BTC Miners Fail To Capitalize On Recent Price Rallies

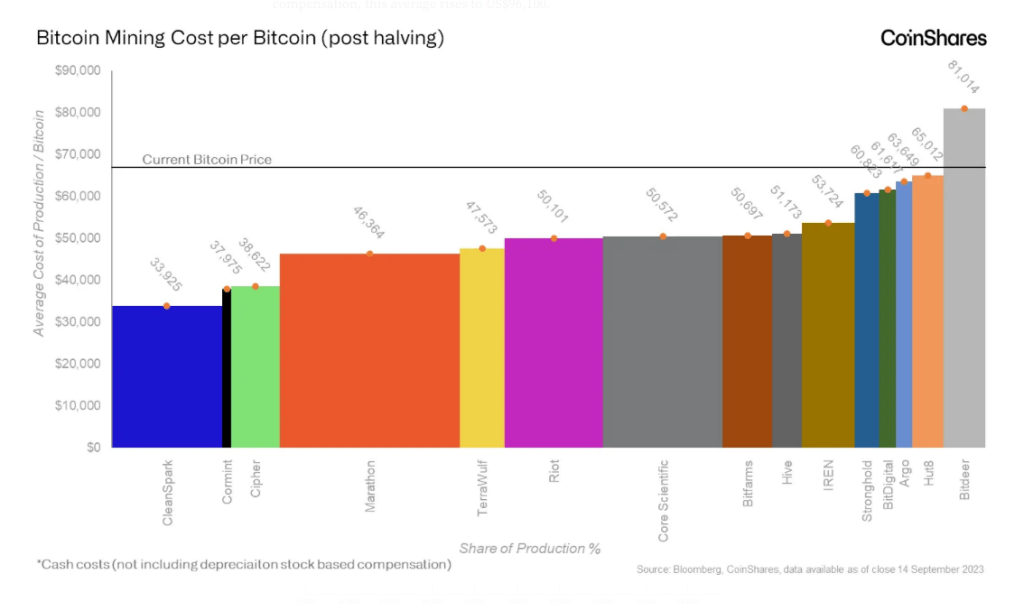

Bitcoin mining is inextricably linked to the digital asset’s extreme volatility. For example, many of our miners failed to capitalize on the rumors of circulating in late 2023. In January 2024, the Securities Exchange Commission (SEC) finally approved the applications of at least 11 ETFs, pushing to breach the $70k level. The sudden increase in the asset’s valuation only showed that the mining industry is sensitive to these price movements, especially after the halving of rewards took effect.Time For BTC Mining To Embrace Alternative Energy Sources?

One of the complaints against BTC mining is that it hurts the environment due to the massive energy requirements, not to mention the carbon footprint it emits. Experts say that if miners use alternative energy sources, we can reduce our carbon footprint by 63% by 2050.

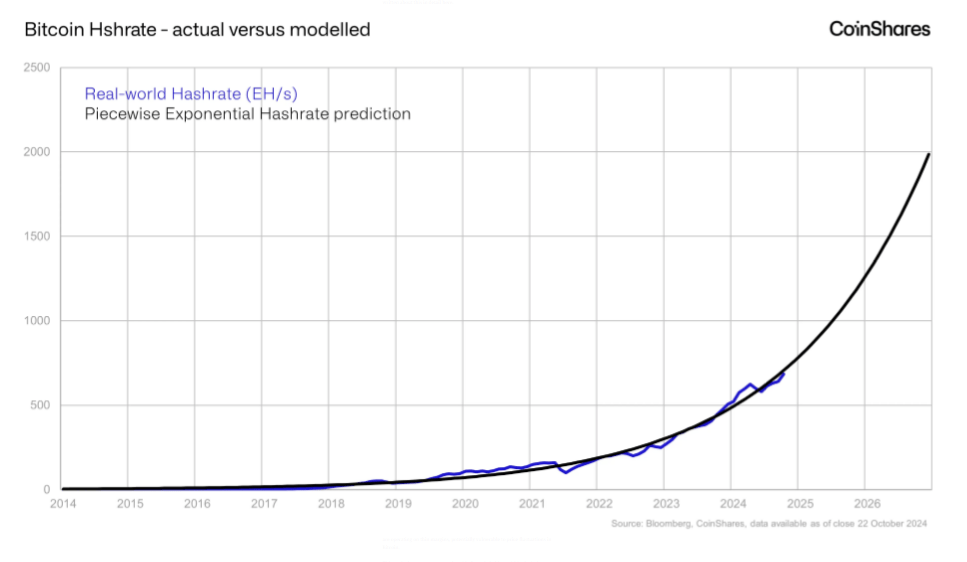

As Costs Rise, Some Bitcoin Miners Turn To AI

Since mining efficiency is starting to fall, many miners are looking for ways to augment their revenues. For example, many experienced miners are holding tokens instead of mining them. Others turn to as a potential source of revenue. It’s safe to say that the BTC mining industry is entering a new phase. When planning and moving forward, miners and other stakeholders must consider the challenges, from costs to compliance to competition. As costs continue to increase, miners must find solutions and options to remain profitable.Featured image from Dall-E, chart from TradingView