Resistance Levels Holding Bitcoin Back

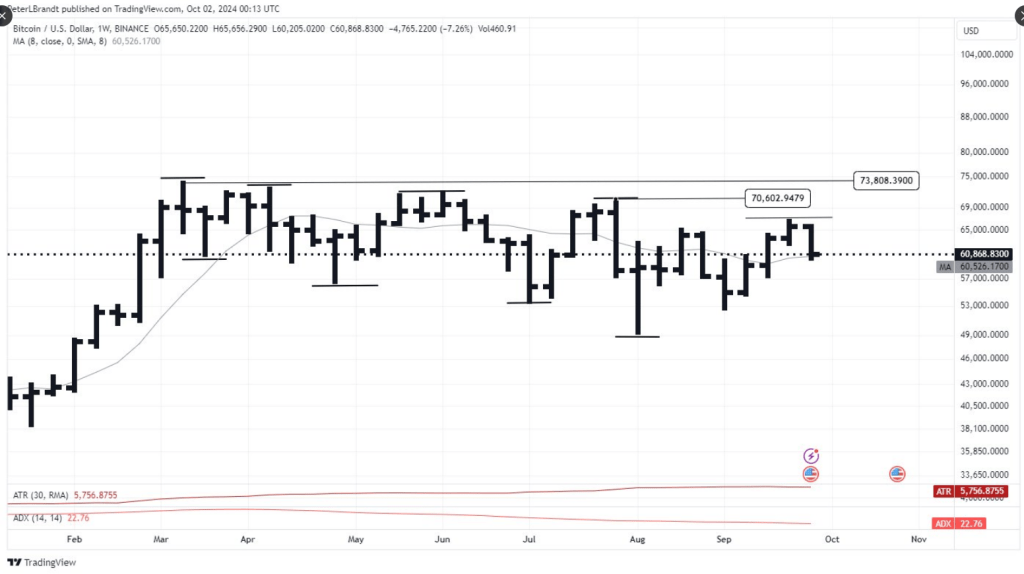

According to Brandt, Bitcoin is caught between two very. The first is at $70,600, while the second and the all-time high of Bitcoin is at $73,800. Both marks have capped the upward movement repeatedly, and thus, they are a must for Bitcoin’s next major move. Since Bitcoin is unlikely to convincingly break above $71,000, the asset is likely going to stay in its current consolidation scenario, Brandt believes.The recent rally in Bitcoin did NOT disturb the 7-month sequence of lower highs and lower lows.

— Peter Brandt (@PeterLBrandt)

Only a close above 71,000 confirmed by a new ATH will indicate that the trend from the Nov 2022 low remains in force

Moving Averages And Market Uncertainty

Bitcoin’s 8-week simple moving average (SMA) has been residing at a level of around $60,526 and has served as resistance recently on the price charts. The price of BTC has hung off that line for a while, which indicates the fact that market participants haven’t really decided if they are buying or selling. It hasn’t traded too low below it to find good strength in order to move up either. For volatility, the Average True Range of Bitcoin is at 5,756. That’s a relatively small level of volatility within the market. That only means the market can generate large moves, but hasn’t built an extreme level of volatility just yet. Dealers are watching closely for these indicators because they could signal where Bitcoin will break next.Geopolitics Tensions And Market Sentiment

The Middle East tension is yet another strain in the cryptocurrency market. Of course, Bitcoin has started to surge in volatility alongside growing concerns of global instability. The price of Bitcoin over the last 24 hours has gone down by 3% to reach $61,380. Actually, that fall was part of the general sell-off among cryptocurrencies within which the entire market capitalization went down by 7.6% over two days.Bitcoin and crypto always tank when there are geopolitical fears, unlike precious metals. That confirms my long-held belief that crypto is not a safe-haven. It’s yet another risk asset just like high-flying tech stocks. — Jesse Colombo (@TheBubbleBubble)

Featured image from Finshots, chart from TradingView