Ethereum Holders In Profit Still At Relatively Low Level

According to data from the market intelligence platform , the recent downturn in Ethereum has significantly affected the profitability ratio of holders on the network.

In the drawdown, the ETH price had slipped from the $3,400 high near the end of July to the $2,100 level about a week ago. Since then, though, the coin has seen a sharp rebound to above the $2,700 mark.

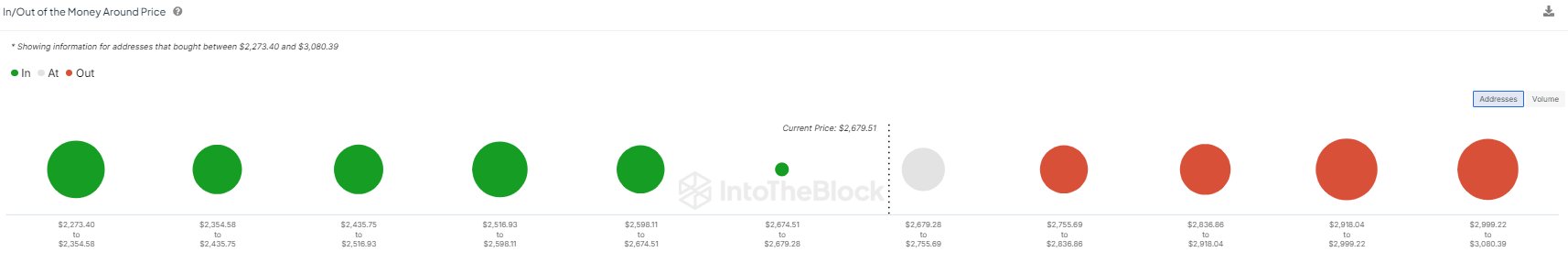

Naturally, these investors would lose right now due to the asset’s spot price being below these ranges. Some holders like these who are at a loss look forward to the asset rising back to their cost basis to exit the market and get their money back. Such selling can provide resistance to the coin.

This selling is usually not of a scale that can impede Ethereum. Still, when many investors share their cost basis inside the same narrow range, the chances of a significant selloff rise. Thus, the aforementioned price ranges can obstruct ETH’s recovery should it proceed that far. Another risk to any rally is profit-taking, but as just 66% of the investors are in profits right now, the risk of a selloff happening with this motive may not be high, especially given that the coin may have already washed out a lot of weak hands during the crash.In some other news, as analyst Ali Martinez has explained in an X , Ethereum has just seen a Tom Demark (TD) Sequential sell signal on its hourly chart.