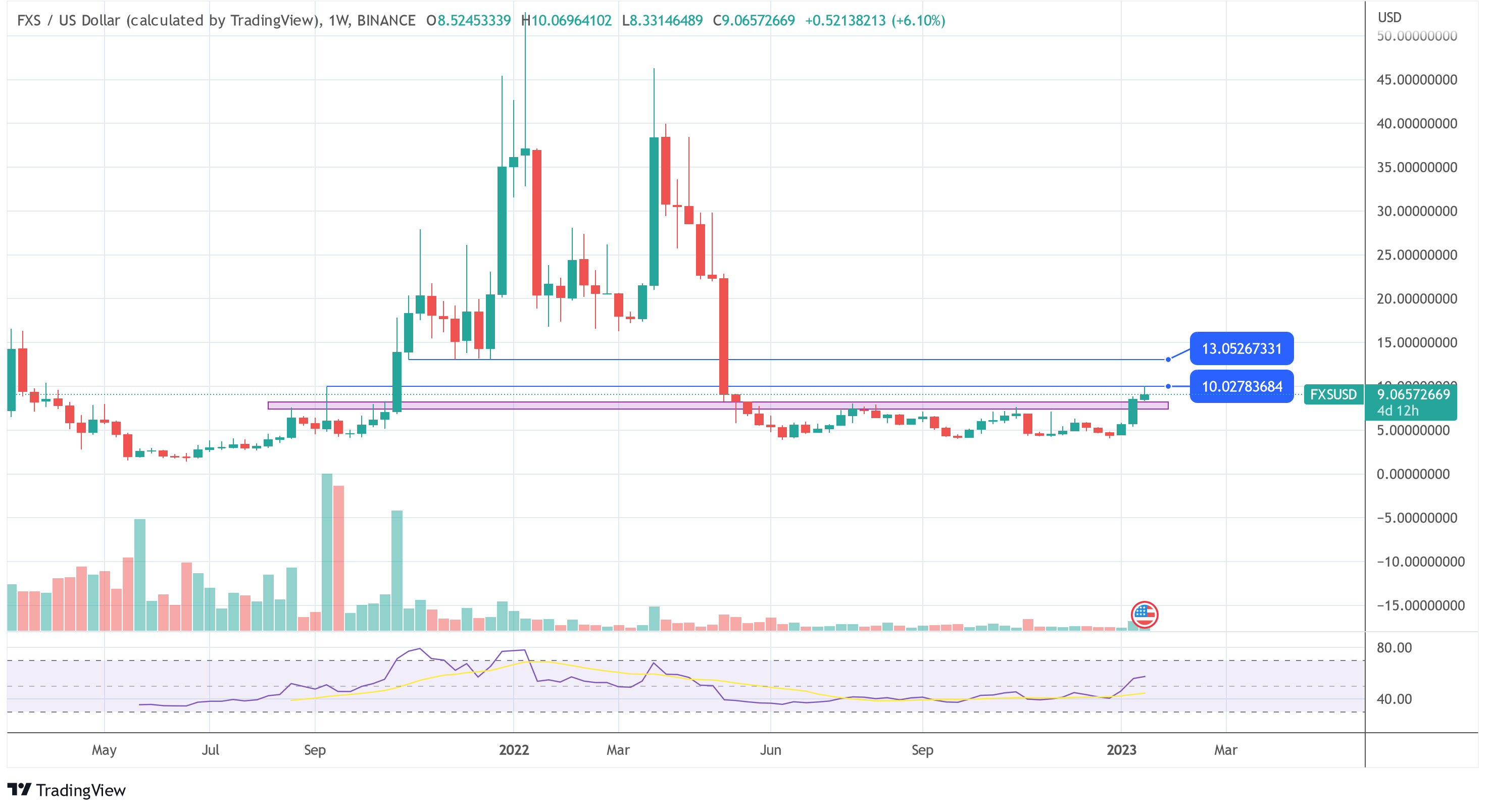

What Do The Fundamentals Of Frax (FXS) Suggest?

As NewsBTC reported, Frax Finance is benefiting from the liquid staking (LSD) narrative that emerged earlier this year and has since caused all LSD tokens to skyrocket. However, it is questionable whether the hype can continue for a longer period of time.

As Jordi Alexander, CIO of Selini Capital , the Ethereum Shanghai hard fork could be in for a rude awakening:But analyst Thor Hartvigsen whether the same will be true for Frax Finance. The analyst shared five reasons via Twitter why Frax Finance will be a key player in DeFi this year.ETH staking is going to explode after the Shanghai fork allows withdrawals- esp. now as Metamask integration makes it easy for Dummies. But LSD tokens are overvalued in anticipation of this – revenue is not going to change much, bc reward yields will plunge as staking % goes up.

¤ Frax Finance has been crushing it lately🔮 And with their growing ecosystem of DeFi products, has a TON of upside in 2023. Here are 5 reasons why will be a central player in DeFi this year and how you should be taking advantage of this 🧵 1/19 — Thor Hartvigsen (@ThorHartvigsen)Third, it’s the AMOs that make Frax special, as they don’t just let collateral sit dormant, but use it in various DeFi applications. It also offers some of the highest stablecoin yields, which significantly strengthens FXS by increasing liquidity on Curve. Last but not least, Hartvigsen points to Frax’s roadmap to reach a market cap in the trillions and become the risk-free underlying in DeFi. The analyst touts the Fed Master Account (FMA) as the biggest innovation:

A FMA is dollars deposited directly into the FED treasury’s ledger and grants access to US Treasuries. The FED gives a status on the ledger once a day which essentially is the ultimate audit.

This would make FRAX one of the closest things to a ‘risk free dollar’. It’s a very ambitious goal however and likely a few years away.

Featured image from Inside Out, Charts from TradingView.com