Bitcoin bulls are back, and they’ve brought with them the biggest crypto bull of them all: Tom Lee. The Managing Partner and the Head of Research at Fundstrat Global Advisors has made many calls for Bitcoin price targets, but once the bear market really ramped up, he began to bite his tongue and reel in his lofty predictions.

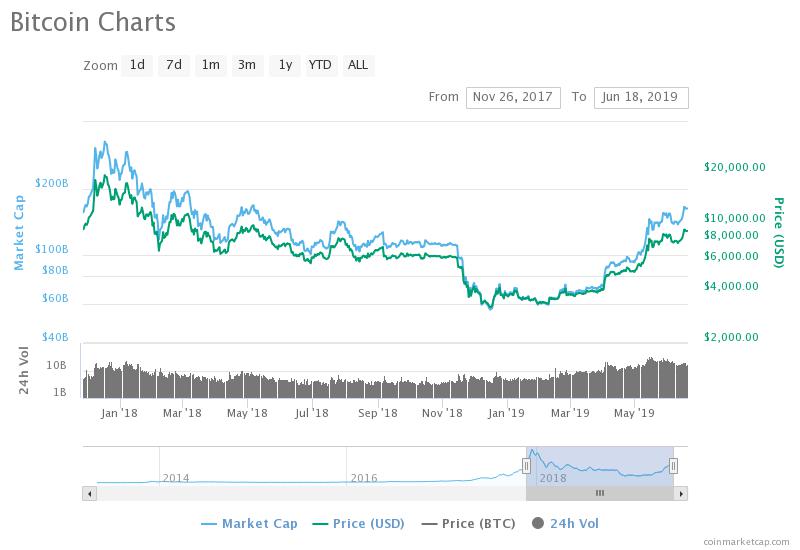

But now that bullish sentiment as enveloped the crypto market it once again, and Bitcoin inches closer to $10,000 – an important FOMO trigger – Tom Lee is back to making bold calls about the leading crypto by market cap, and believes that the digital asset will trade between $20,000 and $40,000.

Tom Lee: Bitcoin Price to Trade Between $20,000 and $40,000, Upside is Substantial

Like a groundhog poking its head out of a hole to check if winter is almost over, Tom Lee is once again making predictions about the future value of Bitcoin now that “crypto winter looks over.” And given his positive prediction for the crypto asset in the coming months, let’s hope he doesn’t see his shadow and cause the market to suffer through a few more weeks of bear market.While speaking to, Lee pointed out how close the asset was to the $10,000 Bitcoin price level that would serve as an enormous FOMO trigger – and has done so effectively in the past, doubling the price of Bitcoin in a matter of days once breached. He added in a CNBC segment that Facebook’s new cryptocurrency is likely to spark renewed interest in Bitcoin.

Related Reading | Majority of Crypto Investors Never Experienced Bear to Bull Transition

Related Reading | Buy Bitcoin: Why Dollar Cost Averaging Is the Crypto Investor’s Best Bet

He calls the upside “substantial,” citing the digital gold counterpart’s scarcity as among the many factors that could drive up the price of Bitcoin. In addition to the asset’s relative scarcity due to its hard-capped supply, Bitcoin was also designed to be deflationary, and was created to feature an event called the “halving” that further constraints supply.These unique factors are part of why Bitcoin is the fastest rising asset ever, outperforms all other asset classes, and investors always wish they bought more.