies, a situation that might become normal while the market lacks clear direction.

After 1 day: $150 mil open interest, $3 bil futures volume, $1 bil spot volume… This is going to suck so much liquidity from the market.— Byzantine General (@ByzGeneral)