Ethereum is steady at press time, as is visible in the daily chart. Even though prices are floating above $2,500, ETH bulls are still weak. The coin remains inside the bear bar of August 27, technically inside a bear formation.

From price action, it would take effort for bulls to take charge in the short term. A convincing high volume close above $3,500 would signal a rapid trend shift beneficial for holders.

Will Ethereum Bears Press On? Traders Monitoring This Reading

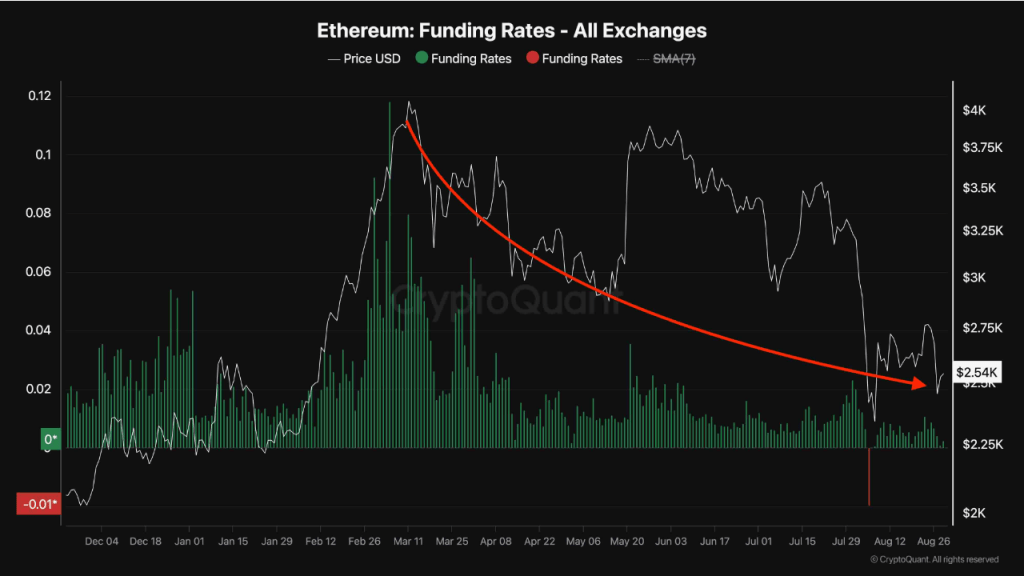

Before then, one analyst thinks the short to medium term projection for the second most valuable coin is bearish. In an analysis, citing CryptoQuant data, the analyst over the last few months, the funding rate in Ethereum perpetuals across exchanges like Binance and OKX has been positive but falling.

Through perpetual platforms, Ethereum traders can place positions using leverage, essentially borrowing from the exchange. The more leverage they have, the more they have to borrow, narrowing their safety margin and increasing the risk of liquidation.

Depending on the prevailing price action, the funding rate in these perpetual markets can be positive or negative. Whenever the funding rate is positive, the outlook among leveraged traders is bullish.

In this case, they expect prices to rise higher. For equilibrium, traders posting long positions have to pay those who are selling.

Conversely, a negative funding rate means the prevailing sentiment is bearish, and the markets could fall further. In this event, short sellers must pay those posting buys.

Looking at the price trend over the past few months, the analyst notes that the funding rate for Ethereum perpetuals has been consistently falling, though still in the positive territory. This state of affairs means that, though ETH has been wavy, moving even to $3,900 in May, the dominant sentiment is bearish.

Eyes On Spot ETF Net Inflows For Growth

Therefore, for the trend to change, there must be a sharp spike in buying interest. In turn, this will also help lift prices and funding rate across these perpetual platforms.

Rising funding rates will signal a shift in trend, helping spur demand.

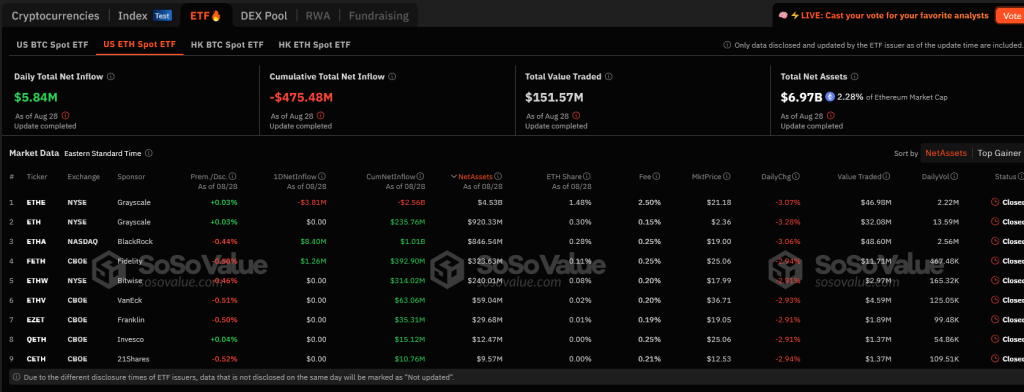

One of the many factors that may drive prices is inflows to spot Ethereum ETFs in the United States. According to , all spot Ethereum ETF issuers in the country recorded net inflows of over $5.8 million. Still, this reading is way lower than what was seen in late July.