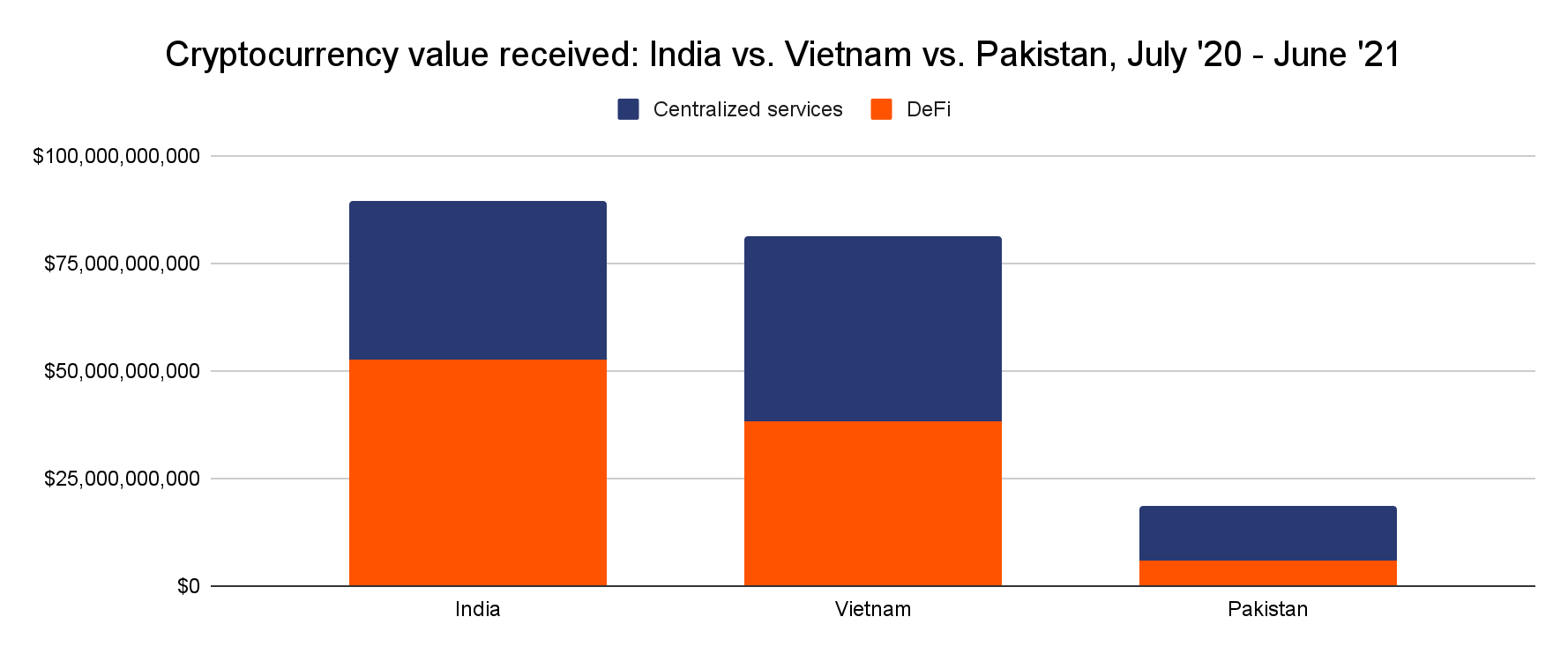

Large institutional-sized transfers above $10 million worth of cryptocurrency represent 42% of transactions sent from India-based addresses, versus 28% for Pakistan and 29% for Vietnam. Those numbers suggest that India’s cryptocurrency investors are part of larger, more sophisticated organizations.

Related Reading | Indian Investments In Crypto Grow Rapidly As $40 Billion Milestone Is Reached

Towards Crypto Literacy

In the past year, WazirX has focused on a strategy that aims to grow crypto literacy in India by providing transparency and different sources of education. For this reason, they launched India’s crypto exchange first last October, where they stated the following:we are committed to spreading the right information to our users by fostering a conducive environment to help them make informed choices.Amongst their efforts, WazirX CEO Nischal Shetty carried a Twitter campaign under the hashtag #IndiaWantsCrypto with the purpose of sharing cryptocurrency insights and creating awareness on the industry, “which generates thousands of jobs, not to mention vast amounts of monetary value.”

They have also launched YouTube series, ‘Blockchain Papers’, and a podcast. All to grow the user’s understanding of their platform, clear fears, and misconceptions. They are also collaborating with educational institutions, such as IIT, IIM, and Delhi University.

Tackling misinformation and busting misconceptions around crypto is just one of the ways we think will help our users make informed crypto investment decisions.These projects are also meant to open paths between the crypto industry and the country’s policymakers, hoping that more widespread information will help bring regulations.

Crypto Exchanges Hope For Regulations

Cryptocurrencies adoption has had a rough path in India over the years. The scenario is not clear enough, although many users and crypto exchanges remain hopeful for future regulations to bring clarity and the possibility for growth in the industry. In 2018 the central bank of India banned all cryptocurrencies, which had many responses from investors and exchanges who were affected by the decision. Around that time, WazirX launched WazirX P2P “to help users buy/sell crypto with INR” and carried a 1000-day Twitter campaign “to build a case of why we need to allow crypto to foster innovation”. Then, in March 2020, The Supreme Court of India lifted the Reserve Bank of India’s (RBI) ban and called it “unconstitutional”. The crypto panorama started to soften for India, which allowed WazirX to become one of the country’s largest cryptocurrency exchanges. Discussions around regulations started to arise back then. India’s crypto exchanges and investors participated in off-the-record meetings with law enforcement agencies and banks hoping to reach a point of amicability. The expectations are for the government to classify bitcoin as an asset class and for the Securities and Exchange Board of India to regulate cryptocurrencies and bring clarity, closing the doors to another ban. Currently, the lower house of parliament a meeting under the name “Hearing of the views of associations, industry experts on the subject of ‘CryptoFinance’: Opportunities and challenges,” believed to happen in February 2022. Crypto exchanges, like WazirX, were officially included as invitees for the first time around and their hopes continue to raise.Related Reading | Reports Show 45% Surge In Stock And Cryptocurrency Sign-Ups Across Rural Areas In India