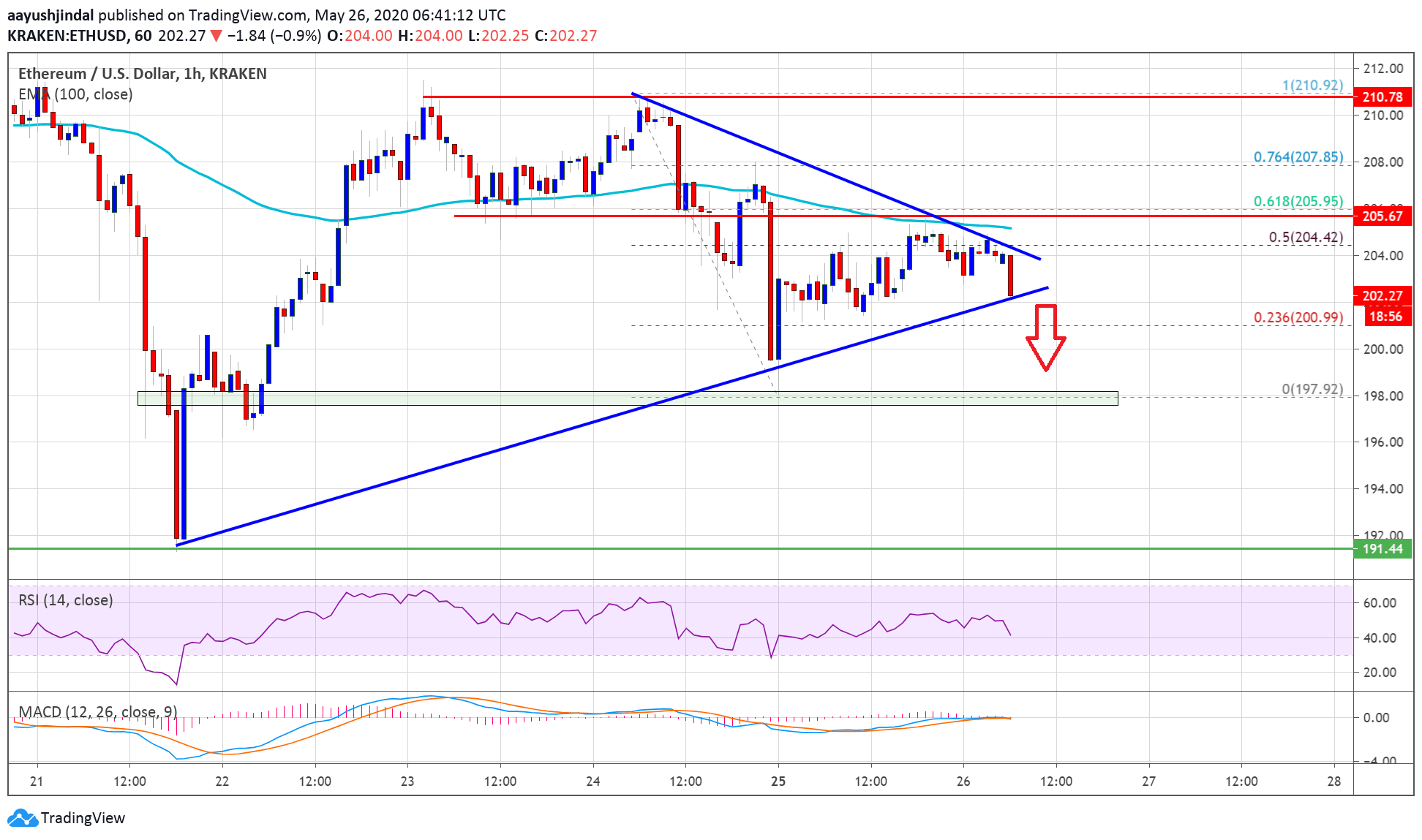

Ethereum is struggling to break the $205 and $210 resistance levels against the US Dollar. ETH price is currently declining and it remains at a risk of a larger decline below $200.

- Ethereum is facing a strong resistance near the $204 and $205 levels.

- The price might continue towards the $192 support if it fails to stay above $200.

- There is a key contracting triangle forming with resistance near $204 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must climb above $205 and $210 to decrease chances of a larger decline in the near term.

Ethereum Price Could Extend Its Decline

Ethereum price found support near the $198 level after a sharp decline from the $210 resistance. ETH price started a short-term upside correction from $198 and managed to settle above $200.

There was a break above the 23.6% Fib retracement level of the downward move from the $210 high to $198 low. However, ether price seems to be facing a strong resistance near the $205 level and the 100 hourly simple moving average.

If the price climbs above the $210 resistance, it could decrease bearish pressure and increase chances of a decent rise towards the $220 and $225 levels in the near term.

Bearish Break

If Ethereum fails to recover above the $205 and $210 resistance levels, there might be a fresh decrease. An initial support is near the triangle lower trend line at $202. The first key support is near the $200 level, below which the price is likely to continue lower towards $198 and $195. The main uptrend support is near the $192 level. If the bears push the price below the $192 support, it could spark a sharp decline towards the $180 level. Technical IndicatorsHourly MACD – The MACD for ETH/USD is slowly gaining pace in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now declining and it is now well below the 50 level.

Major Support Level – $200 Major Resistance Level – $205 Risk disclaimer: 76.4% of retail CFD accounts lose money.