In a recent , the world’s largest cryptocurrency exchange by trading volume Binance revealed that it was going to list Maker on its retail trading platform. Since July 23, users are able to deposit and trade the DeFi Token in their respective accounts.

MKR was listed against Bitcoin (BTC), Binance Coin (BNB), Binance USD (BUSD), and Tether (USDT) expanding market access for millions of retail investors.

Following the announcement, Maker went through a substantial bullish impulse that saw it rise over 23%. The price of this altcoin went from trading around $488 to reach a high of $600. Although MKR has lost some of the gains recently incurred, there was a major spike in network activity that suggests this cryptocurrency is poised to advance further.

Marker Rises Over 23% to a High of $600. (Source: )

Maker’s Network Activity Explodes

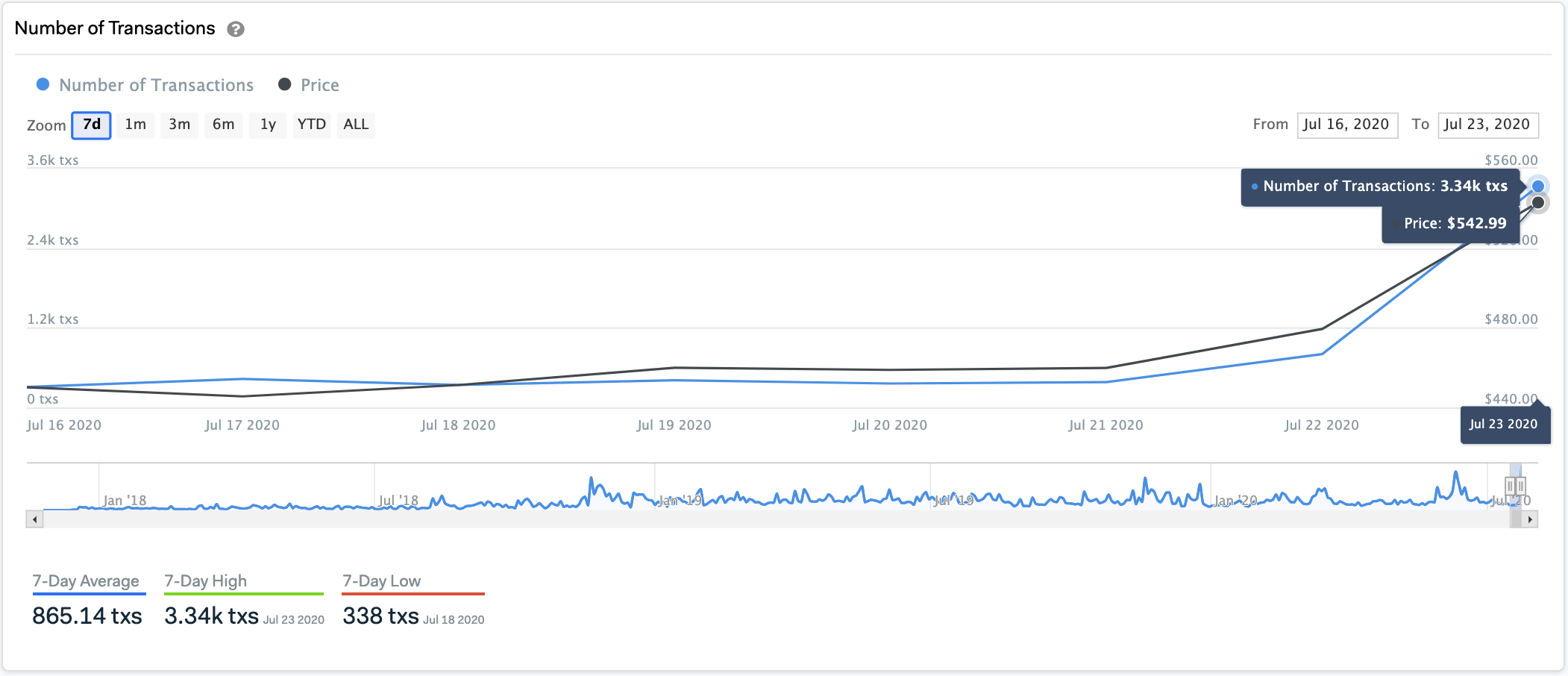

IntoTheBlock registered a massive spike in the number of transactions on Maker’s network after the recent addition into Binance. One day before the listing, the number of transactions on the network was hovering around 800 transactions. However, the activity on the protocol skyrocketed to over 3,300 transactions on July 23, representing a 313% increase in only one day.

The total value transferred also shot up. Data reveals that transaction volume within this period surge by 7.7x to hit a monthly high of 85,220 MKR.

Maker's Network Activity Skyrockets. (Source: )

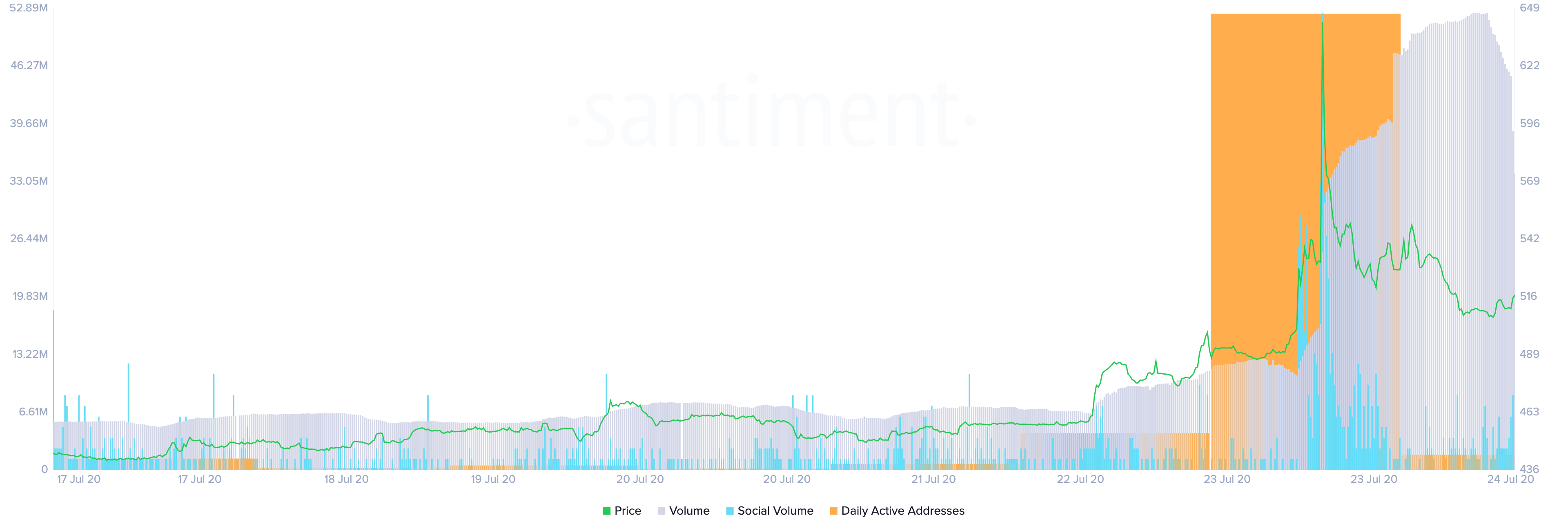

Along the same lines, Maker’s on-chain and social volume, as well as daily active addresses, have increased significantly over the past two days. Santiment, a behavior analytics platform, that these gauges are a “great triple thread to track” in order to determine whether or not a given cryptocurrency is poised for a further advance.

After Binance announced it would add support for MKR, these metrics started trending up. On-chain volume and daily active addresses surged to levels not seen since early June, while social volume reached a three-months high.

Maker's On-Chain Metrics Are on the Rise. (Source: )

These positive movements may soon be reflected in the price of Maker, but there is a significant supply barrier ahead that it must overcome.

Stiff Resistance Ahead

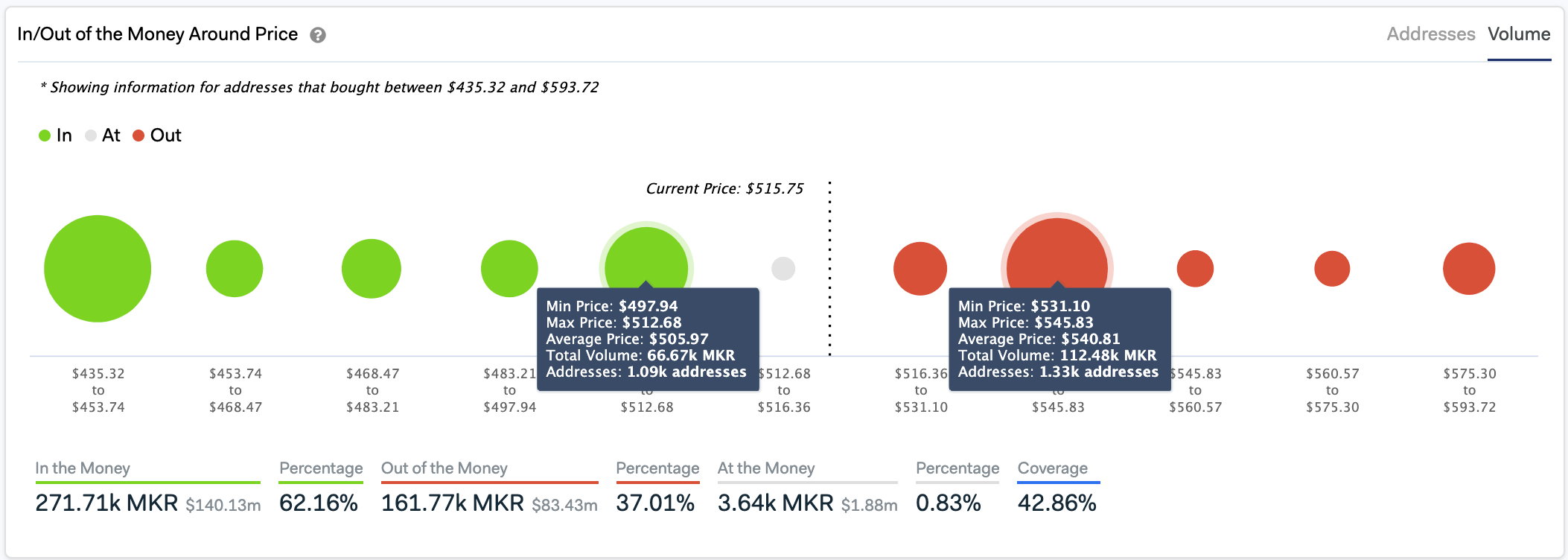

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that for Marker to resume its uptrend, it must turn the $531-$546 resistance level into support. Doing so may no be as easy since 1,330 addresses had previously purchased 112,500 MKR around this price level.

This supply wall may have the ability to hold against any upward pressure because holders within this range would likely try to break even in the event of an upswing. Moving past it, however, increases the odds for the DeFi token to bounce back to $600 or higher.

Maker Faces Strong Resistance Ahead. (Source: )

On the flip side, the IOMAP cohorts show the $506 support level could hold in the event of a correction. Here, nearly 1,100 addresses bought over more than 66,000 MKR.

Featured Image by Depositphotos Price tags: mkrusd, mkrbtc Chart from