Crimson Chart: Long Positions Liquidated

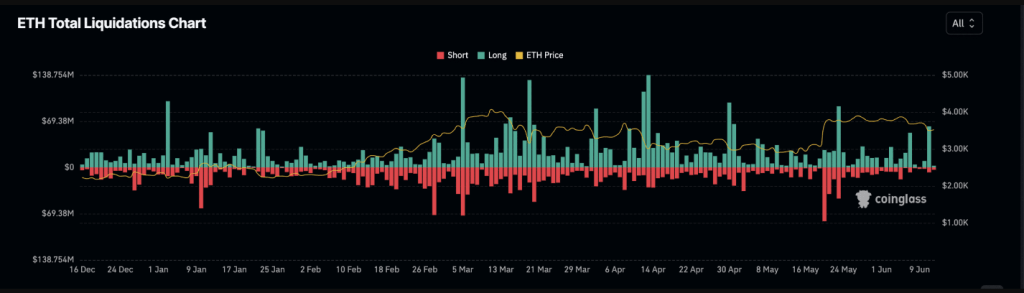

Overconfident investors loaded long bets, effectively waging would rise. But the market had different ideas. Shivers down the spines of these bulls caused by an unanticipated price decline set off a flood of liquidations.

These positions were aggressively liquidated to stop more losses for the unhappy traders as the price dropped below a margin requirement set by the exchange. So the outcome is For some exchanges, a collective sigh of relief; yet, on that fatal day, a hefty bill for liquidated bulls—more than $60 million.

Positive Funding Rate Offers A Glimmer Of Hope

A silver lining in the shape of a good Funding Rate surfaced while the market drop rocked the Ethereum derivative scene. This statistic basically shows the costs incurred by traders with short positions—betting on a price drop—versally from those with long holdings.

Said another way, a positive Funding Rate shows a greater demand for long positions, implying that some investors remain hopeful about Ethereum’s long-term prospects even among the carnage. The fact that ETH’s Funding Rate hasn’t entered negative territory since May 3rd supports this positivity even more.

A Temporary Hiccup?

The jury is still deciding whether this incident marks a passing blip or a more alarming trend. The positive Funding Rate gives some hope, but the notable decline in derivatives activity presents another picture.

Over the previous 24 hours, Open Interest (total outstanding contracts, down 2%) and options trading volume (down 50%) have both show concerning declines. Given less people actively trading options contracts or keeping open positions, this points to a possible market flight.

Ether Price Forecast

Featured image from SignatureCare Emergency Center, chart from TradingView