First Half of 2020 Closes With Strong Crypto Performance, Despite Pandemic

2020 has been an unusual year, both for the world and for the crypto market. People everywhere are dealing with an outbreak that is spiraling out of control. Life has been changed for the long term.The initial onset of fear and uncertainty the pandemic brought about, caused a major collapse in all markets, including crypto. All signs had been pointing to a new long-term uptrend forming in the asset class.

But Black Thursday set valuations backs months. A strong recovery has brought Bitcoin back to former resistance, but it has been thus far been unable to break $10,000.Related Reading | Ongoing Crypto “Alt Season” Might Spark a Much Bigger Rally in 2021: Analyst

Meanwhile, altcoins across the market are surging, setting new all-time high price records and rallying while Bitcoin stagnates.

The first-ever cryptocurrency has been trading sideways for months, which is ideal conditions for alts to thrive. Boredom during consolidation and constant shakeouts sends trader to the sidelines or towards greener pastures. Many BTC holders sitting in profit may be taking capital and putting it into altcoins, causing them to surge.Even the market’s worst performers, such as XRP, are starting to show signs of life once again.

And although even large-cap crypto assets like XRP, and mid-cap alts like Chainlink are exploding in value, it’s small-cap altcoins that are really shining.

Small-Cap Altcoins Outshine Bitcoin By Five Times in H1 2020

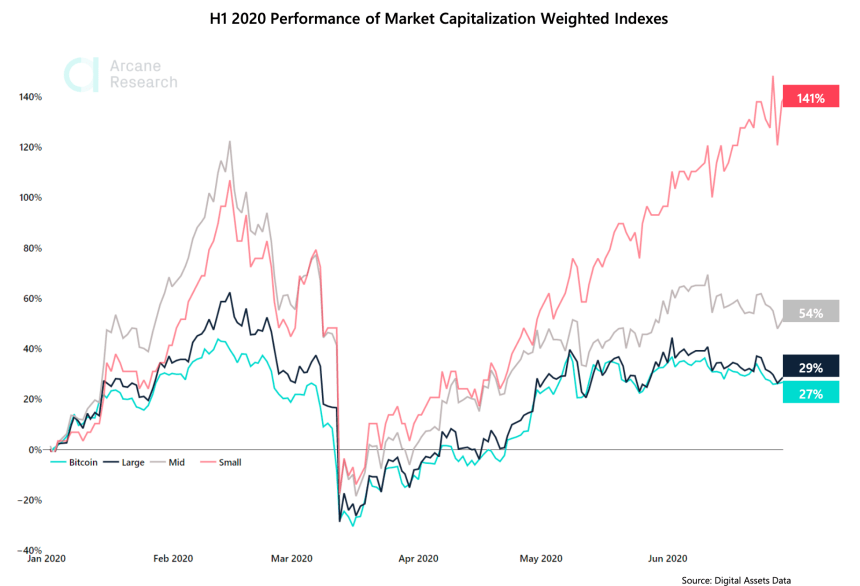

Data from the first half of the year of cryptocurrency market price action shows how Bitcoin stacks up against small, mid, and large-cap altcoins. , Bitcoin grew by 27% in H1 2020. Meanwhile, large-cap alts like Ethereum, XRP, and Litecoin grew by 29%.In the same timeframe, mid-cap alts such as VeChain or Dogecoin have nearly doubled Bitcoin’s growth at 54%. However, it’s small-cap altcoins that significantly outperformed Bitcoin.

The small-cap index grew by a staggering 141%, or over five times more growth than Bitcoin’s meager 27%.Related Reading | Alt Season: Search Volume Surges On Google Trends

The growth is fueled both by a fall in BTC dominance, and several small-cap altcoins setting new all-time highs recently. These low liquidity crypto assets take far less capital to move the needle, causing them to break out from downtrend resistance ahead of other crypto assets.This type of price action is all said to be part of a greater crypto market cycle. Profit-taking in BTC rallies moves into small-cap altcoins. Once gains have been realized, profits flow into mid-caps, then large-cap altcoins as we are now seeing with XRP.

Once large-cap altcoins pump, it’ll be Bitcoin’s time to shine once again. For now, or at least during the first half of the year, the best investments were small-cap alts.