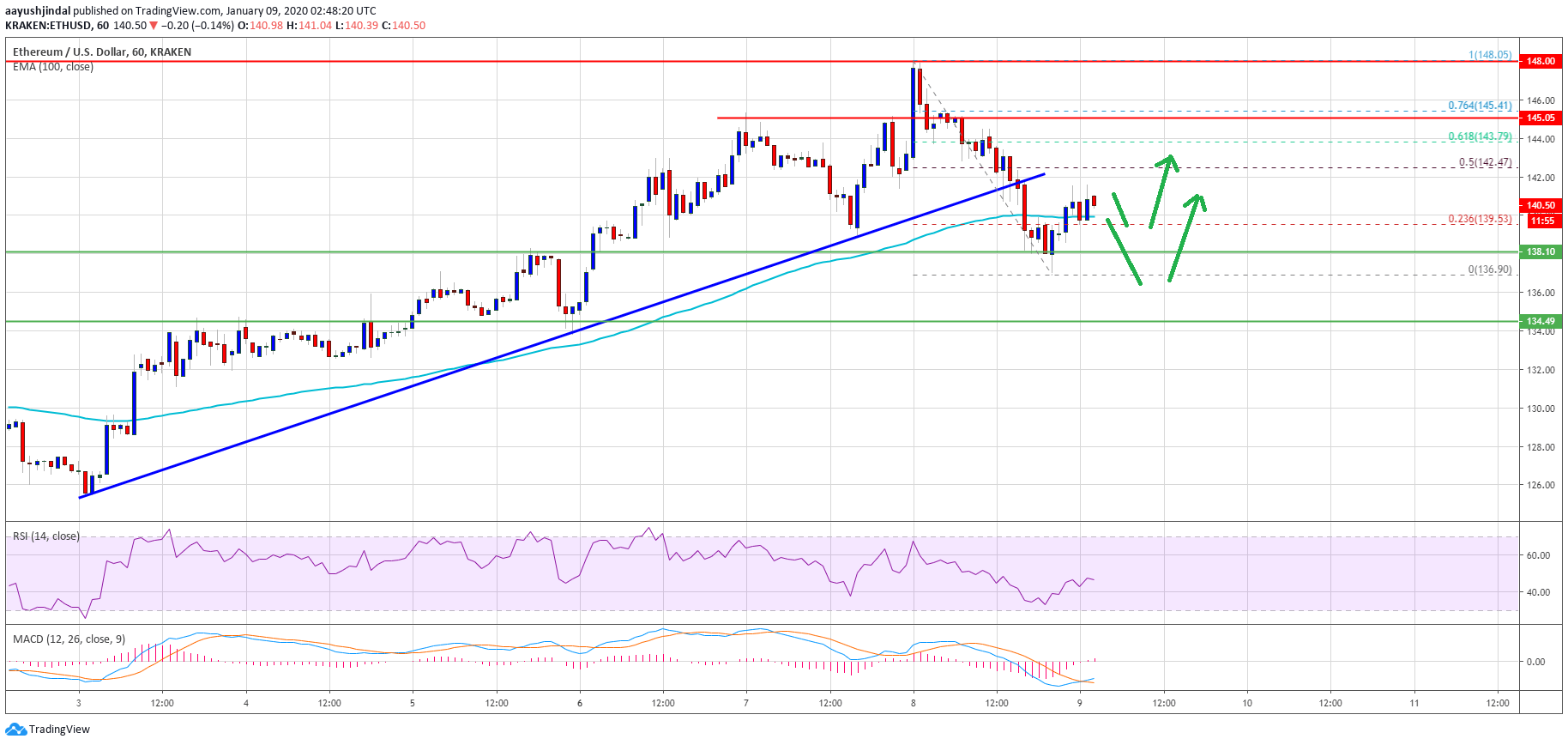

Ethereum started a downside correction from the $148 resistance versus the US Dollar, similar to bitcoin from $8,450. However, ETH price is still in an uptrend unless there is a close below $135.

- Ether price corrected lower after it failed to bounce from the $142 support against the US Dollar.

- The price is currently finding support near the $138 level.

- This week’s followed bullish trend line was breached with support near $142 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair is still in an uptrend and likely to rise again unless the bears push it below $135.

Ethereum Price Holding Support

After a steady rise, Ethereum found resistance near the $148-$150 zone against the US Dollar. As a result, ETH price started a downside correction below the $145 and $142 support levels.Besides, bitcoin is down more than 5% and it failed to stay above the $8,100 and $8,080 support levels. On the other hand, ripple price is still holding the $0.2050 and $0.2000 support levels.

Bearish Case for ETH

The main supports on the downside are near $135. If ETH price fails to stay above the $135 support area, there is a risk of a downside extension. The next key support is near the $128 zone.

Hourly MACD – The MACD for ETH/USD is slowly moving into the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 level, with a flat bias.

Major Support Level – $135 Major Resistance Level – $145