Ethereum Inches Lower as Technical Strength Flashes Some Bearish Signs

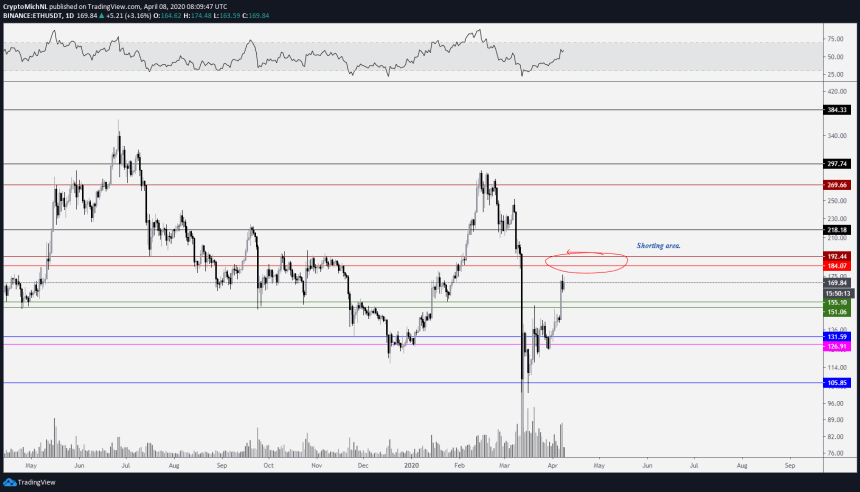

At the time of writing, Ethereum is trading down just over 1% at its of $168, which marks a notable decline from daily highs of over $175 that were set at the peak of the recent rally.

ETH’s drop from these highs has come in tandem with that seen by Bitcoin, which has fallen from highs of $7,500 to its current position within the lower-$7,000 region. In the near-term, Ethereum’s decline from these highs does seem to suggest that bulls have lost their momentum, and that the crypto may need to move back towards the lower-$100 region before it finds enough support to extend its uptrend.“Ethereum: Nice break to the upside, but not convinced we won’t see $125-130 for tests (or $110) for confirmation. Next hurdle to take is the $185-193 area. Looking for shorts in these zones (confluent with BTC movements). Holding $151-155 = long entry time.”

ETH Sees Growing Activity Amongst Futures Traders: Bullish?

One fundamental factor that should be considered in the near-term is that ETH has seen rising futures trading volume across the board over the past few days, with this coming about in tandem with its recent rally.

According to data from , Ethereum’s futures volume is at levels not seen since the immense volatility incurred on and around March 12.

If this climbing futures volume is followed by growth in the crypto’s open interest on trading platforms, it could provide fuel that helps fan the flames of Ethereum’s next uptrend.

Featured image from Shutterstock.