Bitcoin Fear & Greed Index Now Points Towards “Extreme Greed”

The “Fear & Greed Index” refers to an indicator that tells us about the general sentiment among Bitcoin traders and broader cryptocurrency sectors.

The metric represents this sentiment using a numerical scale from zero to hundred. According to Alternative, its creator, the index calculates this score using five factors: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

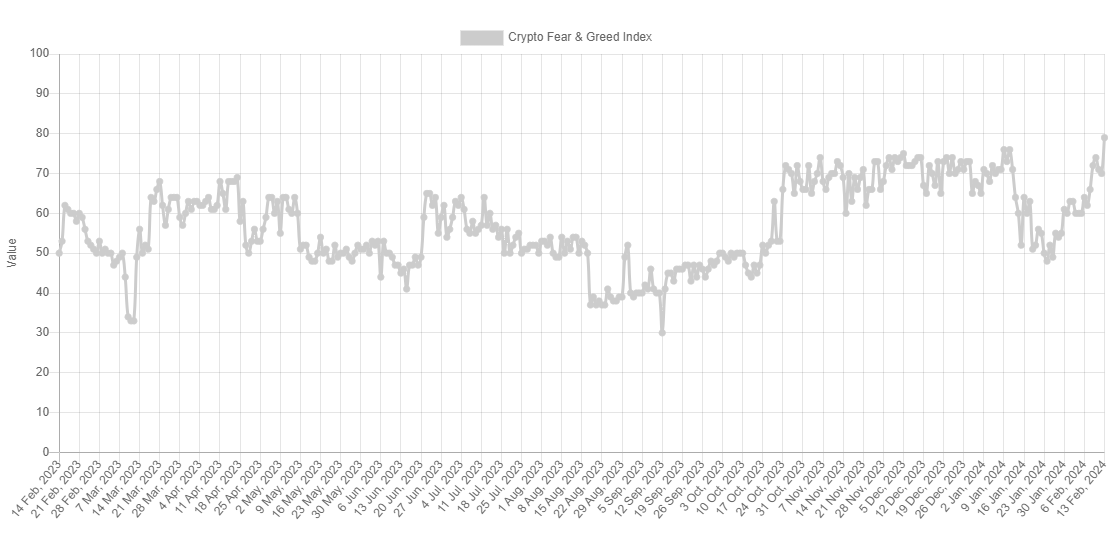

Looks like the value of the metric is 79 at the moment | Source:As displayed above, the Bitcoin Fear & Greed Index has surpassed the 75 threshold for extreme greed during the past day and has attained a value of 79. The metric was at 70 yesterday, so it has seen a bit of a jump in just the last 24 hours.

This surge in sentiment from greed to extreme greed has occurred as cryptocurrency broke past the $50,000 barrier for the first time since December 2021.

Followers of a trading philosophy called “contrarian investing” exploit this fact to time their buying and selling moves. “Be fearful when others are greedy, and greedy when others are fearful” is a famous quote from Warren Buffet that sums up the idea.

As the chart below shows, the last time the Fear & Greed Index attained extreme greed levels was around the time of the spot ETF approval.

The trend in the Fear & Greed Index over the past year | Source:As BTC investors are very well aware, the coin hit a top coinciding with the event as the market took to selling the news. Since the sentiment is now back inside extreme greed with its latest surge, another similar reversal point may be close for its price. Perhaps it’s at a time like this when a contrarian investor would consider moving towards selling, going against the hype and euphoria floating around the market.

BTC Price

Bitcoin has enjoyed a surge of over 4% in the past day, which has taken its price towards the $50,000 mark.The price of the coin appears to have shot up over the past day | Source: