After a strong rejection at $14,000, Bitcoin’s parabolic rally is in jeopardy of being erased, especially the most recent move between $10,000 and $14,000 before flash crash occurred that knocked out a number of crypto exchanges and took down Bitcoin price by $2,000 in mere minutes.

Following such a powerful rally from lows around $3,000 to the local high of $14,000, a substantial correction is expected by most. However, when the crypto market is overly bearish, Bitcoin price often moves in a contrarian manner, doing the opposite of what traders and analysts are expecting. With much of the market expecting a deep correction below $10,000, one has to wonder if bearish targets will ever be reached.

Crypto Traders Lean Bearish, But Bull Run Could Leave Them Behind

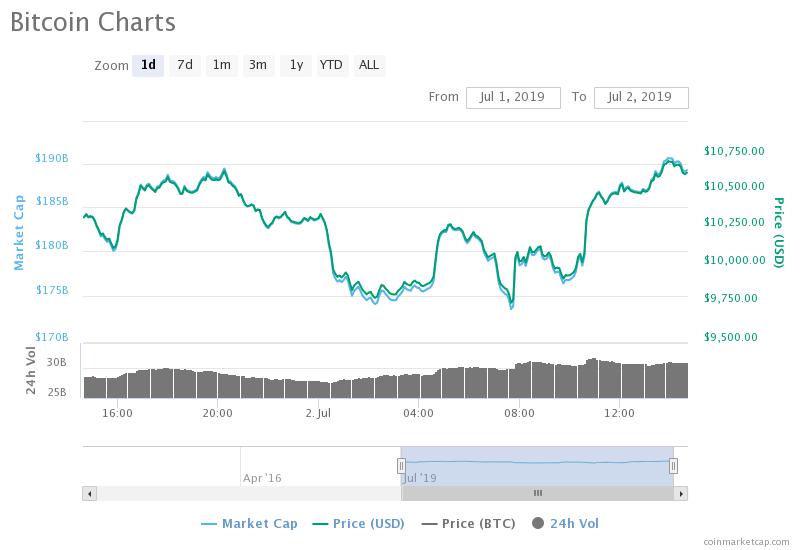

A new poll sheds light into the current sentiment of crypto traders across the internet. At the time the poll was launched, Bitcoin was trading at $10,600. During the time it was live, Bitcoin price feel below $10,000 and already is back around a price level near where the poll was initially launched, and the poll has only skewed more bearish as a result.

The majority of traders are expecting a correction down to $8,400 before another attempt at $12,800 is made. With Bitcoin’s rally stopped in its tracks at $14,000, crypto analyst, traders, and investors alike are expecting a deeper than average correction, and are readying their buy orders to “buy the dip” and load up their bags with sub-$10,000 BTC.

Related Reading | Bitcoin Price (BTC) At Risk Of Correction Below $10,000, Reverse FOMO Trigger?

Except, when sentiment is overly bearish, and the market is expected to move in a certain direction, it often moves in the opposite, as the more obvious direction is the more crowded and less profitable trade.

Lingering Bear Market Blues: Bitcoin Price To Surprise Traders

This sort of occurrence is the definition of a short-squeeze. Traders expect downward movement, so they open short positions. However, when the price moves contrary to their positions, they’re forced to close their shorts, further driving up the price. It’s traders preemptively getting into positions that creates the opportunity for a larger entity to counter-trade against them.

If the majority of crypto traders are hoping to buy Bitcoin back at low $9,000s, $8,000s, $6,000s – and targets of $3,000 or lower are even out there – it may never happen, and traders may be stuck watching the price take back off without them, forcing them to FOMO buy back in later and drive the price up even higher.

Related Reading | Majority of Crypto Investors Never Experienced Bear to Bull Transition

This sort of tactic works best at the start of bull markets when sentiment is still recovering from the bearish downtrend. Traders have become accustomed to falling prices, and shorting peaks – a recipe for short-squeezes that drive rallies higher and higher.

If Bitcoin can break through $14,000, the main resistance above is the previous all-time high of $20,000. Once that Bitcoin breaks that previous high, all bets are off an anything is possible from there.