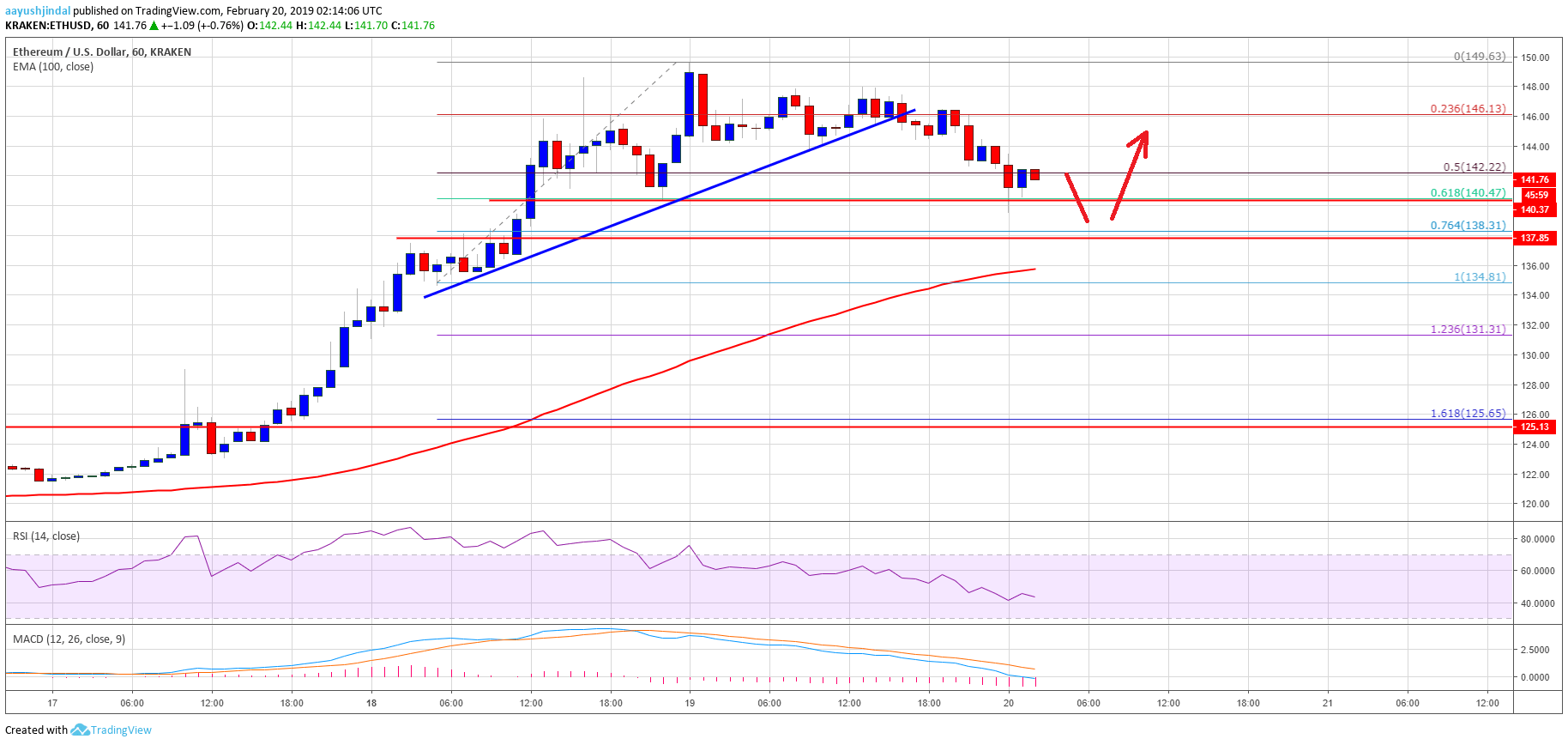

- ETH price started a downside correction after testing the $149-150 resistance area against the US Dollar.

- There was a break below a key bullish trend line with support at $146 on the hourly chart of ETH/USD (data feed via Kraken).

- There was an increase in selling pressure and the price tested the $139-140 support area.

- A few important supports are in place near the $141, $140 and $136 levels.

Ethereum price started a short term correction against the US Dollar and bitcoin. ETH/USD must stay above $136 and the 100 hourly simple moving average to bounce back.

Ethereum Price Analysis

In the past few days, ETH price climbed higher and broke the $135 and $140 resistances against the US Dollar. The ETH/USD pair even traded towards the $150 resistance zone, where sellers emerged. A top was formed just below the $150 level and later the price started a downside correction. It declined below the $146 support and the 23.6% Fib retracement level of the last leg from the $135 swing low to $150 swing high. It opened the doors for more gains and the price dropped towards the $140 support zone.

Moreover, there was a break below a key bullish trend line with support at $146 on the hourly chart of ETH/USD. The pair declined below the 50% Fib retracement level of the last leg from the $135 swing low to $150 swing high. However, there are many important supports are in place near the $141, $140 and $136 levels. The main support is near the $138 level. It coincides with the 76.4% Fib retracement level of the last leg from the $135 swing low to $150 swing high. Besides, the 100 hourly simple moving average is positioned near the $136 level to act as a strong support.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD moved back in the bearish zone, with a few bearish signs.

Hourly RSI – The RSI for ETH/USD is now just below the 50 level, with a bearish angle.

Major Support Level – $136