Ethereum Faces Headwinds Despite Upcoming Milestone

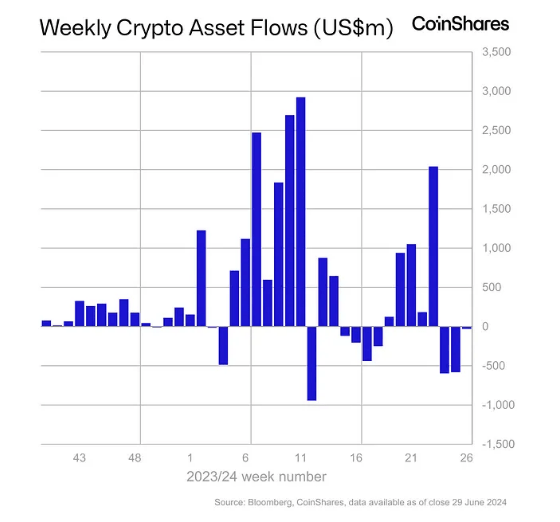

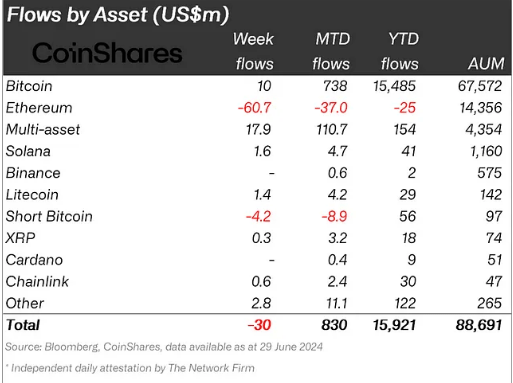

The greatest outflows of any digital asset this year have been seen by Ethereum, the second-largest cryptocurrency in the world, which reached a startling $61 million this week. may be related to the protracted process of approving a spot Ethereum ETF—a much awaited development that has been underway for almost three years.According to CoinShares, digital asset investment products saw $30 million in outflows last week, the third consecutive week of outflows. Ethereum saw its largest outflow since August 2022, totaling $61 million, making it the worst performing digital asset investment product so… — Wu Blockchain (@WuBlockchain)Investors postponing commitments because to the extended wait for regulatory permission can cause confusion in the Ethereum market. Still, the July 4th launch is a day to remember somewhat significantly. This much awaited discovery is under close observation by analysts to determine whether it cannibalises present Bitcoin ETF investments or causes a surge in Ethereum adoption.

Mixed Signals: Regional Divergence And Altcoin Interest

There are geographical differences in investor attitude, even though the general trend is cautious. For instance, the United States had $43 million in inflows, defying the worldwide trend and indicating ongoing interest in the digital asset market by Americans.

Navigating Uncertain Waters

The digital asset market is currently experiencing cautious optimism. Though there is no denying that Ethereum’s problems and outflows are causes for concern, there is also good inflows in some areas and items. is a wild card; it might spur additional adoption or just reorganise current investments.In the near future, investors should probably continue to exercise caution and carefully consider the risks and rewards of any major commitments they make.Featured image from Parents, chart from TradingView