Ethereum Merge Will Help ETH

Messari’s senior research analyst Tom Dunleavy believes in a report titled that the Ethereum merger will likely be a major turning point in investors’ economic outlook. He points out that in the past, the crypto market leaders, Bitcoin and Ethereum, had a high positive association with the broader US stock market. For longer durations, the correlation between the two cryptos and the Nasdaq and S&P 500 index was 40-50 percent, while for shorter periods, it was about 90 percent.Related Reading | The Top 5 Most Valuable NFT Collections And A Tool To Track Them Down

Gold and US government bonds, on the other hand, have historically had a negative correlation with stocks. However, this negative link is weakening at the moment. During the 2020 market slump, both gold and bonds, as well as equities, fell.

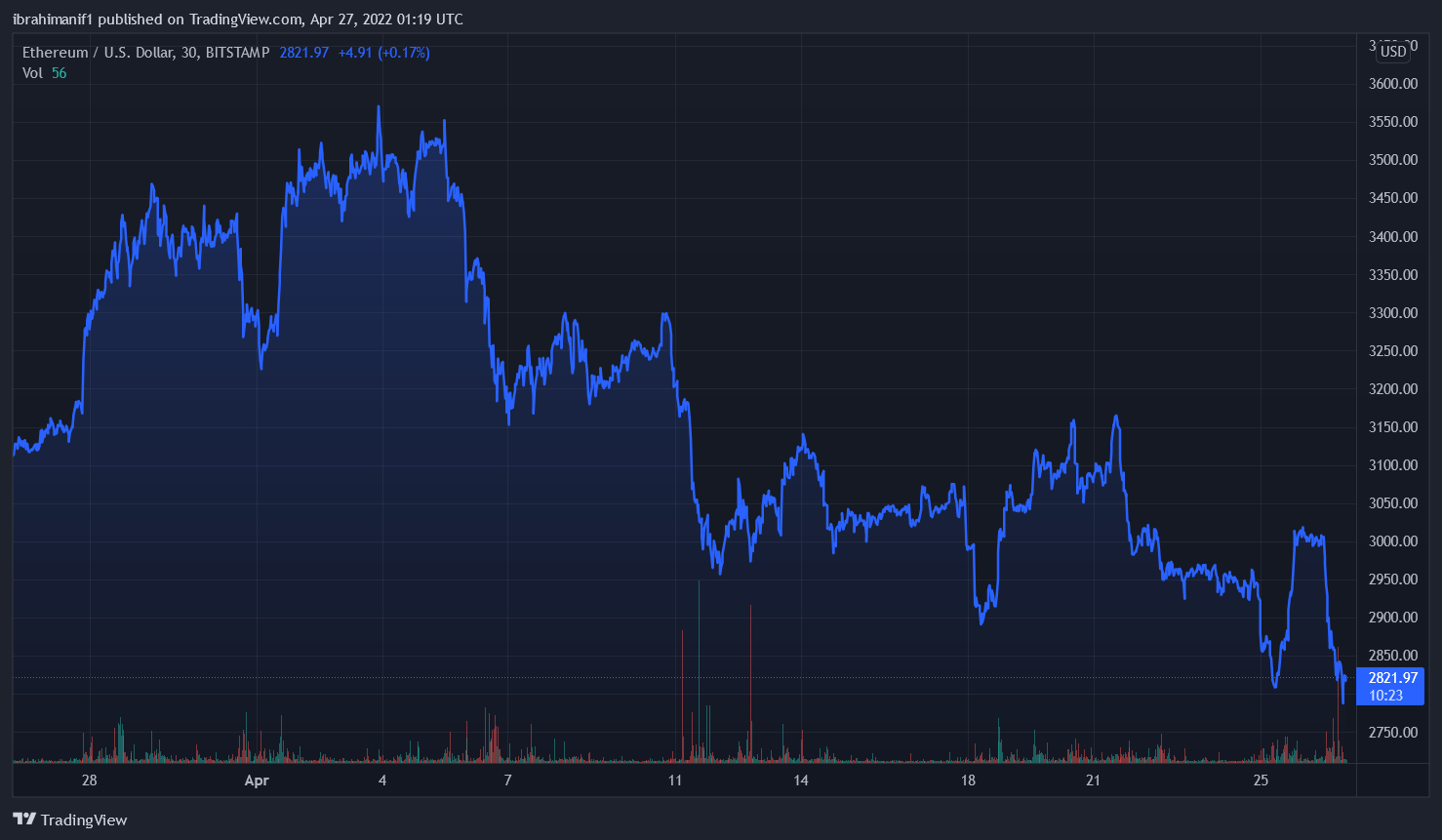

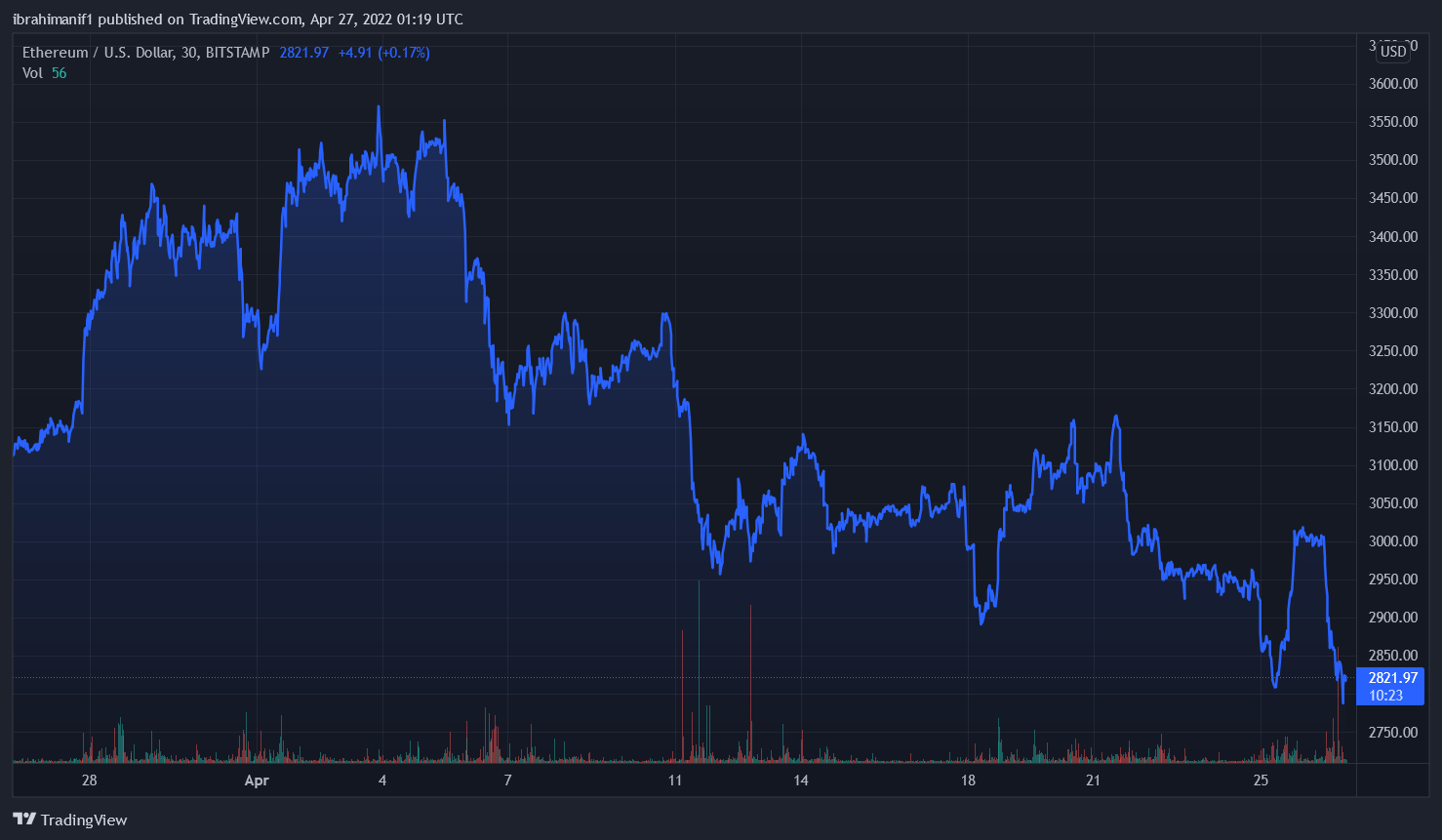

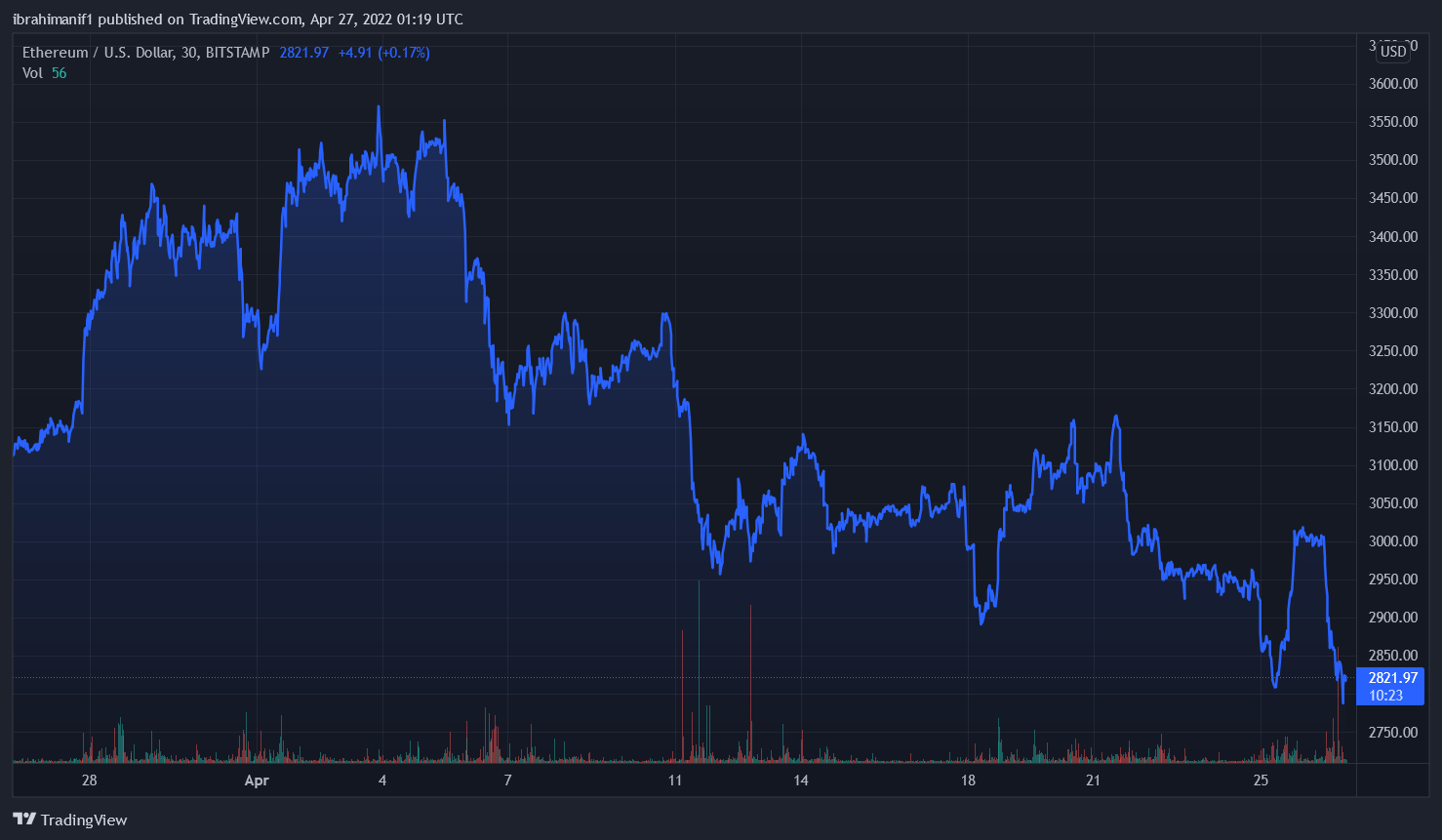

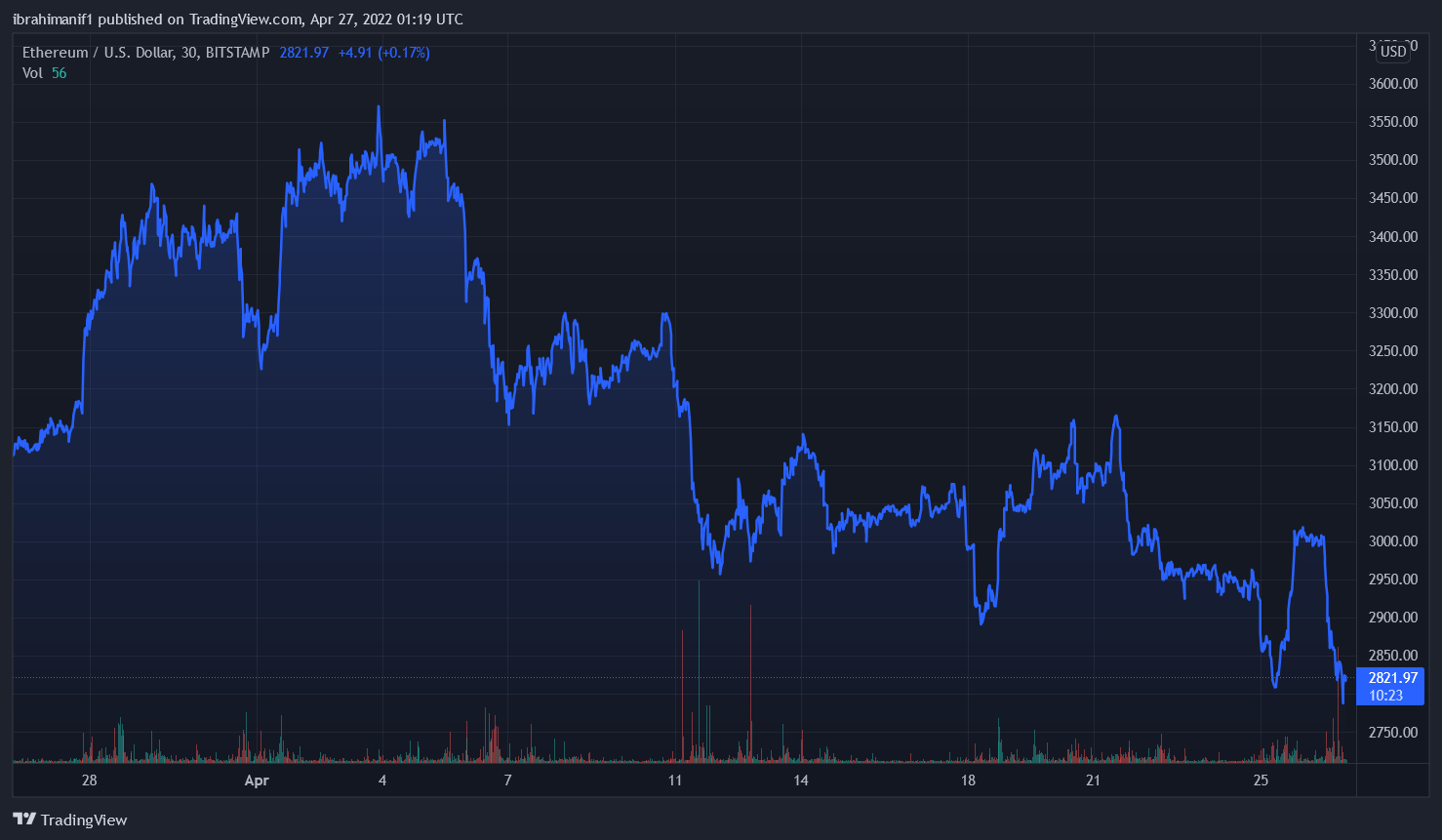

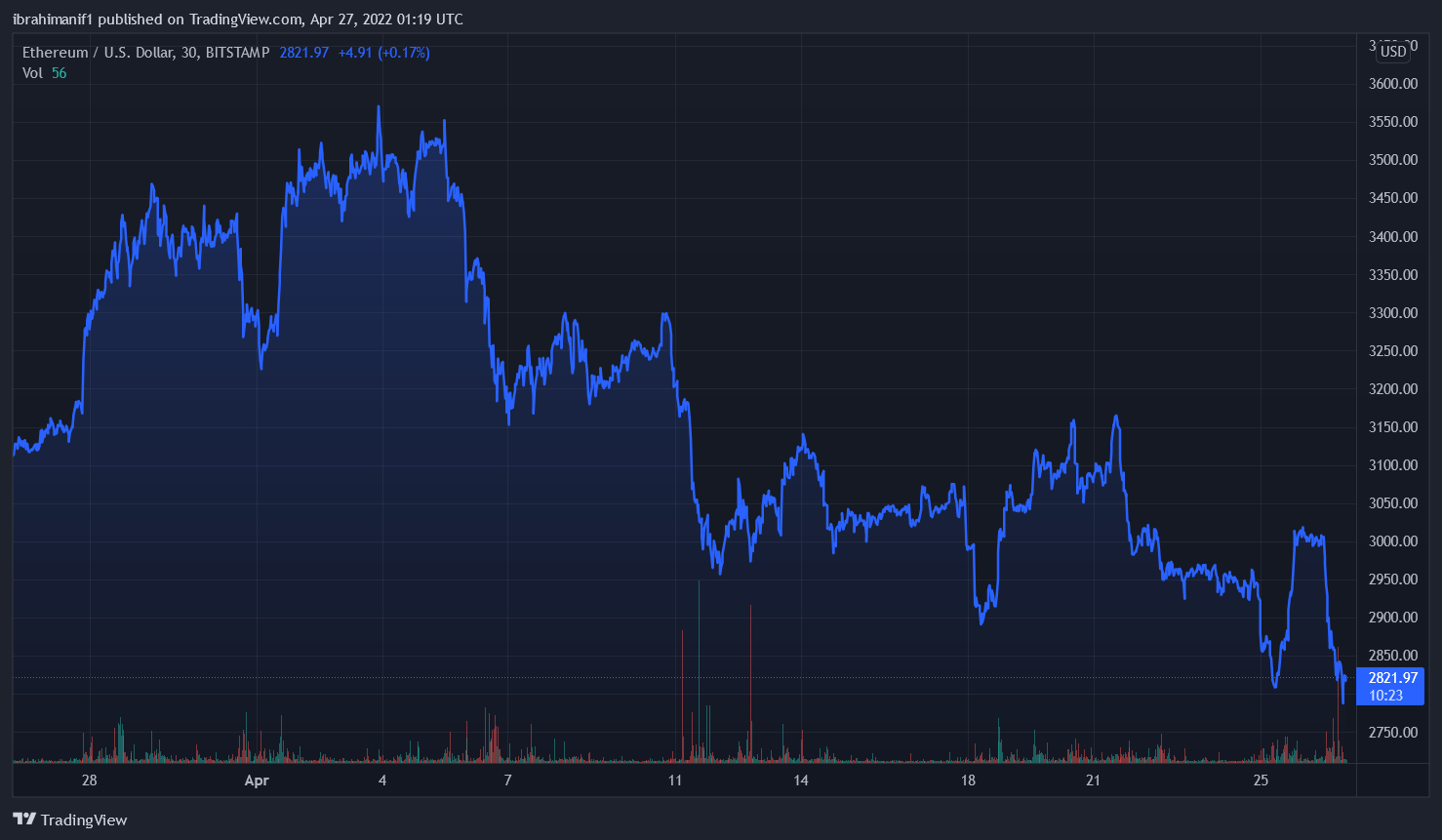

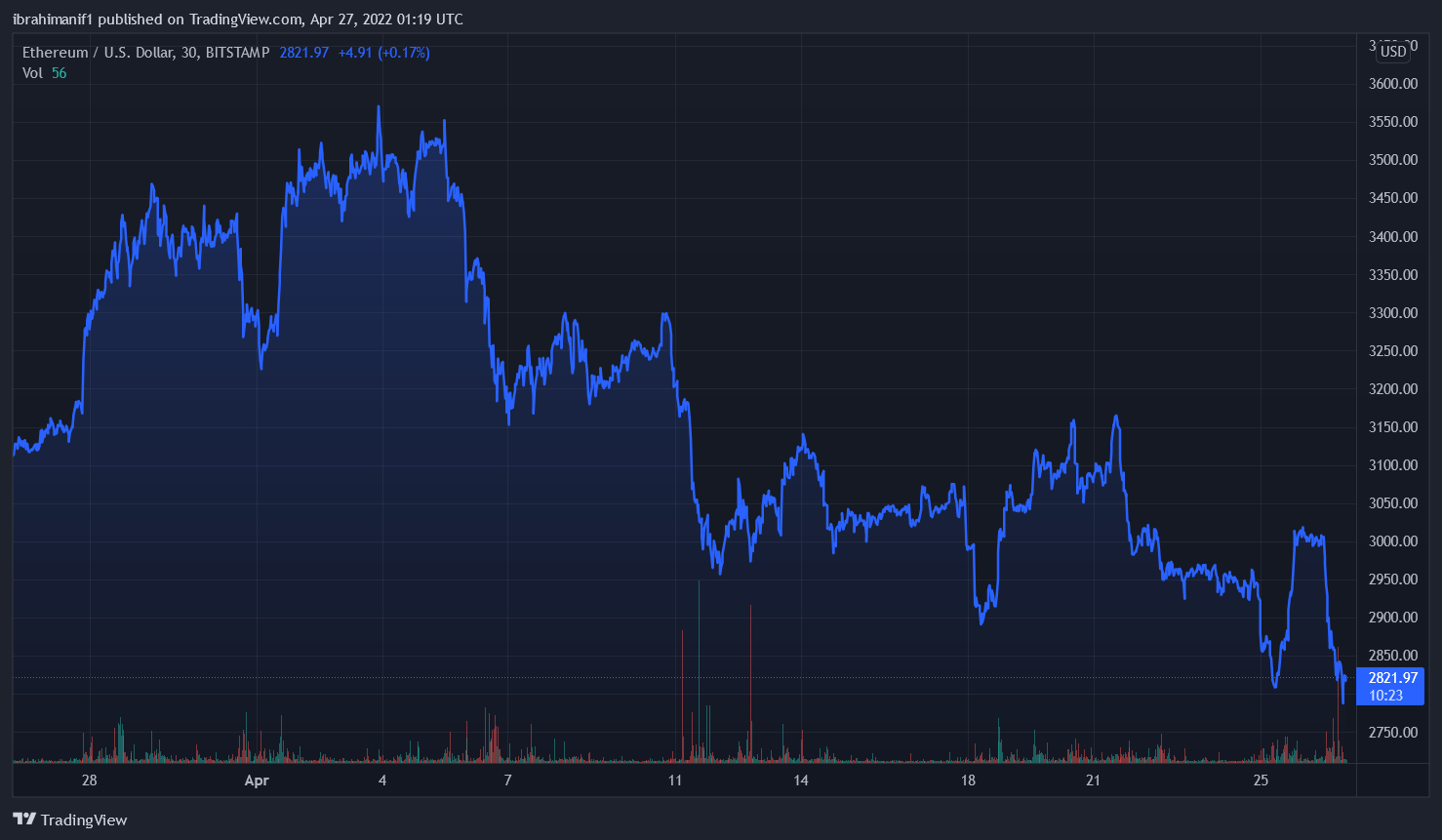

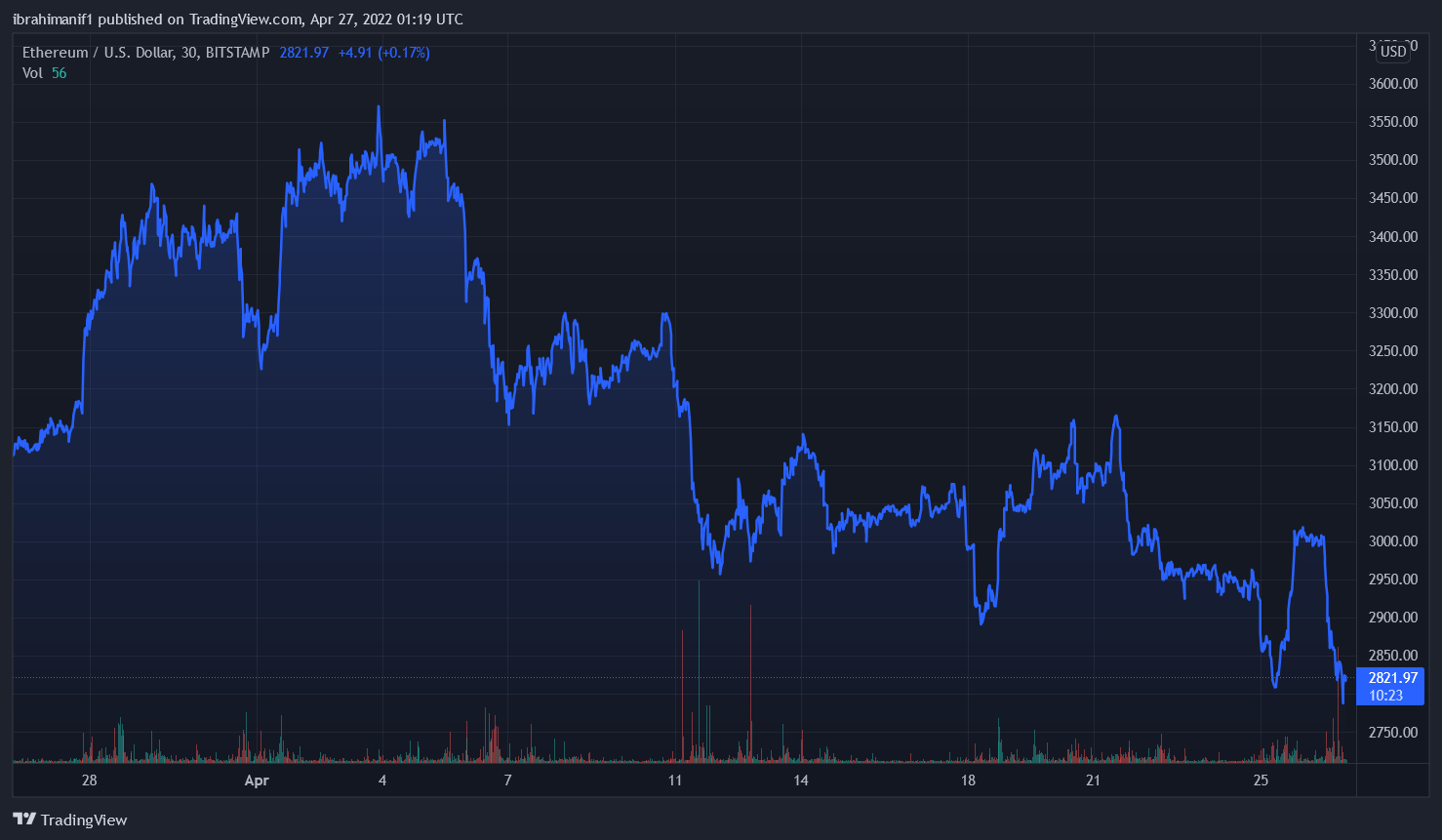

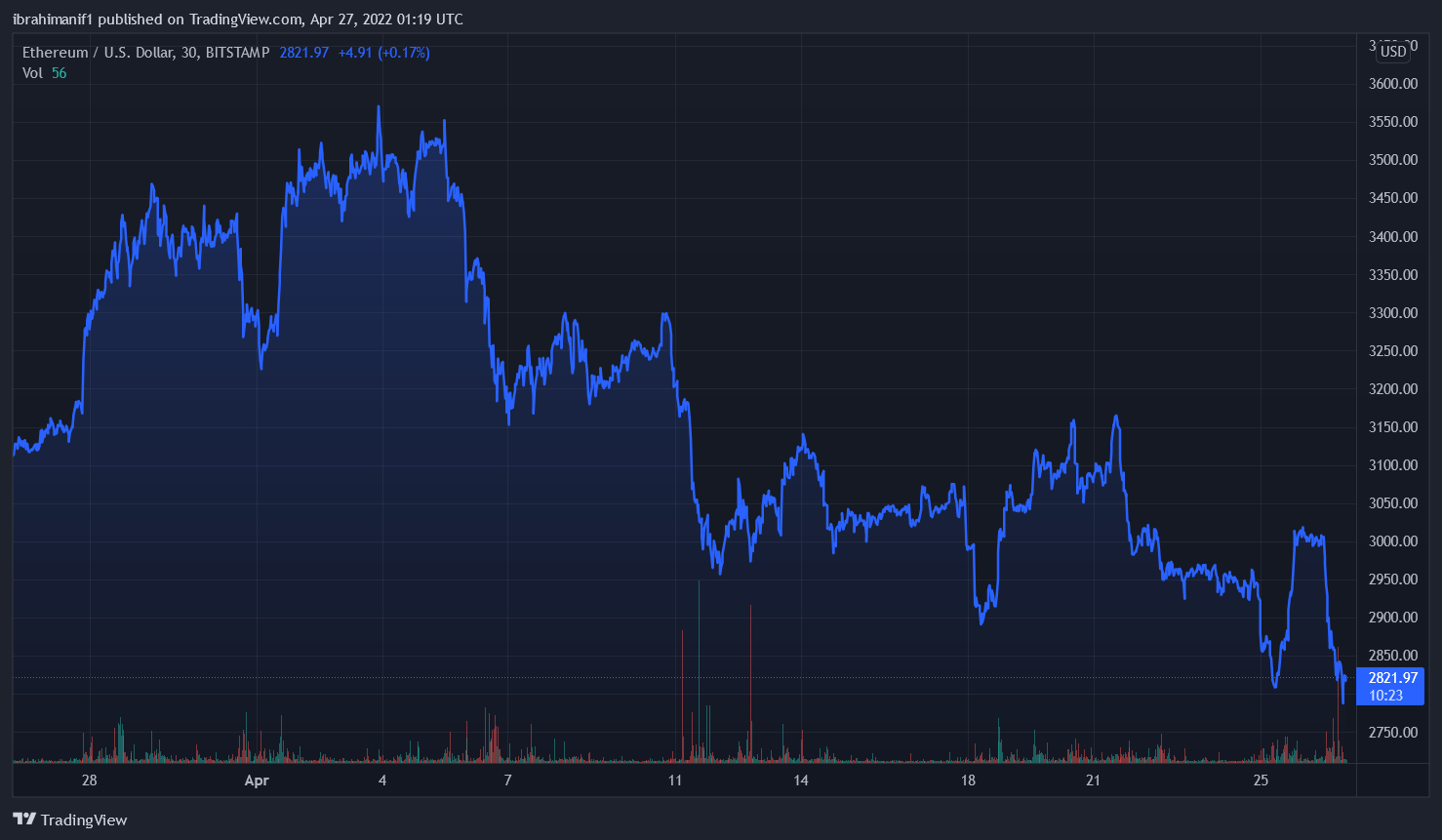

ETH/USD trades at $2,821. Source:

“It’s certainly plausible that Ethereum’s highly anticipated upgrade to a proof-of-stake system could be delayed again given that this transition is highly complicated and still uncertain as to whether it can actually deliver on its promise of lowering costs and increasing transaction speeds.”

The Merge May Push The Flippening Forward

Messari has projected that the broader crypto industry would divorce from global markets by 2022. Various segments of the crypto business will continue to gain traction, according to the market research firm. Meanwhile, predictions that the merger will propel Ethereum over Bitcoin are still circulating. Noelle Acheson, head of market analytics at Genesis Trading, told Reuters that after the merger, more funds will flock to Ethereum. ETH is currently trading at around $2,850, with a market value of $343.98 billion, while Bitcoin is currently trading at around $38,200, with a market capitalization of $726.69 billion.Related Reading | TA: Ethereum Reclaims $3K, Can The Bulls Clear This Key Hurdle

Featured image from Getty Images, chart from TradingView.com

Ethereum Merge Will Help ETH

Messari’s senior research analyst Tom Dunleavy believes in a report titled that the Ethereum merger will likely be a major turning point in investors’ economic outlook. He points out that in the past, the crypto market leaders, Bitcoin and Ethereum, had a high positive association with the broader US stock market. For longer durations, the correlation between the two cryptos and the Nasdaq and S&P 500 index was 40-50 percent, while for shorter periods, it was about 90 percent.Related Reading | The Top 5 Most Valuable NFT Collections And A Tool To Track Them Down

Gold and US government bonds, on the other hand, have historically had a negative correlation with stocks. However, this negative link is weakening at the moment. During the 2020 market slump, both gold and bonds, as well as equities, fell.

ETH/USD trades at $2,821. Source:

“It’s certainly plausible that Ethereum’s highly anticipated upgrade to a proof-of-stake system could be delayed again given that this transition is highly complicated and still uncertain as to whether it can actually deliver on its promise of lowering costs and increasing transaction speeds.”

The Merge May Push The Flippening Forward

Messari has projected that the broader crypto industry would divorce from global markets by 2022. Various segments of the crypto business will continue to gain traction, according to the market research firm. Meanwhile, predictions that the merger will propel Ethereum over Bitcoin are still circulating. Noelle Acheson, head of market analytics at Genesis Trading, told Reuters that after the merger, more funds will flock to Ethereum. ETH is currently trading at around $2,850, with a market value of $343.98 billion, while Bitcoin is currently trading at around $38,200, with a market capitalization of $726.69 billion.Related Reading | TA: Ethereum Reclaims $3K, Can The Bulls Clear This Key Hurdle

Featured image from Getty Images, chart from TradingView.com

Ethereum Merge Will Help ETH

Messari’s senior research analyst Tom Dunleavy believes in a report titled that the Ethereum merger will likely be a major turning point in investors’ economic outlook. He points out that in the past, the crypto market leaders, Bitcoin and Ethereum, had a high positive association with the broader US stock market. For longer durations, the correlation between the two cryptos and the Nasdaq and S&P 500 index was 40-50 percent, while for shorter periods, it was about 90 percent.Related Reading | The Top 5 Most Valuable NFT Collections And A Tool To Track Them Down

Gold and US government bonds, on the other hand, have historically had a negative correlation with stocks. However, this negative link is weakening at the moment. During the 2020 market slump, both gold and bonds, as well as equities, fell.

ETH/USD trades at $2,821. Source:

“It’s certainly plausible that Ethereum’s highly anticipated upgrade to a proof-of-stake system could be delayed again given that this transition is highly complicated and still uncertain as to whether it can actually deliver on its promise of lowering costs and increasing transaction speeds.”

The Merge May Push The Flippening Forward

Messari has projected that the broader crypto industry would divorce from global markets by 2022. Various segments of the crypto business will continue to gain traction, according to the market research firm. Meanwhile, predictions that the merger will propel Ethereum over Bitcoin are still circulating. Noelle Acheson, head of market analytics at Genesis Trading, told Reuters that after the merger, more funds will flock to Ethereum. ETH is currently trading at around $2,850, with a market value of $343.98 billion, while Bitcoin is currently trading at around $38,200, with a market capitalization of $726.69 billion.Related Reading | TA: Ethereum Reclaims $3K, Can The Bulls Clear This Key Hurdle

Featured image from Getty Images, chart from TradingView.com

Ethereum Merge Will Help ETH

Messari’s senior research analyst Tom Dunleavy believes in a report titled that the Ethereum merger will likely be a major turning point in investors’ economic outlook. He points out that in the past, the crypto market leaders, Bitcoin and Ethereum, had a high positive association with the broader US stock market. For longer durations, the correlation between the two cryptos and the Nasdaq and S&P 500 index was 40-50 percent, while for shorter periods, it was about 90 percent.Related Reading | The Top 5 Most Valuable NFT Collections And A Tool To Track Them Down

Gold and US government bonds, on the other hand, have historically had a negative correlation with stocks. However, this negative link is weakening at the moment. During the 2020 market slump, both gold and bonds, as well as equities, fell.

ETH/USD trades at $2,821. Source:

“It’s certainly plausible that Ethereum’s highly anticipated upgrade to a proof-of-stake system could be delayed again given that this transition is highly complicated and still uncertain as to whether it can actually deliver on its promise of lowering costs and increasing transaction speeds.”

The Merge May Push The Flippening Forward

Messari has projected that the broader crypto industry would divorce from global markets by 2022. Various segments of the crypto business will continue to gain traction, according to the market research firm. Meanwhile, predictions that the merger will propel Ethereum over Bitcoin are still circulating. Noelle Acheson, head of market analytics at Genesis Trading, told Reuters that after the merger, more funds will flock to Ethereum. ETH is currently trading at around $2,850, with a market value of $343.98 billion, while Bitcoin is currently trading at around $38,200, with a market capitalization of $726.69 billion.Related Reading | TA: Ethereum Reclaims $3K, Can The Bulls Clear This Key Hurdle

Featured image from Getty Images, chart from TradingView.com

Ethereum Merge Will Help ETH

Messari’s senior research analyst Tom Dunleavy believes in a report titled that the Ethereum merger will likely be a major turning point in investors’ economic outlook. He points out that in the past, the crypto market leaders, Bitcoin and Ethereum, had a high positive association with the broader US stock market. For longer durations, the correlation between the two cryptos and the Nasdaq and S&P 500 index was 40-50 percent, while for shorter periods, it was about 90 percent.Related Reading | The Top 5 Most Valuable NFT Collections And A Tool To Track Them Down

Gold and US government bonds, on the other hand, have historically had a negative correlation with stocks. However, this negative link is weakening at the moment. During the 2020 market slump, both gold and bonds, as well as equities, fell.

ETH/USD trades at $2,821. Source:

“It’s certainly plausible that Ethereum’s highly anticipated upgrade to a proof-of-stake system could be delayed again given that this transition is highly complicated and still uncertain as to whether it can actually deliver on its promise of lowering costs and increasing transaction speeds.”

The Merge May Push The Flippening Forward

Messari has projected that the broader crypto industry would divorce from global markets by 2022. Various segments of the crypto business will continue to gain traction, according to the market research firm. Meanwhile, predictions that the merger will propel Ethereum over Bitcoin are still circulating. Noelle Acheson, head of market analytics at Genesis Trading, told Reuters that after the merger, more funds will flock to Ethereum. ETH is currently trading at around $2,850, with a market value of $343.98 billion, while Bitcoin is currently trading at around $38,200, with a market capitalization of $726.69 billion.Related Reading | TA: Ethereum Reclaims $3K, Can The Bulls Clear This Key Hurdle

Featured image from Getty Images, chart from TradingView.com

Ethereum Merge Will Help ETH

Messari’s senior research analyst Tom Dunleavy believes in a report titled that the Ethereum merger will likely be a major turning point in investors’ economic outlook. He points out that in the past, the crypto market leaders, Bitcoin and Ethereum, had a high positive association with the broader US stock market. For longer durations, the correlation between the two cryptos and the Nasdaq and S&P 500 index was 40-50 percent, while for shorter periods, it was about 90 percent.Related Reading | The Top 5 Most Valuable NFT Collections And A Tool To Track Them Down

Gold and US government bonds, on the other hand, have historically had a negative correlation with stocks. However, this negative link is weakening at the moment. During the 2020 market slump, both gold and bonds, as well as equities, fell.

ETH/USD trades at $2,821. Source:

“It’s certainly plausible that Ethereum’s highly anticipated upgrade to a proof-of-stake system could be delayed again given that this transition is highly complicated and still uncertain as to whether it can actually deliver on its promise of lowering costs and increasing transaction speeds.”

The Merge May Push The Flippening Forward

Messari has projected that the broader crypto industry would divorce from global markets by 2022. Various segments of the crypto business will continue to gain traction, according to the market research firm. Meanwhile, predictions that the merger will propel Ethereum over Bitcoin are still circulating. Noelle Acheson, head of market analytics at Genesis Trading, told Reuters that after the merger, more funds will flock to Ethereum. ETH is currently trading at around $2,850, with a market value of $343.98 billion, while Bitcoin is currently trading at around $38,200, with a market capitalization of $726.69 billion.Related Reading | TA: Ethereum Reclaims $3K, Can The Bulls Clear This Key Hurdle

Featured image from Getty Images, chart from TradingView.com

Ethereum Merge Will Help ETH

Messari’s senior research analyst Tom Dunleavy believes in a report titled that the Ethereum merger will likely be a major turning point in investors’ economic outlook. He points out that in the past, the crypto market leaders, Bitcoin and Ethereum, had a high positive association with the broader US stock market. For longer durations, the correlation between the two cryptos and the Nasdaq and S&P 500 index was 40-50 percent, while for shorter periods, it was about 90 percent.Related Reading | The Top 5 Most Valuable NFT Collections And A Tool To Track Them Down

Gold and US government bonds, on the other hand, have historically had a negative correlation with stocks. However, this negative link is weakening at the moment. During the 2020 market slump, both gold and bonds, as well as equities, fell.

ETH/USD trades at $2,821. Source:

“It’s certainly plausible that Ethereum’s highly anticipated upgrade to a proof-of-stake system could be delayed again given that this transition is highly complicated and still uncertain as to whether it can actually deliver on its promise of lowering costs and increasing transaction speeds.”

The Merge May Push The Flippening Forward

Messari has projected that the broader crypto industry would divorce from global markets by 2022. Various segments of the crypto business will continue to gain traction, according to the market research firm. Meanwhile, predictions that the merger will propel Ethereum over Bitcoin are still circulating. Noelle Acheson, head of market analytics at Genesis Trading, told Reuters that after the merger, more funds will flock to Ethereum. ETH is currently trading at around $2,850, with a market value of $343.98 billion, while Bitcoin is currently trading at around $38,200, with a market capitalization of $726.69 billion.Related Reading | TA: Ethereum Reclaims $3K, Can The Bulls Clear This Key Hurdle

Featured image from Getty Images, chart from TradingView.com

Ethereum Merge Will Help ETH

Messari’s senior research analyst Tom Dunleavy believes in a report titled that the Ethereum merger will likely be a major turning point in investors’ economic outlook. He points out that in the past, the crypto market leaders, Bitcoin and Ethereum, had a high positive association with the broader US stock market. For longer durations, the correlation between the two cryptos and the Nasdaq and S&P 500 index was 40-50 percent, while for shorter periods, it was about 90 percent.Related Reading | The Top 5 Most Valuable NFT Collections And A Tool To Track Them Down

Gold and US government bonds, on the other hand, have historically had a negative correlation with stocks. However, this negative link is weakening at the moment. During the 2020 market slump, both gold and bonds, as well as equities, fell.

ETH/USD trades at $2,821. Source:

“It’s certainly plausible that Ethereum’s highly anticipated upgrade to a proof-of-stake system could be delayed again given that this transition is highly complicated and still uncertain as to whether it can actually deliver on its promise of lowering costs and increasing transaction speeds.”

The Merge May Push The Flippening Forward

Messari has projected that the broader crypto industry would divorce from global markets by 2022. Various segments of the crypto business will continue to gain traction, according to the market research firm. Meanwhile, predictions that the merger will propel Ethereum over Bitcoin are still circulating. Noelle Acheson, head of market analytics at Genesis Trading, told Reuters that after the merger, more funds will flock to Ethereum. ETH is currently trading at around $2,850, with a market value of $343.98 billion, while Bitcoin is currently trading at around $38,200, with a market capitalization of $726.69 billion.Related Reading | TA: Ethereum Reclaims $3K, Can The Bulls Clear This Key Hurdle

Featured image from Getty Images, chart from TradingView.com