The Partnership Perspective: Galaxy Digital

According to , Goldman Sachs is teaming up with Mike Novogratz’s crypto merchant bank, Galaxy Digital. The partnership will enable Galaxy Digital to be Goldman’s liquidity provider for bitcoin futures buy and sell orders on the CME Group derivatives exchange. In a statement regarding the partnership, head of digital assets for Goldman Sach’s Asia-Pacific region Max Minton said “our goal is to equip our clients with best-execution pricing and secure access to the assets they want to trade. In 2021, this now includes crypto, and we are pleased to have found a partner with a broad range of liquidity venues and differentiated derivatives capabilities spanning the cryptocurrency ecosystem.”Related Reading | Bitcoin Flash Crash Pauses As Goldman Sachs Announces Crypto Services

More “Bank” For Your Buck

Banks are understandably timid when it comes to diving in, but crypto derivatives have been a speculative tool that many see as a gateway for more financial services firms to get involved. This is because of strict regulations that make bitcoin difficult to maneuver around traditionally, but more streamlined in the derivatives landscape.

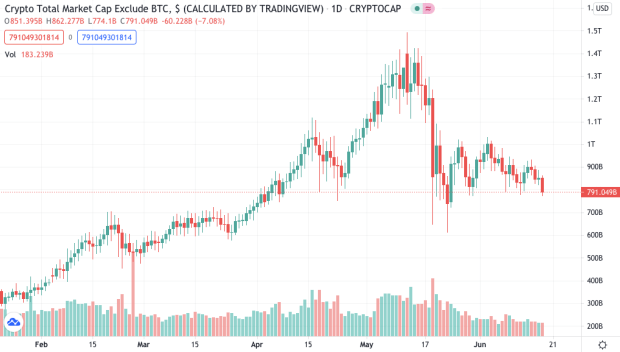

Crypto's continued emergence throughout 2021 have reeled in traditional investors to apply pressure financial services companies to service crypto assets. | Source:

Related Reading | Goldman Sachs Files For An ETF With Option To Invest In Bitcoin

Featured image from Pixabay, Charts from TradingView.com