Ethereum Rises: Growth, Innovations, And Challenges

Beneath the surface of rising price charts lies a complex story of intertwined strengths and weaknesses. Ethereum’s impressive 87% year-on-year market cap surge, catapulting it from $140 billion to a hefty $267 billion, paints a picture of robust growth. The Merge upgrade, a landmark event streamlining Ethereum’s blockchain, and the burgeoning DeFi ecosystem pulsating with innovative applications are key contributors to this ascent. However, lurking beneath this facade is a critical bottleneck: Ethereum’s Layer 1 scalability limitations. The network’s notorious high transaction fees and sluggish throughput have become thorns in the side of DeFi expansion, frustrating both users and developers yearning for a smoother experience. As of writing, on this 26th of December, painting the daily and weekly charts red with a dip of roughly 1.5%, data from Coingecko shows. This recent descent adds further intrigue to the complex dance Ethereum is performing near the critical $2,500 resistance level. This delicate dance between bullish aspiration and bearish pressure underscores the fragile equilibrium in the market. On one hand, the optimism surrounding Ethereum’s future potential continues to draw in traders. On the other hand, the specter of high transaction fees and scalability woes, alongside whispers of a potential bear market, keeps selling pressure simmering just below the surface.Ethereum At $2,300: Bulls’ Battle, Bears’ Threats

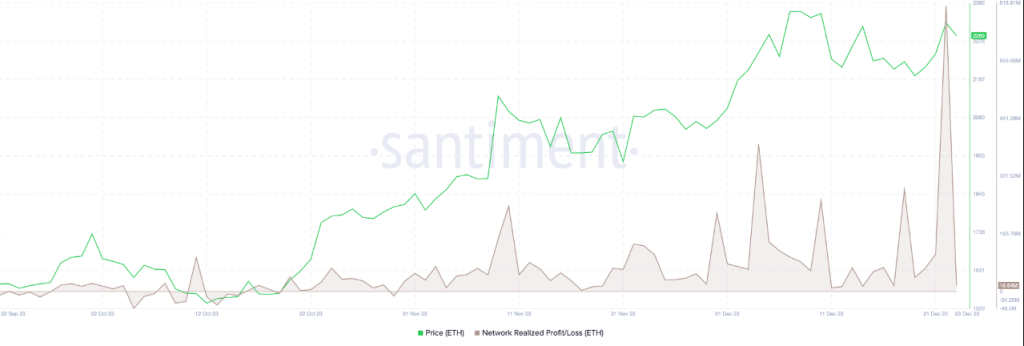

For Ethereum bulls, the $2,300 level is a crucial battleground. If they can muster enough buy-side force to sustain a climb above this mark, it could pave the way for a surge towards the coveted $2,500 resistance level. This breakthrough would be a significant psychological victory, injecting fresh confidence into the market and potentially triggering a new upward trend phase. However, the bears are not out for the count. Their sights are set on breaching the $2,200 support level, which would solidify their grip and potentially trigger a more substantial decline. Should this scenario unfold, the $2,000 mark could come into play, with further losses possible if selling pressure remains unchecked. Adding to the intrigue is the factor of exchange supply. A recent increase in Ethereum tokens on exchanges indicates more readily available ETH for sellers, potentially amplifying downward pressure. This highlights the delicate balance between market sentiment and technical factors in determining Ethereum’s future trajectory. Meanwhile, the ETH traders’ profit-taking is evident in the between October 31 and December 23. A significant amount of profit-taking may cause the price of ETH to decline.

Ethereum’s Critical Crossroads Ahead

Looking ahead, Ethereum’s path hinges on its ability to navigate this complex landscape. Addressing its scalability issues through Layer 2 solutions and potential future upgrades will be crucial for maintaining and expanding its DeFi dominance. Rekindling developer and user confidence by reducing transaction fees and improving network throughput is also paramount. Only by tackling these internal challenges and adapting to the ever-evolving crypto sphere can Ethereum truly reclaim its throne as the king of DeFi. The next few weeks are likely to be pivotal for Ethereum. Will it scale the $2,500 height and cement its position as a leader in the crypto revolution? Or will internal limitations and external pressures force it to face a precipitous drop?Featured image from Shutterstock