- ETH price is currently trading in a broad range above the $140 and $142 supports against the US Dollar.

- The price seems to be facing a strong resistance near the $148 and $150 levels.

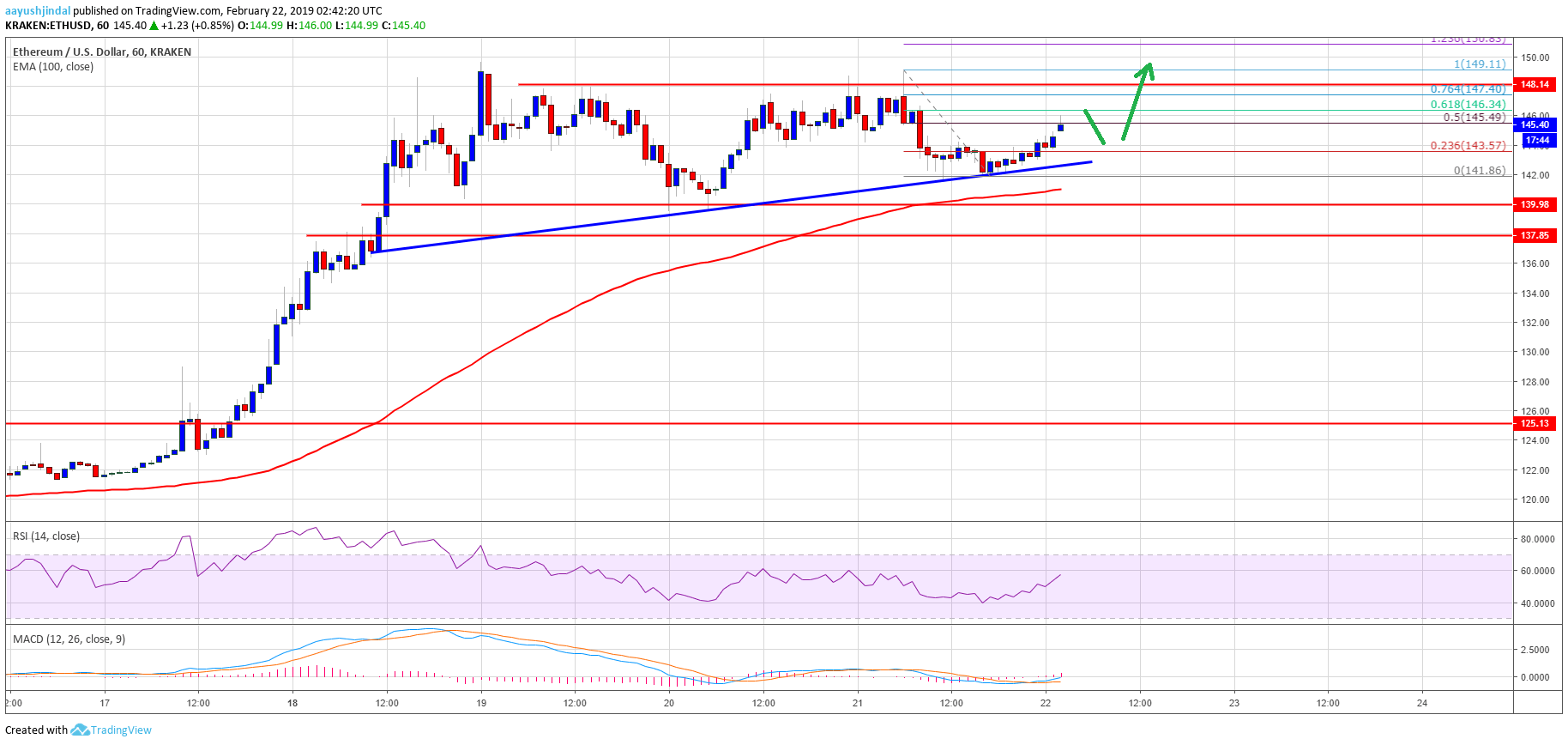

- There is a key bullish trend line formed with support at $143 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must stay above the $140 support to clear the $150 barrier in the near term.

Ethereum price is likely preparing for the next break against the US Dollar and bitcoin. ETH/USD could struggle in the short term, but it will most likely break the $150 resistance area.

Ethereum Price Analysis

Recently, ETH price traded higher towards the $148 and $149 resistances against the US Dollar. However, the ETH/USD pair failed to surpass the $148 resistance on more than two occasions. As a result, there was a fresh drop and the price traded below the $144 level. The price traded close to the $142 support, where buyers emerged. A swing low was formed and later the price corrected higher. It recently moved above $144 and tested the 50% Fib retracement level of the last slide from the $149 swing high to $142 swing low.

At the moment, the $145-146 zone is acting as a short term resistance. An immediate resistance is the 61.8% Fib retracement level of the last slide from the $149 swing high to $142 swing low. A fresh close above the $148 level is needed for buyers to gain strength. More importantly, buyers need to successfully break $150 to start a new upward wave. The next key resistance is near $154 and the 1.618 Fib extension level of the last slide from the $149 swing high to $142 swing low.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is slowly gaining pace in the bullish zone, with positive signs.

Hourly RSI – The RSI for ETH/USD is rising sharply and it is placed well above the 50 level.

Major Support Level – $142