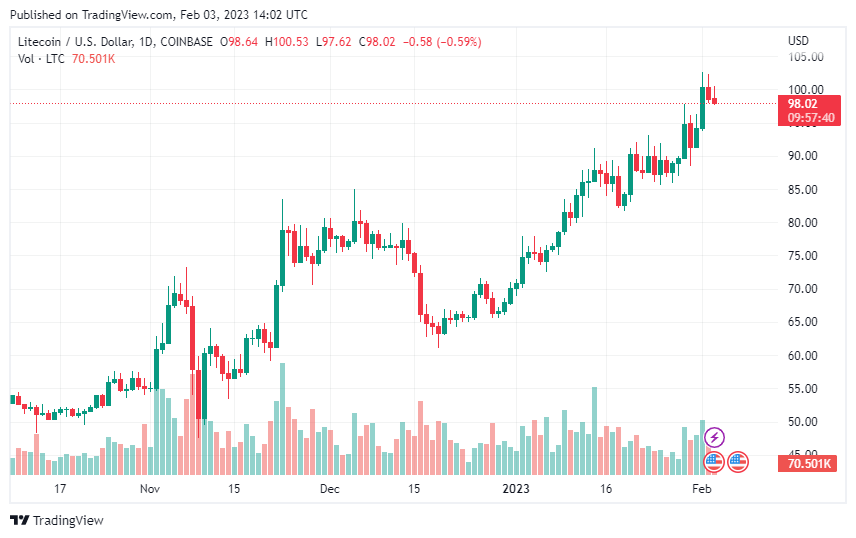

has seen an increase in its value in the past seven days amid the high anticipation surrounding its upcoming halving event. LTC has shown impressive price action since January. Although it’s down a little in the past 24 hours, its price gain in the last 30 days is encouraging.

With this performance, Litecoin is among last week’s top gainers in the crypto market. Last week, in the total number of addresses. Let’s see some of the factors pushing Litecoin’s price action.

Is The Upcoming Litecoin Halving Pumping Litecoin Price?

by on-chain data aggregator Santiment, the two primary factors driving Bitcoin’s price action are increased adoption and the upcoming halving. The Litecoin community is preparing for the halving event that would see the coin’s circulating supply reduced by half. According to , the event would hold on August 3, 2023.

Halving is a mechanism that reduces miners’ block rewards by half. The process aims to maintain a cryptocurrency’s price stability by keeping the circulating supply in check. Block rewards halving on the Litecoin blockchain occur every four years. It is more of an automated process.

Halving reduces the number of Litecoins generated by the network to about 84 million, so miners will only get 6.25 LTC per block instead of 12.5 LTC. Analysts predict more increase in LTC price with the halving.

Meanwhile, Litecoin adoption has been on the rise. More merchants are accepting LTC for payments due to its low transaction cost and faster throughput. As a lighter version of Bitcoin, LTC undertakes high-speed point-of-sale transactions at low costs. These capabilities have attracted more people to use Litecoin for everyday purchases, like sending money and buying goods online.

According to a , the world’s largest crypto payment platform, LTC payments have increased and are closely pursuing Bitcoin. The data revealed that Litecoin contributed 27.645 of total transactions on BitPay, while Bitcoin has 41.625, Ethereum is 11.66%, and Dogecoin 9.23%.

Also, a Glassnode report that the number of Litecoin addresses increased between October 22 and January 2023, surpassing Ethereum. As of January 23, LTC’s total addresses were 171,266,536, while Ethereum had 170,765,345.

Increased total addresses mean more users are creating addresses on the Litecoin blockchain, which signifies a higher adoption rate. It could be among the reasons behind Bitcoin’s impressive performance.

LTC Price Outlook

Litecoin is currently , with a high of $101.61 and a low of $98.02. LTC is down by 2.1 over the past 24 hours, with a 7-day increase of 12.5% and a 14-day price gain of 17.0%. Litecoin also has a market dominance of 0.637%.

From the technical point of view, Litecoin’s Moving Averages are currently flagging a buy action while the Oscillators are neutral. The asset is already trading above the support levels and is pushing to exceed the resistance levels.

Litecoin is today and is close to its pivot point at $99.61. If its price gets to this level, you might see an even more push. The support levels to watch out for are $93.73, $95.98, and $97.36, while the resistance levels are $100.98, $103.23, and $104.60.