- Ethereum (ETH) drops 3.7 percent

- SEC flexibility shall boost innovation

The motive of Blockchain.com’s acquisition of a blockchain startup is to merge knowledge, work towards improving security, and solving interoperability issues. However, that was not enough to move this market. Ethereum (ETH) is down 3.7 percent in the last 24 hours.

Ethereum Price Analysis

Fundamentals

The crypto markets may be shaky, but that’s just about it. Fundamentals and other on-chain developments are bullish. Of the many projects whose tokens are depreciating as analysts root for their recovery, Ethereum (ETH) is among them. The platform promotes the original intrinsic values of blockchain, namely decentralization and transparency.Although it may not score big on scalability, creators are hard at work to overcome this huge stumbling block. That may explain the high number of developers and dApps launching on the platform.

Meanwhile, what creators have on the project’s road map is an assurance that the network is committed to being a preferred launching pad where projects can securely launch their dApps or even crowdfund. After all, the U.S. Securities and Exchange Commission (SEC) is flexible, executing their mandate while not trying to snuff innovation.

Perhaps in line with this development, Blockchain.com acquired , a German startup and among the first developers of Ethereum. The goal of this merger is to work towards bolstering security and solve existing interoperability issues.Candlestick Arrangement

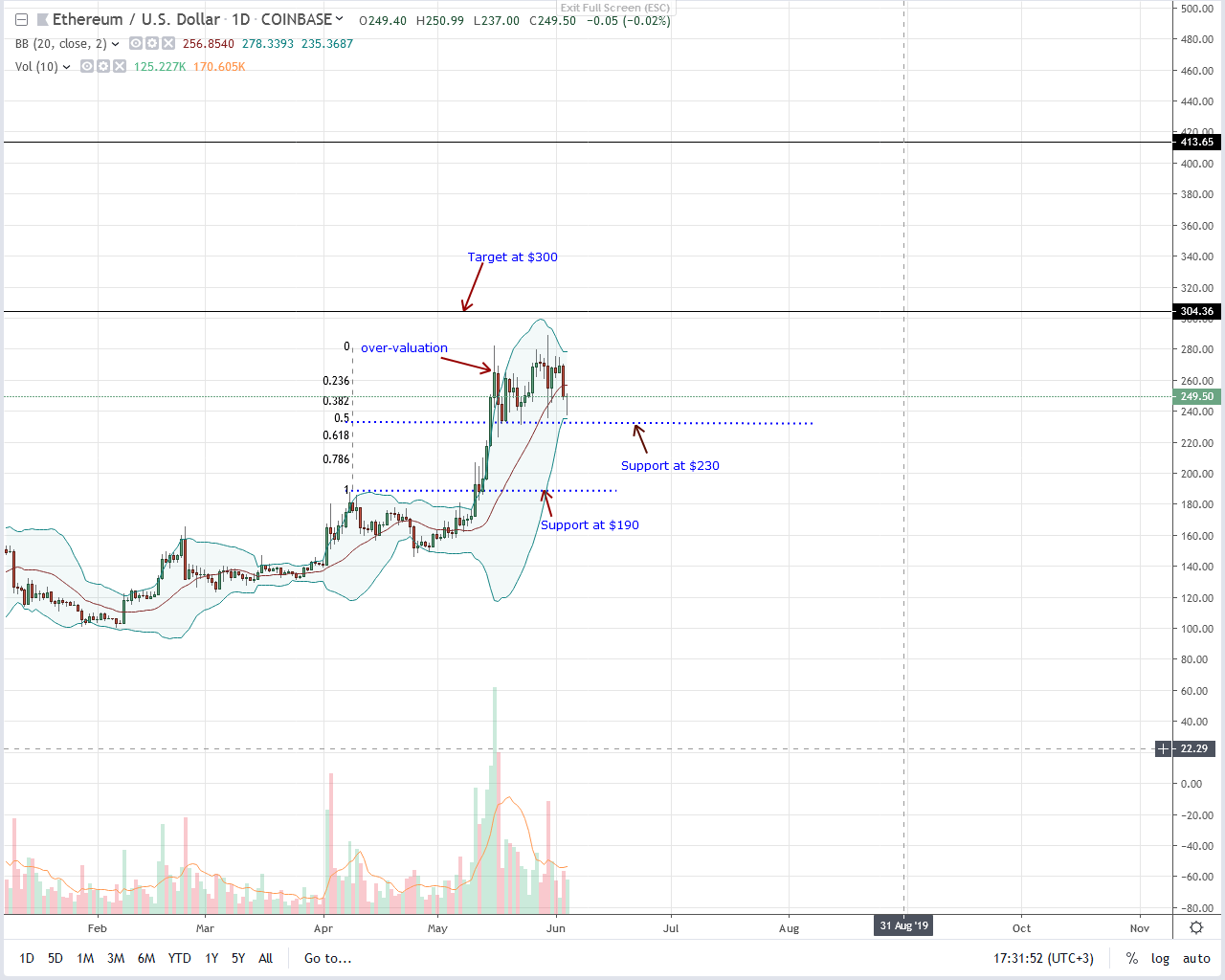

At the time of writing, Ethereum (ETH) is down 3.7 percent. Even though under pressure, ETH is nonetheless oscillating within a $60 trade range. Despite liquidation pressure, ETH bulls are in control.

As a result, there is an opportunity for aggressive traders to pick up entries in smaller time frames. However, this condition is valid if ETH trades above $230. The level is immediate support, flashing with the 50 percent Fibonacci retracement level of May trade range.Other than this, notice that ETH is below the middle Bollinger Band (BB). The flexible support was reliable, and this breach is significant for bears. Should bulls fail to recover and prices close below this mark, then the three-bar bear reversal pattern of May 30th will be valid.

Technical Indicator

From above May 30th, the candlestick is a reference. It has high trading volumes of 410k against 192k average. For trend continuation, any rally above $300 ought to be with high participation exceeding 410k. Conversely, any meltdown below $230 with high trading volume nullifies this trade plan.

courtesy of Trading View. Image Courtesy of Shutterstock