Come on, Gary Gensler didn’t threaten the industry. Of course he didn’t, but… maybe he did? If a mafia boss repeated the exact same words, there would be no doubt. And we’re quoting him verbatim. This is exactly what the Securities Exchange Commission’s Chairman told The Washington Post. They had series. The host was David Ignatius. They talked about “those five- or six thousand projects” that are “raising money from the public.”

Related Reading | Erik Voorhees: Selling Unregistered Securities is a Made up Crime

Yesterday, we focused on Gary Gensler’s comments about stablecoins and Evergrande. Today, the topic is fighting words… or are they? Read what he had to say and decide for yourself.

Gary Gensler Lures Crypto With Honey And Vinegar

The topic of the day, of course, is, are cryptocurrencies securities? And the head of the Securities Exchange Commission appeals to the exchanges and related platforms instead of aiming at the projects themselves. Interesting strategy. Gary Gensler explains:

“If these tokens–and there’s five- or six thousand different projects–if these tokens have the attributes of an investment contract or a note, or have attributes of equities or bonds. And in essence, one of the core issues is that there are platforms: trading platforms where you can buy and sell these tokens; lending platforms, where you can earn a return on these tokens that have not just dozens of tokens but sometimes hundreds or thousands of tokens. And it’s highly likely that they have on these platforms, securities, investment contracts, or notes or others, that fit the definition of security. Those platforms should come in, they should figure out how to register, be an investment–investor protection remit.”

Well, good luck with that. What will happen if people don’t obey your organization’s mandate, Mr. Gensler?

“I do really fear that we’ll keep bringing these enforcement cases, but there’s going to be a problem. There’s going to be a problem on lending platforms or trading platforms. And frankly, when that happens, I think a lot of people are going to get hurt.”

We’re not saying that Gary Gensler is threatening you. He’s obviously speaking about the risks of unregulated markets. However, “there’s going to be a problem” and “a lot of people are going to get hurt.” That’s what the man said.

Gary Gensler (SEC):

— PlanB (@100trillionUSD)

– is going after the "5000 or 6000 PROJECTS that are raising money from the public [..] anticipating profit"

– views as a "digital, scarce STORE OF VALUE"

The Definition Of Investment Contract

Here, Gensler is speaking directly to host David Ignatius:

“If you, David, ask some of the listeners from this program to give them your money, something of value. And they were relying on you, David, with maybe five or ten other entrepreneurs and computer scientists to build a platform–build a platform, that token and so forth, and they were giving it to you with an anticipation of profits. Our Supreme Court long ago said that’s an investment contract.”

And it’s hard to argue with that. However, it sounds threatening when you mix it with this:

“So, public money has a certain place around the globe. Private monies usually don’t last that long. So, I don’t think there’s a long-term viability for five- or six thousand private forms of money. History tells us otherwise. So, in the meantime, I think it’s worthwhile to have an investor protection regime placed around this.”

The newspapers went with that phrase, “I don’t think there’s a long-term viability for five- or six thousand private forms of money,” for their headlines. The markets tumbled. Some people argued that, in context, the phrase wasn’t that menacing. Maybe, but, if you mix it with something like this:

“And I think at $2 trillion, 5- or 6,000 projects, that it would be better to be inside investor-consumer protection, inside the tax compliance and anti-money laundering and financial stability.”

A crystal clear picture of the SEC’s intentions and politics emerges.

🤯 — Eduardo Prospero (@edprospero23)

What Does Gary Gensler Think About Bitcoin?

According to the Securities Exchange Commission, Bitcoin is a commodity. Its unique characteristics make it so. Also, there’s Gary Gensler’s reverence for Satoshi Nakamoto and the fact that he taught a cryptocurrencies class at MIT. Because of all that, Bitcoiners seem to feel like they’re exempt from the SEC’s wrath. Are they, though?

When host David Ignatius asked about Bitcoin’s effectiveness as a store of value, Gary Gensler answered:

“I mean, holding a highly volatile asset–bitcoin is that. It’s a digital, scarce, I would even say speculative store of value. To hold appropriate capital, if it’s on a bank’s balance sheet, which seemed to fit into the remit that we’ve had in the past, that there be appropriate shock absorbers against the potential loss.”

That doesn’t sound like a Satoshi Nakamoto fan. Or like he appreciates Bitcoin at all. Flat out, what do you think about Bitcoin as an innovation Mr. Gensler?

“I think it’s been a catalyst for change. Nakamoto-san’s innovation, not only bitcoin as the first sort of one but this whole distributed ledger technology has been a catalyst for change that, around the globe, central banks and the private sector are looking in on how we can enhance our payment systems, and enhancing our payment systems to make them 24 hours a day, 7 days a week, real time, at lower cost.”

He did everything but say “Blockchain, not Bitcoin.” That slogan might’ve been phased out, but apparently, the idea remains. That’s actually what presumed pro-crypto regulator Gary Gensler thinks that Bitcoin brought to the world. A catalyst for the central banks and the private sector to step up their game. Wow.

Related Reading | This Is What Gensler’s Confirmation Could Mean For XRP

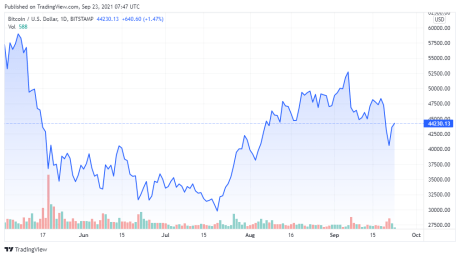

BTC price chart for 09/23/2021 on Bitstamp | Source: BTC/USD on

And What’s His Position On Decentralized Lending?

You’re not going to believe what this man thinks about DeFi lending. According to Gary Gensler:

“It’s raising new and interesting innovations around how exchanges work and how even potentially some forms of decentralized lending. We’ve had peer-to-peer lending for 15-20 years, we’ve experimented with it. This is a new type of experiment. So, those, I think, are really interesting innovations challenging the established business models.”

Oh. That’s actually a fair description of the phenomenon. Never mind, then. Carry on.

Featured Image: Screenshoot from | Charts by