The native token of Uniswap, UNI, has bucked the trend in a week of consolidation across the bitcoin market by. Positive changes in the Ethereum ecosystem and Uniswap’s continuous legal struggle with the US Securities and Exchange Commission (SEC) define this optimistic run.

Riding The Ethereum Wave

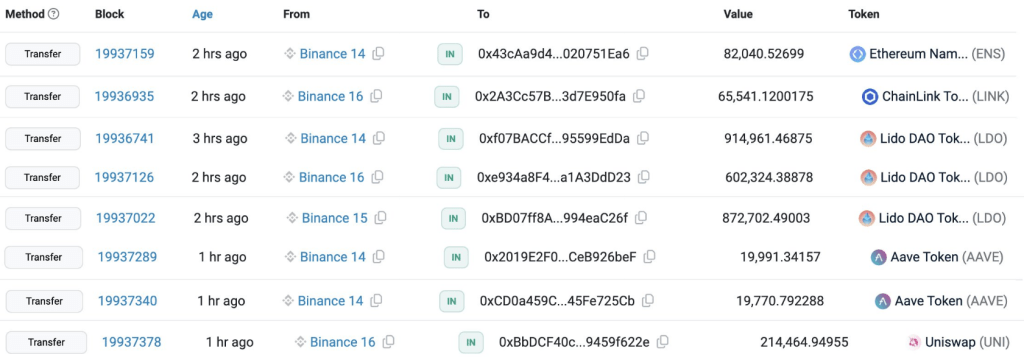

Beyond the legal dispute, UNI’s price is rising thanks in part to the present enthusiasm within the Ethereum community. On-chain data shows substantial whale withdrawals from crypto exchanges following announcements of a possible Ethereum ETF.

Another fresh wallet withdrew 213,166 UNI($1.96M) from just now. — Lookonchain (@lookonchain)

Along with the general positive attitude about Ethereum, this flight to safety is having a knock-on effect that helps UNI, a major participant in the Ethereum DeFi scene.

The token’s recent advance suggests a possible bull run; assuming the present trend keeps, analysts see a price objective of $12.80.

This on-chain indicator suggests that investors are waking to UNI’s potential, therefore supporting its optimistic view.

Short Sellers Get Burned As Bulls Take Charge

Moreover accompanying the recent price surge has been a notable increase in trading activity. Data from Coinalyze exposes almost $1 million in Uniswap liquidations over the last day.Over $750,000, most of these liquidations were short positions, meaning traders opposing UNI are under fire. More traders going long on UNI and this increase in open interest help to enhance the bullish control on the price of the token.

Uniswap Takes A Stand Against The SEC

Investors, who saw this act of rebellion as a hopeful indication of Uniswap’s future, have gained confidence from it Recently the regulatory agency issued a Wells notice to the popular distributed exchange (DEX), claiming UNI is a security. Uniswap has promised to contest this assertion, nevertheless, claiming that the SEC’s case is weak.

Featured image from Wallpapers, chart from TradingView